From a minor tweak in position to GET ME OUT

December 15, 2023

***************************

–Hey wait a second…did Gundlach say he expects 10s to trade to the low threes sometime next year? Or by the end of this year? 10y yield dropped another 8.6 bps yesterday to 3.902%. That level corresponds to a 61.8% retrace from the April low of 3.31% to the October high 4.99% (=3.95%). After the jarring re-adjustment of the past couple of days, one would think this area would hold. Of course, I also had thought the 50% area, (around 4.15%) would provide strong yield support.

–On the SOFR curve, near calendar spreads made new lows as the prospect for rate cuts hurtles closer. For example, SFRH4/H5, the most inverted spread, dropped another 9.5 bps to -151 (9496.5/9647.5). Similarly, FFF4/F5 settled -149. It’s not exactly a forecast for 150 bps of cuts over the year, but it’s a fairly aggressive inversion. I was in a brief conversation about what comes next year, and it seems to me that a money spread this inverted means there will still be plenty of action. My own bias is that the curve from 2’s forward will have to slope positive next year (2/10 is currently -46) but I’m not at all confident of the path. As we like to say in this business, “Tell him the good part Mortimer!” In any case, the two week flip from “We’re not considering rate cuts” to “We’re discussing rate cuts” has sparked a firestorm of trade adjustment, and those that believed in Powell’s inflation fighting crusade were left shaken. Political? Maybe…he’s not the only one on the Fed.

–There was heavy volume yesterday and I missed a lot of SOFR option plays, but there clearly was a large exit of SFRM4 9600/9700cs. This call spread had been heavily bought (way too early) and yesterday was used as an opportunity to trim. Open interest fell 46k in M4 9600c and 70k in 9700c. The sprd settled 9.75 ref M4 9540.5. Not even sure if this was a scratch, but I think the same guy has a lot of call spreads in more deferred contracts which are doing fine. In any case, even though this wasn’t a huge trade, it sort of captures the theme. On the SOFR curve open interest fell in futures contracts within the next year, H4 -33k, M4 down 43k, U4 down 29k. The entire strip fell 77k. So shorts have thrown in the towel on fronts, and longs are willing to lighten up. The June call spread sales, as an example, tend to hold down fronts relative to deferred and M4/M5 also made a new low at -127 (M4 9540.5 +5 and M5 9667.5 +13).

–What’s a bit odd is that a spread like 5/30 didn’t rally. I marked at 14.4 at futures settle, down from 19.2 on Wednesday. Bond futures and vol were relative outperformers on the treasury curve. My sense is that it’s a gift to buy 5/30 if the Fed’s going to start easing soon, but perhaps an end to QT is going to influence the curve in unanticipated ways.

–I have to admit I was triggered first thing this morning. Nah, it’s got nothing to do with Harvard… it was a headline on Reuters:

A $6 trillion cash hoard could fuel more U.S. stock gains as Fed pivots

Total money market fund assets hit a record $5.9 trillion on Dec. 6, according to data from the Investment Company Institute

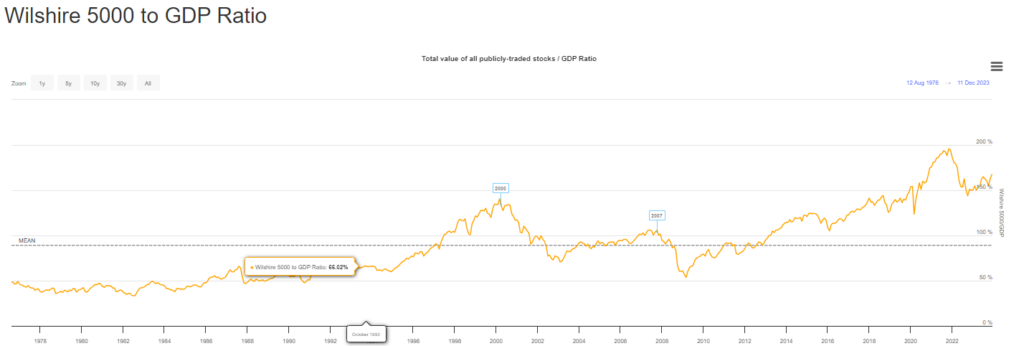

–So…money market funds are going to drain right into stocks. Makes perfect sense to JUMP IN right? Well, according to the Buffet indicator market cap to GDP, we’re not ‘cheap’. Chart attached. In the relatively high-rate years of the early 1990s, the mkt cap to GDP ratio was around 66%. Now around 160%. Maybe that money will just pour into the Hang Seng which is down around 25% from February’s highs. Of course, there are problems in China, different considerations… But there are ALWAYS other considerations. Potential money flows are but one…

https://www.longtermtrends.net/market-cap-to-gdp-the-buffett-indicator/.