A Tale of Two Headlines

December 12, 2023

**********************

WSJ Headline: Underlying Inflation Could Complicate Prospect for Rate Cuts

Bloomberg lead-off headline: CPI Expected to Give Room for Rate Cuts, Bloomberg Economics Says

CPI today, rate cut deliberations tomorrow.

–CPI is expected 0.0 from 0.0. Yoy 3.1 from 3.2% last. Core yoy 4.0 vs 4.0. Thirty-year auction today, but bonds rallied after mediocre 3s and 10s yesterday.

–Trade was quiet yesterday, though there was a new buyer of 12k SFRZ4 9800c (settled 8.25 ref 9578.0) and 8k SFRH5 9800c (settled 12.75 ref 9606.5). Overall yields were little changed.

–April FF settled 9478 vs January at 9467.0. So that spread of -11 captures odds of an ease at the Jan 31 and/or March 20 FOMCs. However, January’25 FF settled 9579.0, so FFJ4/FFF5 is -101. Easing is targeted for the second half of next year, though the Fed dots tomorrow aren’t going to show anything like a drop of that magnitude for the 2024 FF projection. I’m going with 4.875% for the median 2024 dot, from 5.1% last. Given estimates of PCE prices of 2.5%, that’s still a very stingy real rate.

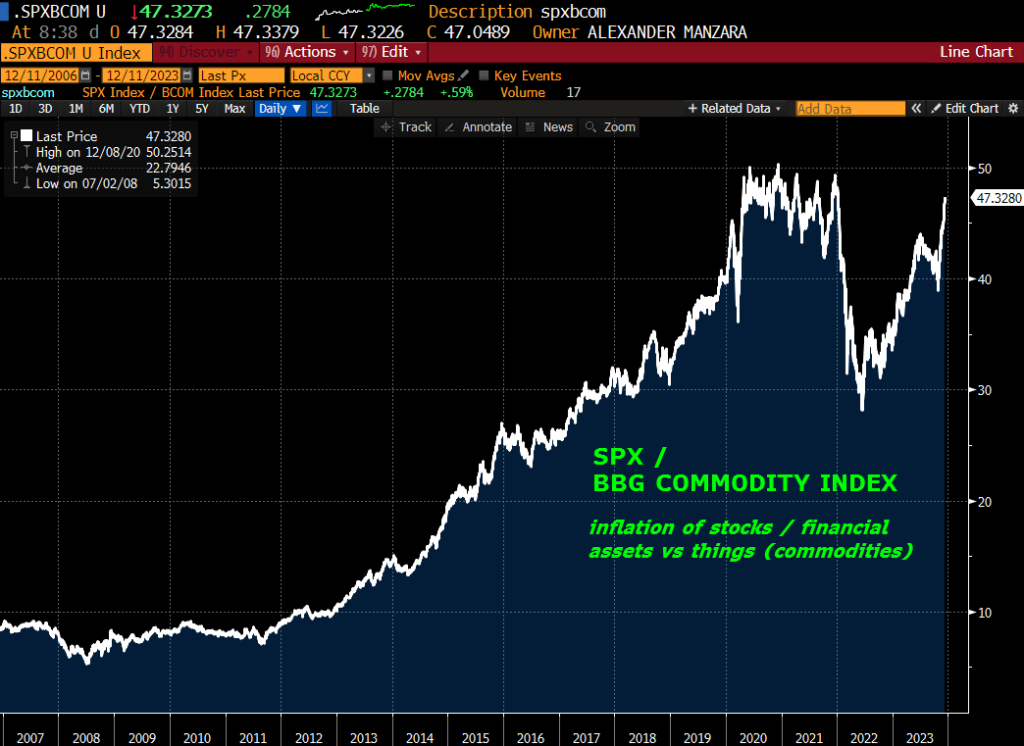

–Attached is a chart of SPX divided by BCOM. Does inflation manifest thru stocks or things? The period from 2012 to 2020 was dominated by financial market inflation as opposed to goods and services (rate repression). Covid arrested the trend, and the resulting goods inflation sparked a resurgence of commodities vs financial assets. Now this ratio appears poised to retest all-time highs, perhaps due to runaway gov’t deficits.