Bunker Mentality

October 8, 2023 – Weekly Comment

**************************************

On September 21, the day after the last FOMC, the ten-year yield was 4.5%. On Friday I marked it at 4.78% at the time of futures settle, or more than ¼ % higher. The Bankrate 30y mortgage was 7.59% on Sept 20 and is now 7.93% (with many examples of quotes >8%). Several Fed officials mentioned tighter financial conditions as a substitute for more overt hiking by the Fed. DXY weakened slightly last week but was 105.36 on Sept 21 and 106.04 on Friday, an additional headwind for the global economy.

Another example of tighter/looser conditions comes in the form of oil prices. On Sept 27 CLX3 settled at a high for the year of 93.68. On Friday, just 7 sessions later, it settled 82.79. The Yom Kippur war of 1973 started 50 years ago in October. Oil more than doubled. I’ve seen several analysts say that the Hamas attacks on Israel this weekend are unlikely to play out like 1973. I think that’s wrong. The entire world seems to be in political disarray, and this proxy war will spread. I think the following snippet from Bloomberg’s Javier Blas is worth noting (For Oil, It’s Not 1973. But It Could Still Get Ugly):

5) Even if Israel doesn’t immediately respond to Iran, the repercussions

will likely affect Iranian oil production. Since late 2022, Washington has turned

a blind eye to surging Iranian oil exports, bypassing American sanctions. The

priority in Washington was an informal détente with Tehran. As a result, Iranian

oil output has surged nearly 700,000 barrels a day this year – the second-

largest source of incremental supply in 2023, behind only US shale. The White

House is now likely to enforce the sanctions. That could be enough to push oil

prices to $100 a barrel, and potentially beyond.

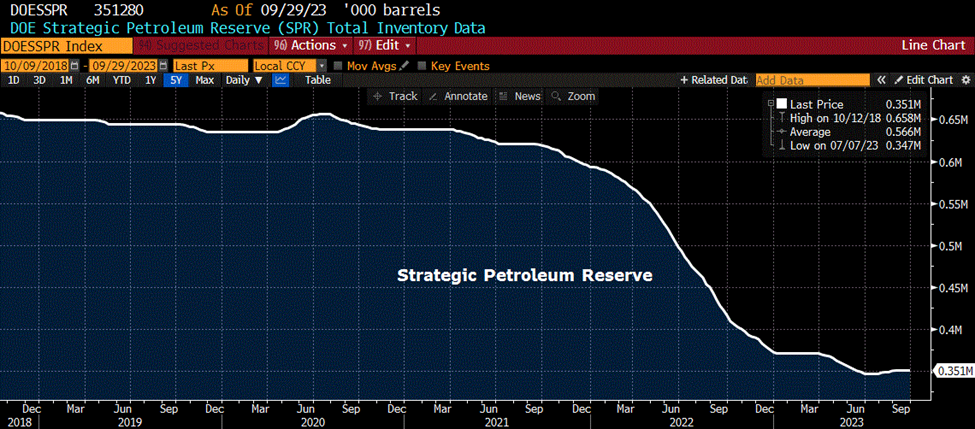

My inclination is to hunker down and shun risk assets. The US is going to support Israel which risks even worse budget implications. Blas says the US could still tap the SPR. As the attached chart shows, that well is running dry. In my opinion the implications are tightened credit conditions. I’m not sure of the ultimate response of long-end treasuries. There’s a natural flight to quality, but tame energy prices were widely credited with deceleration in inflation. That dynamic may change quickly. Supply remains a problem (both treasuries, too much, and oil, too little).

There’s a fair amount of news this week, including several Fed speakers, the most important of which are probably Logan on Monday and Waller on Tuesday. CPI on Thursday with Core expected 0.3% m/m and 4.1% vs 4.3% last y/y. FOMC minutes on Wednesday, but faced with uncertainty, the Fed is likely to hold fire at the Nov 1 meeting.

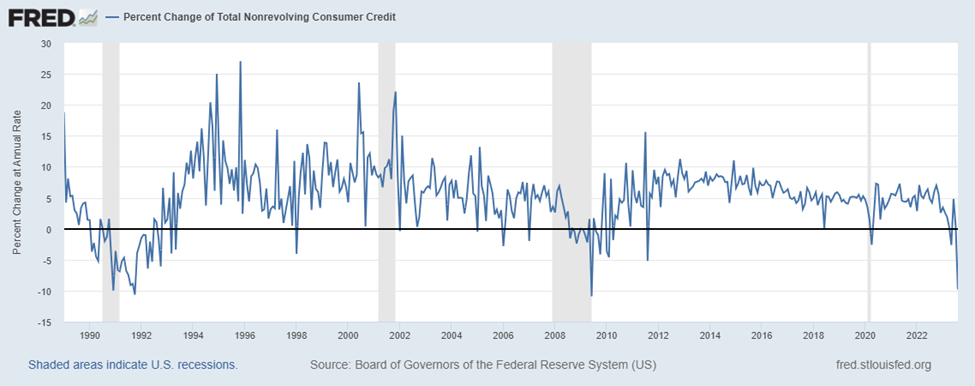

The consumer is showing strong signs of rolling over. Expansion of war is not going to help. Although I would guess this data might be revised, Friday’s plunge (-9.8% annual rate) in non-revolving credit is eye-opening. The outstanding level fell over $30 billion from $3.715T in July to $3.684T in August. As can be seen on the chart, since 1990 there are only two other examples of this magnitude of decline. (Revolving credit increased from $1.27T to $1.285T).

This is a big week for news and speakers:

Monday- Lorie Logan on the economy with Q&A

Tuesday – Bostic at 9:30 and Waller at 1:00

Wednesday – PPI expected +0.3 m/m with Core +0.2 m/m. FOMC minutes. Collins at 4:30

Thursday – CPI +0.3 m/m both headline and Core. Core expected 4.1 y/y vs 4.3 last

Friday – Harker at 9:00.

OTHER THOUGHTS/ TRADES

The 2/10 treasury spread easily posted a new high for the year, ending Friday around -30. A double bottom from around -105 in March and last June suggests a target of +25 which is also about halfway back from the 2021 high of +157 to the 2023 low of -108.

There was a fair amount of buying last week of SFRZ3 9475/9500cs for 1.375 to 1.5. Settled 1.25 (3.25/2.0) ref 9453.0. SFRZ3 9475c has 471.7k of open interest, the most of any SOFR call. Underlying SFRZ3 contract has 1.4m open. Current SOFRRATE is 5.32% and EFFR has been 5.33% since the July FOMC. An immediate ease would, of course, put these 9475 calls in the money. If there are no further hikes at the next two meetings and CERTAINTY of a 25 bp cut at the Jan 31 meeting, then SFRZ3 would likely trade around 9480. Of course, if an emergency develops, the first cut could easily be 50.

I am not recommending +SFRZ3 call spread vs 2QZ3 call spread, but just as a comparison, I would note that with SFRZ5 settling 9589.0, the 2QZ3 9687.5/9712.5cs settled 1.5, and it’s nearly 100 bps out of the money.

Above all, the Fed saves the banks. At Friday’s close of 40.57, Citi’s share price is below the March low. This week’s low was 39.81, a lower close than any price since the pandemic. Same thing with BofA at 26.07. US Bancorp at 31.86 is above the 2020 low, but in May it posted a low of 28.68, below the 2020 low. At the margin, the weakest players have a tendency to shake the entire system.

| 9/29/2023 | 10/6/2023 | chg | ||

| UST 2Y | 504.8 | 508.1 | 3.3 | |

| UST 5Y | 460.5 | 474.8 | 14.3 | |

| UST 10Y | 457.1 | 478.0 | 20.9 | wi 478.5/78.0 |

| UST 30Y | 470.8 | 494.0 | 23.2 | wi 494.0/93.5 |

| GERM 2Y | 320.3 | 313.3 | -7.0 | |

| GERM 10Y | 283.9 | 288.4 | 4.5 | |

| JPN 20Y | 147.7 | 159.2 | 11.5 | |

| CHINA 10Y | 268.1 | 268.1 | 0.0 | |

| SOFR Z3/Z4 | -86.0 | -85.5 | 0.5 | |

| SOFR Z4/Z5 | -63.5 | -50.5 | 13.0 | |

| SOFR Z5/Z6 | -1.0 | 4.5 | 5.5 | |

| EUR | 105.73 | 105.90 | 0.17 | |

| CRUDE (CLX3) | 90.79 | 82.79 | -8.00 | |

| SPX | 4288.05 | 4308.50 | 20.45 | 0.5% |

| VIX | 17.52 | 17.45 | -0.07 | |