Canary

March 16, 2025 -Weekly Comment

*************************************

The inset is a painting ‘The Goldfinch’ by Carel Fabritius in 1654. It features in the 2013 Donna Tartt Pulitzer Prize winning novel of the same name. In the book, the young protagonist Theo Decker is at New York’s Metropolitan Museum of Art with his mother when a bomb explodes. His mother is killed. In the rubble he takes the painting. Throughout his youth to early adulthood, he conceals the artwork, but it is stolen from him by a friend involved with nefarious associates. From a summary, “…the painting has since been used as collateral by criminals and drug dealers.”

It’s not a canary. But for the purposes of this note, it might as well be.

An article in the Financial Times last week reports that lenders are issuing margin calls to borrowers who have used fine art as collateral for loans, as the value of art has declined. The article estimates the total amount of the market at around $40 billion, secured by art worth perhaps double that. Collectors sometimes borrow to create liquidity. Obviously, this is a tiny sliver of global markets. However, the same dynamics run through the world’s financial system. It gives some degree of pause when Bessent talks about monetizing the Federal Gov’t balance sheet…

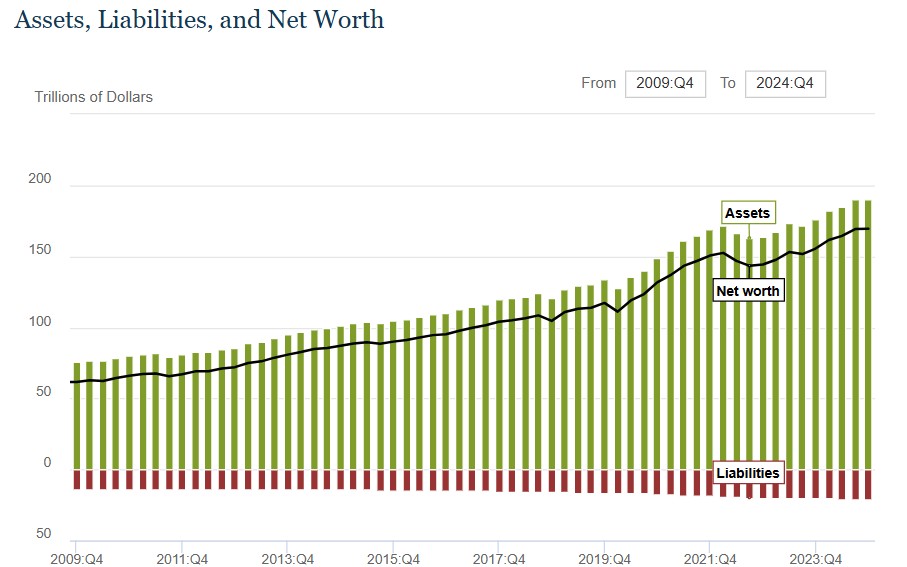

When one looks at total Household Sector net worth (published by the Fed last week, quarterly report, chart below) it reveals current NW of $169T: Assets 190t and liabilities 20.8t. Staggering growth since Q1 2020, when Assets were 128t, Liabilities $16.6t and NW $111t. Net worth has exploded by about 45% in nearly 5 years, in the amount of $58t. I listened to a recent Thoughtful Money podcast with Cem Karsan, and he refers to this increase as an increase in ‘collateral’. But the numbers don’t really bear that out. Household liabilities aren’t increasing anywhere near the same rate. Except for one borrower of course. Uncle Sam.

The same Z.1 Fed report shows Federal Gov’t Debt at $19.5t in Q1 2020 vs $31.6t in Q4 2024, an increase of 62%. Maybe that’s a fabulous multiplier. Increase Fed’l debt by $12.1t to get over 4x that in HH net worth. (Total Business debt from $18.69t to $21.55, up 15%).

Of course, it comes at a price when one steals from or borrows against the future. Five years from the depth of covid is a good time to reflect. For example, the Fed’s five-year policy review will be released in August. Last time it resulted in the ill-fated FAIT (Flexible Avg Inflation Targeting).

In March of 2020 the five-year note yield was at the then historic low of around 40 bps. By August it had reached the all-time low of 19 bps, right at the time of FAIT. The all-time low in tens, also in August, was 51 bps. We’re right around the five-year anniversary. So, if a corporate had ‘termed-out’ all debt at the 40 bp low in March 2020, it’s now running about 3.75% higher. Obviously, corporate finance is a dynamic process, and everyone knows rates soared. The point is that it can take a fairly long period for pressures to build. Of course, changes can also be rapid, as evidenced by last week’s plunge in Consumer Sentiment which printed 57.9, lowest since late 2022 and down from 74 at year’s end. (Conference Board’s Consumer Confidence data reflects a similar drop). One brief note, in late 2022 when confidence measures were floundering as the Fed hiked, stocks were selling off. SPX ultimately bottomed at 3491, which was a 50% retracement of the covid low of 2192 to the start of 2022 high at 4819. If SPX had a similar 50% pullback from the 2022 low to this year’s high, it would be 4813 (current 5639).

Retail Sales are released Monday. Many anecdotal reports (WSJ article, ‘Consumers and Businesses Send Distress Signal as Econ Fear Sets In’) support the idea of lessened confidence. Retail shares have been hammered. XRT (the retailer ETF) is off 17.3% since the end of January. We’ll see if Retail Sales data can hold.

The big event of the week is the FOMC press conference on Wednesday. No change in rates is expected, but I think Powell will set the stage for a May 7 cut. As I mentioned last week, the Fed has subtly indicated that the labor mandate is now more important than inflation. While the U of Mich Inflation expectations data soared in last week’s release (1y was 4.3 last and expected, actual 4.9%) the 5 and 10 year breakevens are at the lows for this calendar year. 5y is 2.53% and 10y is 2.31%. The next PCE price data is 28-March. Also likely is some discussion (announcement?) regarding the end of QT.

I enjoyed reading The Goldfinch, though some critics panned it. Everything turned out in the end. It will this time too. Eventually.

OTHER THOUGHTS, TRADES

Implied vol was pressured in treasuries, especially near the end of the week. MOVE index went from 104.41 to 101.01. On Friday, March 7, TYM5 settled 110-185 and TYM 110.5^ settled 2’39. On Friday, TYM5 settled 110-205 and TYM 110.5^ settled 2’29.

On Wednesday, BBG reported that ‘Brevan Howard Slashes Trader’s Risk-Taking as Losses Exceed 5%’. I have to believe that some large positions have been recently jettisoned across markets. For example, the pop in TY following lower than expected CPI was immediately rejected. On the week, treasury yields showed little net change (table below), even as gold posted a new all-time high, ending the week at 2985 (GCJ5 3301.10s).

The lowest quarterly SOFR contract is SFRM5, now the first quarterly slot, which settled 9593.0 from 9596.5 the previous Friday. The peak contract is SFRU6 at 9641.5, down just 1 bp on the week. Near contracts were sold on higher than expected inflation expectations, but again, net changes were small.

I believe Powell will signal a May cut (dependent on inflation data). The meeting is May 7. By early June I think another cut will be priced with near certainty for the June 18 FOMC.

| 3/7/2025 | 3/14/2025 | chg | ||

| UST 2Y | 400.0 | 401.7 | 1.7 | |

| UST 5Y | 409.4 | 408.4 | -1.0 | |

| UST 10Y | 432.2 | 431.0 | -1.2 | |

| UST 30Y | 461.7 | 461.5 | -0.2 | |

| GERM 2Y | 224.7 | 218.7 | -6.0 | |

| GERM 10Y | 283.6 | 287.4 | 3.8 | |

| JPN 20Y | 223.1 | 226.4 | 3.3 | |

| CHINA 10Y | 184.5 | 185.1 | 0.6 | |

| SOFR M5/M6 | -46.5 | -47.5 | -1.0 | |

| SOFR M6/M7 | 9.5 | 4.0 | -5.5 | |

| SOFR M7/M8 | 12.5 | 12.5 | 0.0 | |

| EUR | 108.34 | 108.79 | 0.45 | |

| CRUDE (CLK5) | 66.75 | 66.91 | 0.16 | |

| SPX | 5770.20 | 5638.94 | -131.26 | -2.3% |

| VIX | 23.37 | 21.77 | -1.60 | |

| MOVE | 104.41 | 101.01 | -3.40 | |

https://x.com/ftfinancenews/status/1900600512602398825

Collectors reluctant to sell at low prices used art-backed loans as “a way to create liquidity out of something that’s just sitting there”, said Nishi Somaiya, global head of private banking, lending and deposits at Goldman Sachs.