Auctions and CPI

March 10, 2024 – Weekly Comment

**************************************

The Fed’s Z.1 quarterly report was released last week for Q4. While the data is perhaps a bit stale, the debt levels are still somewhat eye-opening. Total Household Debt ended 2018 at $15.582 trillion. By the end of last year it had grown to $19.955T, an increase of 28% over five years. Total business debt grew at a similar rate, from $16.151T in 2018 to $21.126 in 2023, or 31%. Surprisingly, on the Gov’t side, State and Local Gov’t debt was $3.124T at the end of 2018, and rose to just $3.255 in 2023, an increase of just 4%! (Did they even have Chicago in there?) But Federal Gov’t Debt over that time period grew 65% from $17.865t to $29.472T. The one-year increase from 2022 to 2023 was $2.621T. In one year Fed’l Gov’t Debt rose almost as much as total State & Local debt. That deficit spending is what is driving economic “growth”.

Yields ended a bit lower last week, with twos down 4.5 bps to 4.484% and tens down 9.1 to 4.087%. Powell repeated that the Fed needs more confidence that inflation is trending to target before easing. The employment report featured a strong headline NFP gain of 275k, but the previous number was revised lower by 124k, the unemployment rate ticked up to 3.9% and average hourly earnings were up only 0.1% month/month. Overall, a moderately weak report.

This week brings auctions of 3-yr notes on Monday ($56b), 10-yr notes on Tuesday ($39b) and 30s on Wednesday ($22b). CPI is released on Tuesday, expected 0.4% m/m with Core 0.3%. Yoy expected 3.1% from 3.1% last and Core 3.7% from 3.9% last. Energy prices firmed over the month of February. On Thursday, PPI and Retail Sales are released.

The FOMC meeting is one week from Wednesday. The BOJ meeting is March 18/19. $/yen had a significant move on the week, falling from 150.12 to 147.06 as an end to negative rates is being considered. From Reuters:

A growing number of Bank of Japan policymakers are warming to the idea of ending negative interest rates this month on expectations of hefty pay hikes in this year’s annual wage negotiations, four sources familiar with its thinking said.

Many BOJ policymakers are closely watching the outcome of big firms’ annual wage negotiations with unions on March 13, and the first survey results to be released by labour umbrella Rengo on March 15, to determine how soon to phase out their massive stimulus.

A shift in BOJ policy could reverberate throughout global markets, strengthening the yen further, making yen carry trades less attractive. While US and European yields were lower on the week, the 10y JGP ended at 73 bps, near the high of this calendar year (up 2 bps on the week).

******************************************

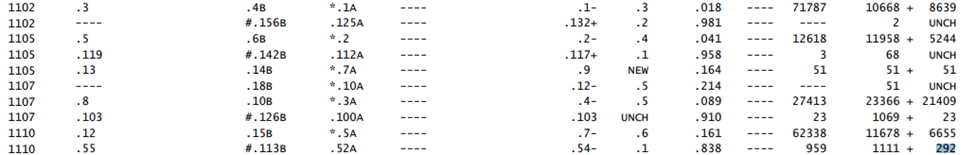

A large amount of Wednesday (March 13 expiry) treasury options traded Friday, weighted heavily toward puts. About 9.8k calls traded, but put volume was over 220k with open interest increasing 76.7k. The 30yr auction is Wednesday (3s and 10s Monday and Tuesday) so all auctions are captured. CPI is Tuesday. It’s a bit hard to see on the CME volume and open interest site, but Wednesday week-2 110.75 puts settled 4, and added 21.4k in open interest. The 111p traded 62k in volume and settled 7, adding 6.6k in open interest. Underlying TYM4 settled 111-23+.

April puts on TY expire on 22-March, just after the FOMC. Put open interest is 1.045 million, with the peak strike being the 109.5p at 129k, settled 3/64. TYJ4 call OI is just 575k.

Does it matter? My sense is that the market’s underlying concern is higher long end yields. Whether these put trades are sparked by fears of inflation due to energy cost spikes, or shipping and other supply chain issues, or just massive bond supply, a ten-year yield nearing 4% requires upside yield protection.

A friend asked where I thought TY Wed 111p would be on CPI if futures printed exactly 111-00. I would imagine the straddle would still be about 7-9 bps given unknown results for 10 & 30 auctions, and figure the puts would be about 15/17.

*****************************

I have to mention NVDA which posted a huge key reversal Friday (new high, outside range, massive volume, closed near the bottom of the range). Volume was over 114 million shares. There have only been three other days in the past year with larger volume: Aug 24 with 115m, closing price 471.63, and May 25, with 154 million volume and a close of 379.80 (both coinciding to earnings reports). On a $2 trillion market cap the range of 974 to 865 represented a swing of over $200 billion.

Technical markers like key reversals haven’t been all that valuable recently in terms of identifying trend changes. For example, March Bitcoin futures had a huge 10k outside range day on Tuesday, 60120 to 70195. Big volume, and price settled in the bottom quarter of the range. Classis reversal. However, on Friday BTCH4 made a new contract high 71055.

My bet is that NVDA will see further weakness going into Friday’s option expiration, which will likely take Nasdaq along for the ride.

*******************************

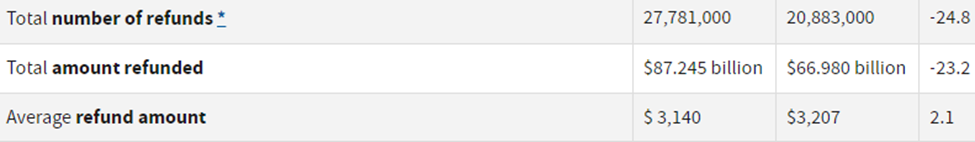

I don’t follow tax refunds closely. However, it’s worth noting that the average refund amount, as of Feb 16, 2024, was $3207 vs $3140 in 2023. That’s an increase of just $67 or 2.1%. Relative to CPI of 3.4% at the end of 2023, this data suggests that aggregate wage increases aren’t keeping pace with inflation. Likely due to calendar quirks, the total amount refunded so far is $66.9 billion vs $87.2 billion last year. Hey Krugman, tell me again why the average consumer should be thrilled with Bidenomics. A podcast by Grant’s noted that auto insurance has increased by about 20% over the past year, partially due to the fact that social inflation has been staggeringly large, contributing to outsized jumps in insurance costs. [Social inflation is related to large jumps in jury awards] Your government at work?

From the IRS as of Feb 16, 2024. First column is 2022, middle is 2023, followed by percentage change

| 3/1/2024 | 3/8/2024 | chg | ||

| UST 2Y | 452.9 | 448.4 | -4.5 | |

| UST 5Y | 415.7 | 406.1 | -9.6 | |

| UST 10Y | 417.8 | 408.7 | -9.1 | wi 409.0/08.5 |

| UST 30Y | 432.7 | 426.0 | -6.7 | wi 426.5/26.0 |

| GERM 2Y | 289.0 | 275.9 | -13.1 | |

| GERM 10Y | 241.3 | 226.7 | -14.6 | |

| JPN 20Y | 144.3 | 149.5 | 5.2 | |

| CHINA 10Y | 238.3 | 229.3 | -9.0 | |

| SOFR H4/H5 | -119.0 | -126.3 | -7.3 | |

| SOFR H5/H6 | -54.0 | -58.5 | -4.5 | |

| SOFR H6/H7 | -0.5 | -1.5 | -1.0 | |

| EUR | 108.41 | 109.41 | 1.00 | |

| CRUDE (CLJ4) | 79.97 | 78.01 | -1.96 | |

| SPX | 5137.08 | 5123.69 | -13.39 | -0.3% |

| VIX | 13.11 | 14.74 | 1.63 | |