Markets with high uncertainty giving me the blues

January 14, 2024 – Weekly Comment

**************************************

Blue Monday is said to be the most depressing day of the year, typically the third Monday in January. It’s on top of us. But, spin a little bit of BB King, and you’ll shake it off pretty fast.

I don’t quite feel like I can trust any of the news or data that’s been spinning out, so I thought ‘Nobody Loves Me But My Mother (and she could be jivin’ too)’ might capture that skepticism. That’s the world we’re trading in.

In the three months since the middle of October every treasury yield from tens in fell over 100 bps. The two-year yield dropped from 5.22 to 4.134 as of Friday’s futures settlement. Same with fives, high of 4.96 to 3.83. Tens hit 4.99 in October, posted a low of 3.79 in December and are now 3.95. Thirties reached 5.11 in October, plunged to 3.95 in late December (so over 100 bps at the low), and are now 4.19.

The first SOFR contract which is lower in yield than the five year is December’24 at 9637.5 or 3.625%. SOFR contracts are above 9617, or 3.83, the 5-yr yield, all the way out to September 2031 (SFRU’31 = 9617). That means positive carry; the yield on longer dated paper can be profitably financed with shorter term borrowing. (High point is SFRZ’25 at 9689)

From BBG: “Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before. Saddled with the kinds of bloated deficits that were once unthinkable, these countries – along with Japan – will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.”

The White House projects a US deficit of $1.8 trillion in 2024, which is, of course, the bulk of what is cited in the BBG article. The last SEP, from the Dec FOMC, projected end of 2024 Fed Funds at 4.6%, end of 2025 at 3.6%, and end of 2026 at 2.9%. The market has airbrushed 2024 out of the picture, and gone right to 2025. The 2025 projection of 3.6% is right where SFRZ4 settled on Friday, 9637..5 or 3.625%. SFRZ5 is approaching the 2026 FF estimate of 2.9 at 9689 or 3.11%. How does the US government shove another 1.8t of debt down the market’s gullet? The Fed can make the whole thing happen with positive carry. Et voila, foie gras.

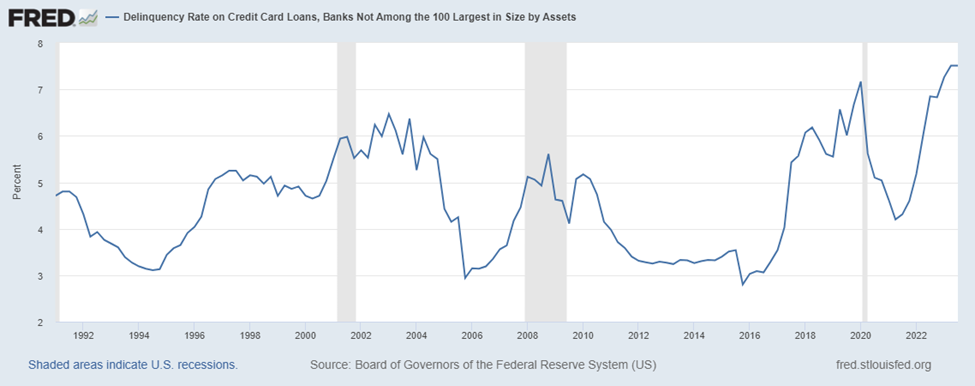

However, accommodating Federal fiscal largesse likely crowds out the private sector and could easily re-ignite smoldering inflationary embers. On the other hand, the household sector is showing increasing signs of stress on the frayed edges. The delinquency rate on credit card loans (all commercial banks) is 3%, which hasn’t been this high since 2012. The delinquency rate on credit cards loans (not among banks in the 100 largest) is a record 7.5%.

A Fortune article from last week sports this headline:

2023 was a worse year for corporate bankruptcies than 2020 – and the highest since the GFC – after a stunning 72% surge, S&P Global finds

At the start of the subprime mortgage crisis in 2007, many labeled problems in that little corner of the market as “a mile wide and an inch deep”. Analysts thought it just wasn’t large enough to spill over into the broader economy. I skimmed through a few articles about subprime in 2007. This one outlines many of the problems quite succinctly. It’s from 1-November 2007.

I love the concluding paragraph:

Now attention focuses on the wider economy. So far, the business sector has acquitted itself decently, manifesting an underlying strength. The global economy also keeps booming. While spreads have narrowed in the wake of the rate move, it will take months to see how consumers react. Will mortgage delinquency rates continue to rise, and trigger financial markets to lose confidence again? Will Wall Street scare Main Street enough for consumers to stop buying? If that doesn’t happen, and we avoid a recession, the credit crunch may go down as a summer squall, rather than a force 10 storm.

Now it’s all about “landing” scenarios rather than perfect storm analogies. Don’t worry comrades, the storm comparisons are right around the corner.

In 2007 stocks topped in mid-October, right after a 50 bp cut in September from 5.25 to 4.75%. A pullback ensued in late October, and another run for the high occurred right at the end of Oct, corresponding to another rate cut of 25 bps to 4.5%. That rally failed. It’s right when the article above was published. We know what happened next. A proper storm.

There are many complicating factors in the present environment. At the top of the list, in my opinion, is the threat of expanding military and terrorism conflicts. Domestically, I think that Stephanie Pomboy (in an interview on Thoughtful Money) synthesizes a huge issue. She said it’s well known and accepted that the government inflated moral hazard relating to banks and the corporate world in the aftermath of covid. But she cites current non-payment of student loan debts and rising credit card delinquencies as akin to a household payment strike, awaiting (another) government bail-out. After all, even after the moratorium on education loan payments ended, the Biden administration keeps dangling out hints that loans will be forgiven. Given the circumstances, and the likely lack of penalties, those who are dutifully making payments are chumps. That mindset is a huge problem going forward.

There’s a lot of talk about the Fed pivoting in order to influence the election. I don’t personally believe that’s in Powell’s DNA. However, the Fed does have to walk the line between the possibility of defaults crushing the economy, and the idea that easier policy feeds into fiscal stupidity (in an attempt to kick a heavier can a bit further down the narrowing road). In any event, the market is forecasting increasing geopolitical risks and a weaker global economy to result in rate cuts. Look back at 2007: 75 bps of cuts in two meetings. On Friday SFRH4/SFRM4 settled at a new low -56.5 (9501/9557.5). SFRH4/SFRH5 settled at a new low of -163.5 (9501/9664.5) down 21 on the week. FFG4/FFG5 settled -182.5! Maybe these spreads aren’t as crazy as they look, even if certain Fed members continue to jawbone higher-for-longer.

The defiant Taiwan election adds to uncertainty of the Middle East.

OTHER THOUGHTS / TRADES

The curve steepened by a lot last week. On 5-Jan 2/10 closed -34.5. On Friday I marked it at -18.6. Last year in July, the low in 2/10 was -108.5. By the end of October it rallied to -16, nearly 100 bps. Recent low in mid-Dec is -53.5, and it’s now back testing last year’s high.

In 2007, 2/10 went from around -15 in March to around +50 in August, before the first ease. By March 2008 It was 200. So, a move of over 200 bps in a year. A similar magnitude would put 2/10 at ~ +100.

On Friday, Feb VIX 17 calls were bought in size 250k. I believe price was 0.79. BBG lists open interest at 91k (cover short and double up the other way?) The highest OI in Feb VIX calls is the 20 strike at 334k, with premium of 0.51. Spot VIX ended last week at 12.7, pretty much at pre-covid levels. In April 2007 VIX was around 12.7. In October it hit 80. I’m not sure that 2007 is the right template for today, but it wouldn’t surprise me at all to see VIX hit 20 before Feb expiration.

Last week I suggested buying SFRH4 9481.25p delta neutral (3.75, -0.29d vs 9493.0). Given Logan’s assertion that we’re no longer in a super-abundant reserve regime, I thought vol might firm significantly in near contracts. It didn’t. However, Friday’s settles showed a small profit due to gamma: puts settled 2.0 and futures 9501. Lose 175 bps on puts per hundred, make 232 on futures.

20-year auction on Wednesday. Ten-year tips on Thursday. There was very heavy trade in SOFR options Friday, weighted heavily to upside. Will summarize on tomorrow’s daily.

| 1/5/2024 | 1/12/2024 | chg | ||

| UST 2Y | 438.7 | 413.4 | -25.3 | |

| UST 5Y | 400.7 | 383.0 | -17.7 | |

| UST 10Y | 404.0 | 394.8 | -9.2 | |

| UST 30Y | 420.0 | 419.5 | -0.5 | |

| GERM 2Y | 256.8 | 251.7 | -5.1 | |

| GERM 10Y | 215.6 | 218.4 | 2.8 | |

| JPN 20Y | 136.0 | 130.7 | -5.3 | |

| CHINA 10Y | 252.0 | 252.2 | 0.2 | |

| SOFR H4/H5 | -142.5 | -163.5 | -21.0 | |

| SOFR H5/H6 | -34.0 | -21.0 | 13.0 | |

| SOFR H6/H7 | 6.5 | 13.0 | 6.5 | |

| EUR | 109.43 | 109.51 | 0.08 | |

| CRUDE (CLH4) | 73.86 | 72.79 | -1.07 | |

| SPX | 4697.24 | 4783.83 | 86.59 | 1.8% |

| VIX | 13.35 | 12.70 | -0.65 | |