Asset Values Can be Fickle

September 8, 2023

–Much of Wednesday’s sell off in rate futures was reversed yesterday and yields are slightly lower this morning. Two year yield down 7 bps yesterday to 4.95% and tens fell 3.2 bps to 4.256. Having made a new recent high Wednesday of -104.5, SFRZ3/Z4 fell 9.5 yesterday to settle -114 (9455.5/9569.5).

–Dallas Fed President Lorie Logan gave a speech yesterday which supported a skip at the Sept 20 FOMC, but her comments were more or less balanced on risks:

“But skipping does not imply stopping. In coming months, further evaluation of the data and outlook could confirm that we need to do more to extinguish inflation.”

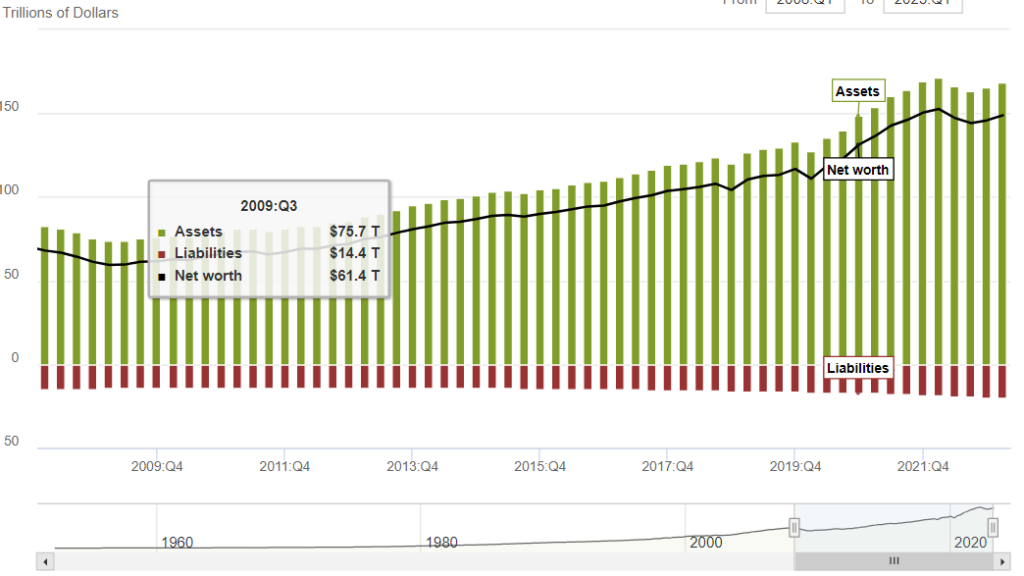

–Fed releases its quarterly Z.1 report today at noon. Headlines mostly cover Household Net Worth, but there are a lot of stats in the report. Summary picture of net worth below. Assets likely boosted by inflated values, while liabilities barely move. Large rally in SPX during Q2 will potentially trumpet new highs in Net Worth.

–Now here’s where you grab your tin foil hat. These are very rough approximations for illustrative purposes. NVDA is worth about 1.1T, or at least that’s current market cap (price 462 vs recent high 502). From end of March to end of June the stock went from 240ish to 420 a jump of 75%. There are a lot of twitter articles about possible improprieties regarding NVDA’s orders in the last quarterly report, some of which revolve around a company called Core Weave. I have no idea how to ascertain these allegations. However, I did see this August 3 article on Reuters:

Aug 3 (Reuters) – Specialized cloud provider CoreWeave has raised $2.3 billion in a debt facility led by Magnetar Capital and Blackstone (BX.N) and collateralized by Nvidia chips, with the funds to be used to expand to meet rising AI workload, the company said on Thursday.

So CoreWeave buys NVDA chips and then is able to collateralize them to raise money? Over my head. However, if the smoke from these embers turns into a fire [sale], then Nasdaq as a whole would likely take a tumble, which could reverberate into other assets. This is all rampant speculation on my part; I just feel it ties in to PERCEPTIONS of net worth, so it’s “worth” a mention as Z.1 is released.