Bull runs

July 31, 2023

–Today’s news includes Fed’s Sr Loan Officer Survey (SLOOS) which may indicate tighter credit conditions. Dallas Fed Mfg.

–Treasury releases financing estimates; TBAC /Treasury presentation is Wednesday

https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding/most-recent-quarterly-refunding-documents

–PCE prices on Friday were friendly. PCE yoy 3.0% and Core 4.1%. Yields fell, with tens -4.7 bps to 3.967, while thirties hold above 4% at 4.027.

–New buyer 100k SFRH4 9700/9725cs for 1.0. Settled 1.0 (5.0/4.0) vs 9482.

–CLU3 prints 81.20/bbl this morning. Highs in this particular contract this year: 81.75 on Jan 23. 81.44 on April 12.

–BOJ trending on my Musk feed as an unscheduled bond buying operation occurred on JGBs with the yield now around 60 bps.

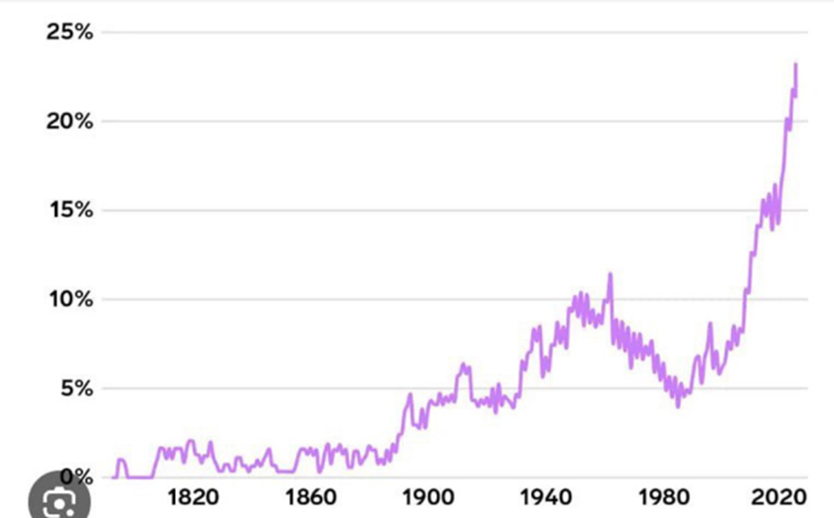

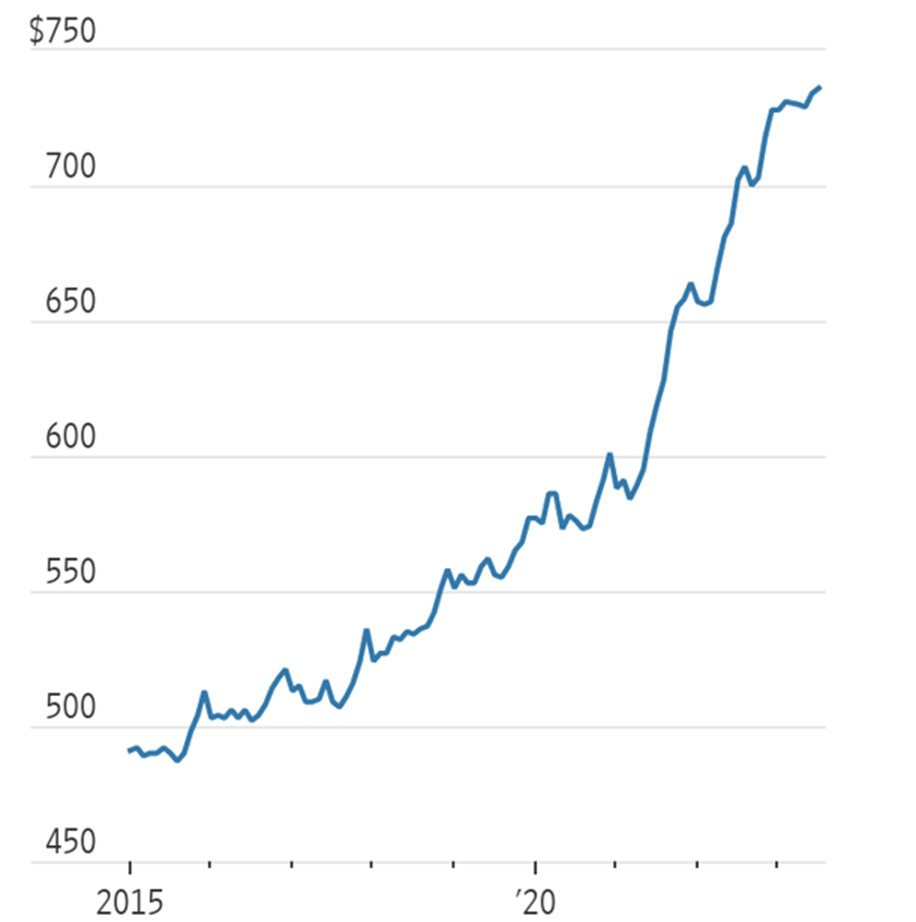

Below I present three charts showing bull markets. All inextricably intertwined. Or is that inexplicably. See if you can tell what they are.

The top chart is Frozen Concentrated Orange Juice. New historic all-time high.

The next is the percentage of Congress over age 70 (lavender)

The bottom is the average monthly payment on new cars. (blue)