Jokers and Thieves

May 19, 2025 – Weekly Comment

***********************************

Jokers and thieves

May 19, 2024

Alex Manzara/ Interest Rate Strategy and Execution/ amanzara@rjobrien.com

______________________________________________________________________

There must be some kind a way outta here

Said the joker to the thief

–Jimi Hendrix All Along the Watchtower

The youtube clip is a rendition of this song by Playing for Change, “…using music as a tool for education and social change around the world.” A lot of fantastic covers by this organization.

This week we had a brief resurrection of meme stocks. GME and AMC exploded in a starburst followed by flickering embers falling back to earth. Just an interesting market footnote, right? Maybe, but my theory is that the bros, or apes, or whatever they are called these days, are out of money (and ideas). I googled “investing apes” and was directed to the subReddit site WallStreetBets. Yup, Reddit is the site that AI will be mining. I guess we’ll see how it all works out.

In any case, the short squeeze in GME was short-lived this time. Why? My theory is that the first time around, there were government stimulus funds to burn through. And now…it’s gone.

So, what are the ramifications for interest rate futures? I think it means that US rates at the short end are likely to come down. But the market already reflects that, with heavily inverted calendars in short-rate futures. For example, SFRM4/SFRM5 closed -100 post-CPI before bouncing back to -88 to end the week. The high settle in SFRM5 on Wednesday was 9570.5 or 4.295%, still about 100 bps lower than the current Fed Eff rate of 5.33%. SOFR calendars have reflected the ebbs and flows of more or less easing, but have been continuously biased toward lower rates in the future since late 2022. Of course, new information can always impact perceptions of the future, though sometimes it’s just about flows. More on that below.

For example, Redfin says that the median home price hit a new record in April of $434k.. Whether that’s actually inflationary or not isn’t clear, but it doesn’t make one think of disinflation and rate cuts. However, the Redfin release also noted “18% of homes for sale in April had a price cut, up from 12% in April 2023.” Rick Rieder of Blackrock had an interesting take on Fed policy and inflation: he thinks cuts may actually cause inflation to recede. “I’m not certain that raising interest rates actually brings down inflation,” Rieder told Bloomberg’s David Westin… “In fact, I would lay out an argument that actually if you cut interest rates, you bring down inflation.” The reason has to do with the bifurcated economy. High rates help savers who can now afford to pamper themselves with more services due to large interest rate cash flows. Lower the cash flows (interest income) and lower the demand for expensive services. I love the example he gave: “The price of a pair of tennis shoes is what it was 20 years ago. If you go to a tennis match, it’s double what it used to be.” Honestly…who goes to a tennis match?

Anyway, the bros aren’t the ones with large savings earning interest. They’re the ones trying to show Wall Street fat cats who’s boss. And it didn’t work. Know what else the bros do? They bet on sports. (Probably not tennis, Rick). So, rather than ponder the complications of interest rate strategy, I went right to the source and placed a bet with long puts on one of the online gambling sites. I won’t say which one, but it’s not a casino company…a lot of those have a large Macau presence, and China’s stimulus measures might actually help those companies. No…I want to isolate the guy in the US who loves sports betting, but now is finding himself strapped for funds. No more easy short squeezes, no more job-hops for big raises. We’re now more likely to see advertisements of the sort that Rocket Money is running, to help CUT expenses by canceling subscription services.

I think the US consumer has turned, in a negative way, and that will feed into softer labor market data. However, the flows are a bit mixed. For example, on Friday there was a seller of 50k SFRH5 9600/9650c spreads (exit) at 6.5. Settled 6.0 ref 9535.0. Typically, when the Fed starts to cut, they move fairly quickly, but here’s a guy paring back on longs.

Another thought on flows. Last week’s TIC data showed a large decline in China’s Q1 holdings of US treasuries. From BBG: “Beijing offloaded a total of $53.3b of Treasuries and agency bonds combined in the first quarter.” Below are monthly changes in China and Hong Kong holdings of treasury securities in Q1, March, February and January, in billions:

China, Mainland -$7.6, -$22.7, -$18.6

Hong Kong -$10.3, -$16.0, -$5.7

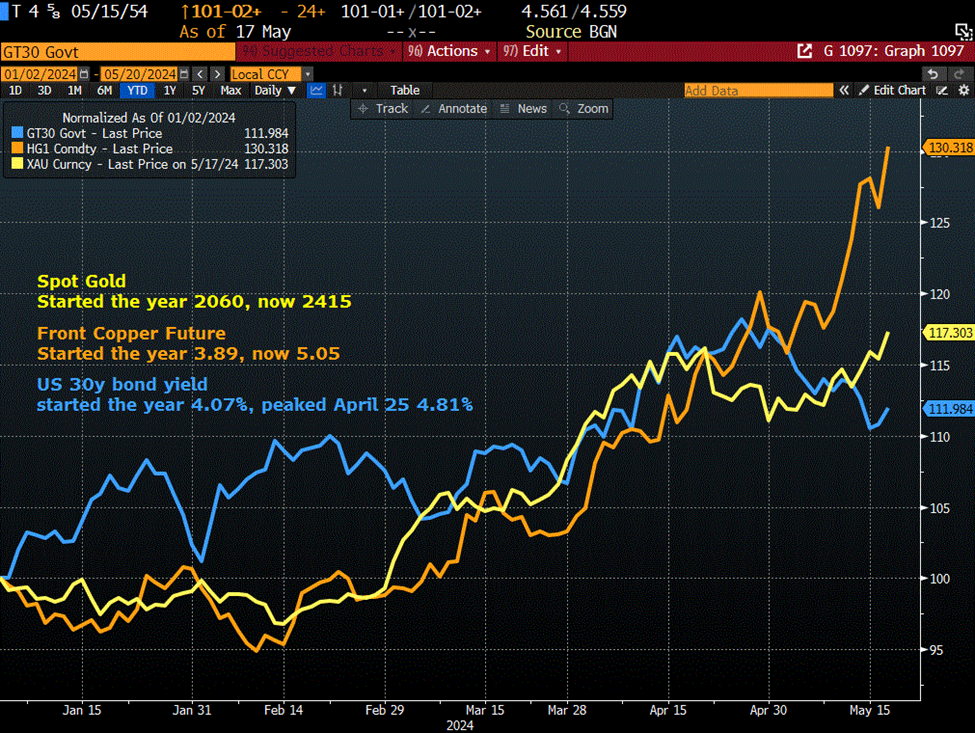

That’s $48.9b for China and $32b for Hong Kong. Consider the chart below. The chart starts at the beginning of the year. What if it’s all about China’s flows? Selling US bonds (yields generally increased through Q1 into April), buying gold, and buying copper. Maybe the increase in US yields and the surge in commodity prices have little to do with forecasts of future inflation, but simply reflect China’s portfolio shift. From a Thursday BBG article: “China sold a record amount of Treasury and US agency bonds in Q1, highlighting the Asian nation’s move to diversify away from American assets as trade tensions persist.” Also from BBG regarding China’s sale of 1 trillion yuan ($138 billion) ultra -long special sovereign bonds:

“Bonds with 20-year and 50-year tenors will be offered from May 24 and June 14, respectively. Auctions of the securities will continue until a final batch consisting of 30-year notes goes on sale in November.” China’s 10y yield was over 2.7% in November and is now 2.3%. China looks to be locking in low rates for long-term financing (taking out a mortgage to buy unsold homes) while Yellen borrows short, at the highest end of the US rate curve spectrum. Jokers and thieves.

Should be a quiet week, with little US data coming out before the Memorial Day weekend. I will be out next week.

| 5/10/2024 | 5/17/2024 | chg | ||

| UST 2Y | 486.6 | 482.2 | -4.4 | |

| UST 5Y | 451.6 | 444.0 | -7.6 | |

| UST 10Y | 450.2 | 441.8 | -8.4 | |

| UST 30Y | 464.4 | 455.9 | -8.5 | |

| GERM 2Y | 296.7 | 298.6 | 1.9 | |

| GERM 10Y | 251.7 | 251.5 | -0.2 | |

| JPN 20Y | 169.2 | 175.2 | 6.0 | thru Oct’23 high |

| CHINA 10Y | 232.0 | 231.7 | -0.3 | |

| SOFR M4/M5 | -82.5 | -88.3 | -5.8 | |

| SOFR M5/M6 | -43.0 | -48.0 | -5.0 | |

| SOFR M6/M7 | -12.5 | -12.5 | 0.0 | |

| EUR | 107.72 | 108.72 | 1.00 | |

| CRUDE (CLN4) | 77.84 | 79.58 | 1.74 | |

| SPX | 5222.68 | 5303.17 | 80.49 | 1.5% |

| VIX | 12.55 | 11.98 | -0.57 | |