Asia in focus

November 16, 2020

–Yields edged slightly higher Friday and vols firmed a touch from depressed levels. Tens ended at 89.1 bps

–Cues for US markets may now be more dependent on Asia. The PBOC injected 800 billion yuan into its one-year Medium-term Lending facility today as 600 billion becomes due this month. According to BBG, China’s banks face a 900 billion funding gap over the next two months, amid concerns that SOE’s debts are no longer sacrosanct. Again from the BBG article: “Earlier this month, the PBOC once again raised the topic of exiting easing policies when vice governor Liu Guoqiang said such a move ‘is a matter of time and it is also necessary.'” China’s ten year is currently 3.27%.

–Note that 15 Asian nations including China, Japan, S Korea just signed the largest economic trade pact covering 29% of the world’s GDP.

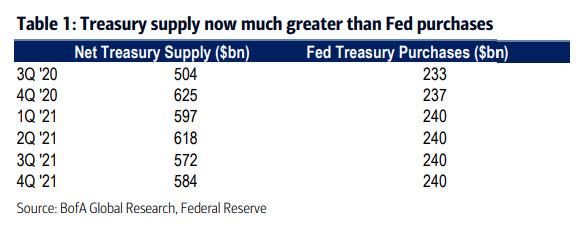

–While China grapples with a possible funding shortfall, BofA notes the same regarding US treasury buying. At the current Fed pace of buying $80 billion UST per month or $240 billion a quarter, BofA projects that buying will only absorb about 40% of issuance next year. Table below. Expect the Fed to hint at ramping up QE in the near future.

https://blinks.bloomberg.com/news/stories/QJV7XEDWX2PZ

https://www.zerohedge.com/markets/traders-edge-china-faces-900-billion-funding-shortage