A bit of volatility at a less liquid time of year

December 21, 2023

*********************

–Afternoon swoon in stocks underpinned the bid in rate futures. Good Reuters headline: Stocks Sober Up, But Rate Cut Party Lives On. SPX fell 1.5% after having made a slight new high. Note that from mid-March to late July SPX rallied from around 3800 to 4600 in four and a half months. Impressive rally. From the end of October to yesterday , not quite two months, SPX rallied nearly the same point amount, from around 4100 to just under 4800, compressed in less than half the time. No wonder there’s a pullback!

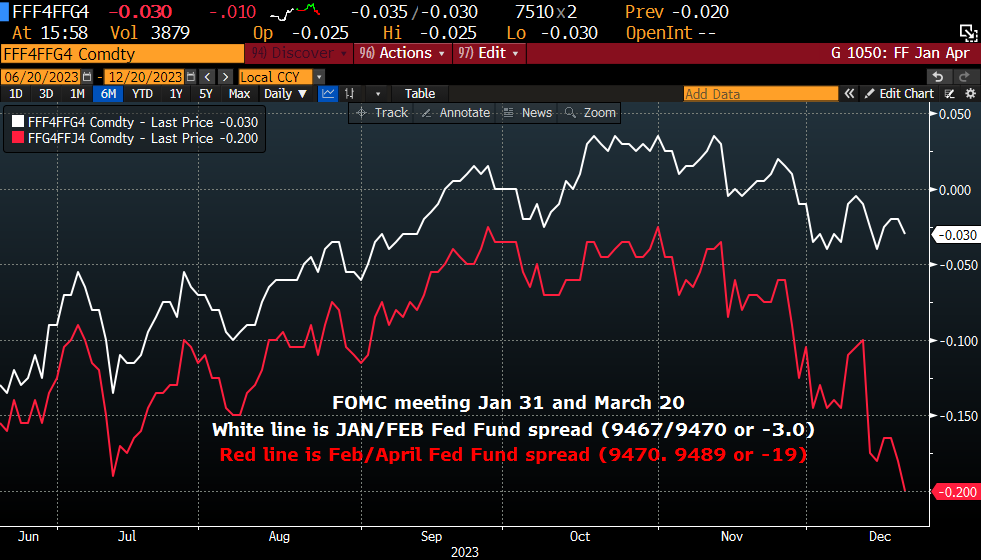

–New low in SFRH4/M4 at -47 (9497.5/9544.5). Also a new recent low in SFRH4/H5 at -152.5 (9497.5/9650). Rate cut perceptions are being somewhat front loaded as nearer spreads invert further. Attached is a chart of Jan/Feb FF spread and Feb/April. These two spreads forecast the Jan 31 and March 20 FOMCs. Jan/Feb settled -3 (9467/9470) around a 10% chance of a cut at 2024’s first meeting. But Feb/April settled -19 and was -20 late, indicating about 80% odds of a cut in March.

–30 year yield went out just over 4%, down 3 bps (ref USH settle 124-13). Curve from 2s forward steepened slightly.

–GDP revision this morning. Philly Fed expected -3.0 from -5.9.