C students

November 21, 2019

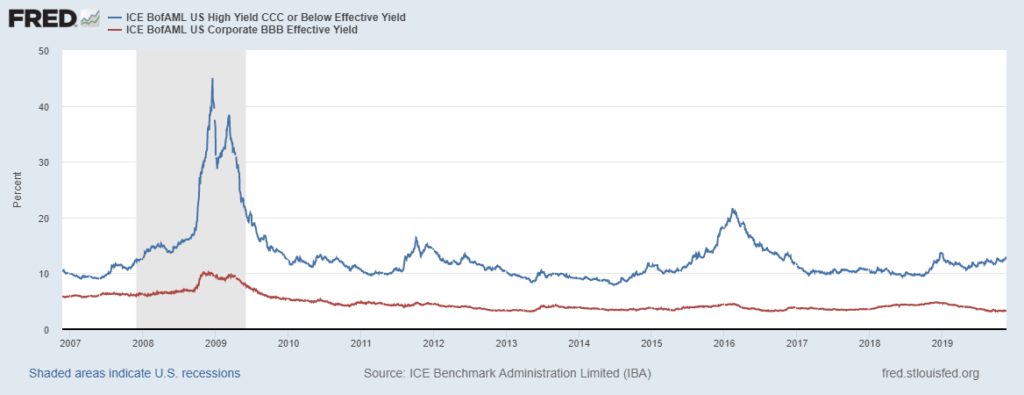

–There’s an interesting video post on twitter with Raoul Pal and Keith McCollough where the latter notes that the spread between BBB and CCC corps keeps moving higher. I created the attached chart from the St Louis Fed website. Indeed. the CCC effective rate is nearing the high seen at the end of 2018 when stocks had cratered into year end. CCC effective now 13.01% vs end of ’18 peak at 13.55%. As a comparison, BBB had peaked then at 4.69% but the yield has been declining since then, now at 3.25%. Dudley (and others) have warned that the next downturn will see an avalanche of BBB downgrades; Gundlach has sounded the same alarm and noted that a lot of BBB paper shouldn’t have investment grade ratings now. My thought is that this impacts the current repo funding debate. No one wants to fund bad collateral, and there’s a chance that there will be a lot more of it. [more on themacrotourist.com https://themacrotourist.com/dudley-does-his-best-icahn/

–Dominant theme for prices continues to be the trade war, with Reuters upending stocks yesterday by saying a Phase I deal might not get done this year. Bonds rallied; tens finished the day down 4.8 bps at 1.736%. This morning the lead China negotiator is saying he’s cautiously optimistic, but stock futures are still slightly lower. FOMC minutes release had little impact: rate path on hold, no standing repo facility, Fed staff saw downside risks.

–New lows in near ED one-year calendars suggest that the market sides with Fed staff. EDZ9/Z0 fell 4.5 to a new recent low of 43.5. EDH0/H1 fell 2 to a new low -26.0. FFF0/FFF1 spread (which is a proxy for easing through 2020) had closed as high as -18.5 in early November, indicating less than ONE 25 bp cut through the year. But in the past seven sessions it has cratered to yesterday’s close of -34.5. In August, the near one-year spread (then being EDU9/U0) had gotten below -75 and the second spread below -60. So current levels are no where near extreme, but the direction indicates increased bias toward ease.

–A few option trades indicate the same: Buyer of 30k EDM0 9850/9875 call spreads vs selling 9837/9825 put spreads covered 9845.5, 33d, 1.0 paid. There was also a sizable 3EZ 9825/9875 risk reversal, paid 1 for the call 35k covered 9850.5 to 51, settled 2.0 call and 1.0 put. Large buyer of 225k FVH 111 put for cab-7. Just a cap on risk.