Big Week

January 28, 2024 – Weekly Comment

******************

There’s a lot going on this week. FOMC and Refunding Announcement on Wednesday. Payrolls on Friday. Earnings announcements by MSFT and GOOGL on Tuesday, AAPL, AMZN, META on Thursday.

Not much change in rates last week. SOFR contracts were 1.5 bps on either side of unchanged out four years. Treasuries Fri to Fri: FVH4 107-217 to 107-207. TYH4 111-04 to 111-01, USH4 120-00 to 119-18.

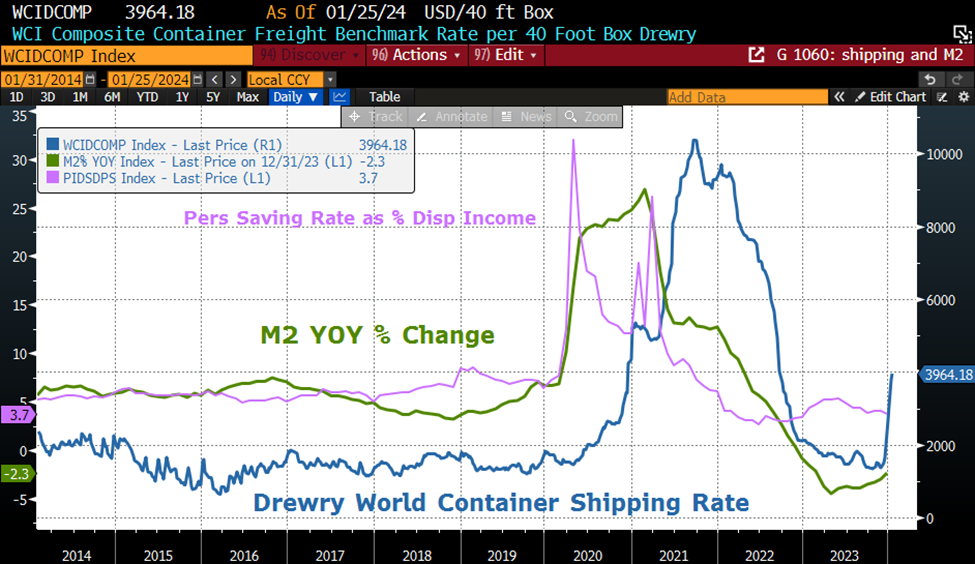

One thing that did have a significant move was oil, with CLH4 settling 78.01, up 4.76 or 6.5% on the week, highest since November. Of course, that move is due to Red Sea attacks and other geopolitical issues. I saw a chart of Container Shipping Rates which is included on the chart below. The recent surge is thought to be inflationary as oil prices and shipping/insurance costs jump.

Many charts over the past five years follow the same basic pattern: a huge spike associated with covid shutdowns and stimulus, followed by reversion lower. What’s interesting about the Shipping chart is that it is making a new run. However, I included M2 yoy growth and the Personal Savings rate (as % of Disp Income) on the chart below. M2 is negative and well below pre-covid. The Savings rate is just 3.7, also below covid levels, and that’s with much higher interest rates which should encourage saving.

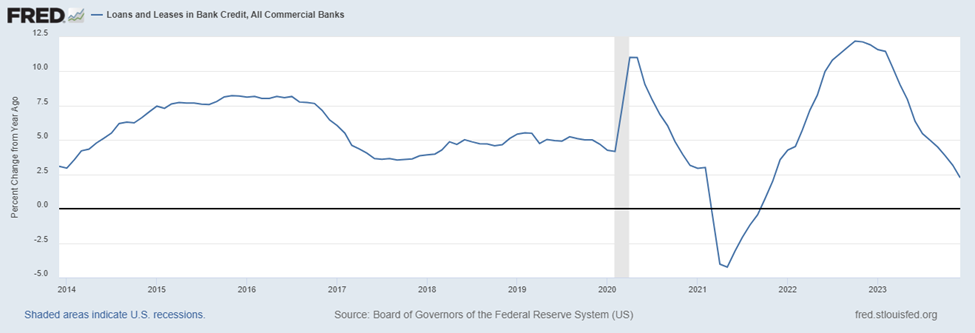

I also include the chart below from the St Louis Fed, Commercial Banks Loans and Leases, % change yoy. It’s a bit difficult to see, but it begins 2014, the shaded area is, of course, the covid recession, which corresponded with large draws on credit lines. The most recent reading of +2.3% is the slowest growth outside of the post-covid reversion.

My point here is that oil and shipping costs may have a temporary effect on inflation, but without support from M2 (or a large jump in velocity) and without credit growth, it’s difficult to see a sustained increase. The low savings rate suggests that consumers are already stretched, and not likely to create a big new surge in demand.

However, that’s not to say that yields can’t move significantly higher, especially on the long end. Both the quarterly refunding plans and the Fed’s discussions about scaling back QT will likely have a large impact. Treasury’s financing estimate for the quarter will be released Monday, Jan 29. The expected composition of issuance is released Wednesday.

Last quarter’s recommended financing table is included below. In the lower section, provisional indications for the upcoming quarter are included.

Total funding needs are huge. According to provisional indications, 7s and 10s could increase $3 billion per month, and 30s $2b per month larger than Q4.

Last quarter the Treasury weighted issuance more heavily toward t-bills. I don’t think that’s as likely this time. The long bond yield topped at 5.11 in October, and plunged in the next two months to sub-4%. However, it appears as if the 4 handle has been rejected, and Friday ended at 4.39%.

Core PCE prices yoy were just 2.9% (released Friday). Payrolls are expected to show lower growth, with NFP expected 180k on Friday. In my opinion, both inflation and growth are trending moderately lower and are inclined to continue along that path (regardless of temporary Red Sea problems). Wednesday’s FOMC is likely to support an ease at the March meeting, though many analysts are emphatically saying it would be a policy error. The Feb/April FF spread at -11.5 (9468/9479.5) currently leans slightly toward ‘no ease’. Of the five huge stocks reporting this week, MSFT, META and GOOGL are at all time highs and AAPL is only 3.5% away. There are clearly arguments to be made both ways. However, longer dated treasuries must contend with supply which could easily push yields higher over the next couple of months.

| 1/19/2024 | 1/26/2024 | chg | ||

| UST 2Y | 438.9 | 436.5 | -2.4 | * no roll adjust |

| UST 5Y | 408.0 | 405.9 | -2.1 | * no roll adjust |

| UST 10Y | 415.0 | 415.9 | 0.9 | |

| UST 30Y | 436.0 | 438.8 | 2.8 | |

| GERM 2Y | 273.0 | 263.3 | -9.7 | |

| GERM 10Y | 234.0 | 229.9 | -4.1 | |

| JPN 20Y | 146.0 | 151.7 | 5.7 | |

| CHINA 10Y | 251.6 | 250.2 | -1.4 | |

| SOFR H4/H5 | -144.0 | -143.0 | 1.0 | |

| SOFR H5/H6 | -29.0 | -30.5 | -1.5 | |

| SOFR H6/H7 | 10.5 | 11.5 | 1.0 | |

| EUR | 108.98 | 108.55 | -0.43 | |

| CRUDE (CLH4) | 73.25 | 78.01 | 4.76 | |

| SPX | 4839.81 | 4890.97 | 51.16 | 1.1% |

| VIX | 13.30 | 13.26 | -0.04 | |