Long bond yield sinks in flattener

December 7, 2023

*******************

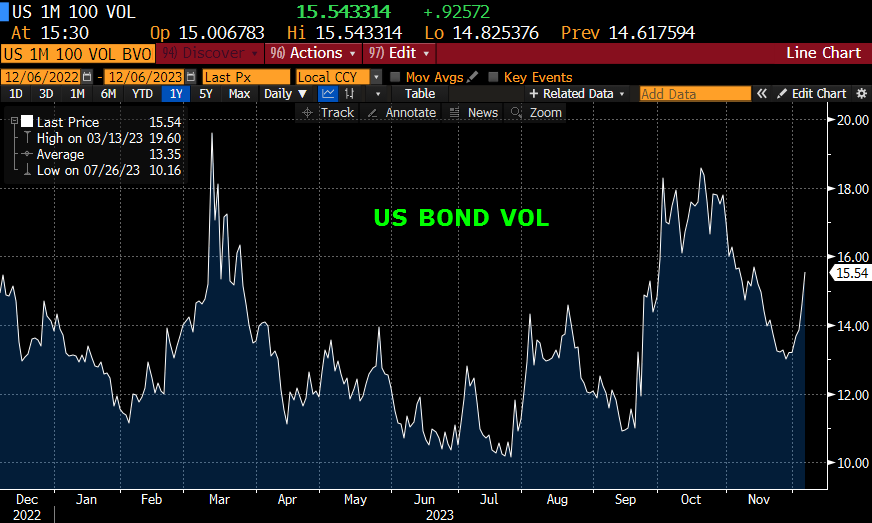

–Long end of the market was well bid in conjunction with a hard flattening trade. Two year rose 2.6 bps in yield to 4.601% while the thirty yr fell 8 bps to 4.225%. US vol had a nice jump from 13.9 to 14.5 ( USH4 atm straddle from 6’12 to 6’32). Icing on the cake was a new 5k buy of Jan 134.5c for 2. These expire two weeks from tomorrow against yesterday’s future settle of 120-11. Now THAT’S a reach! Ten year breakeven hit a new recent low of 214.5 bps.

–ADP was only 103k. Unit Labor Costs -1.2%. Today’s news includes Jobless Claims expected 225k, Fed’s Z.1 quarterly report on Net Worth and Debt aggregates, and Consumer Credit. Could HH Net Worth show a rare decline? SPX was down around 3.7% from June to Sept, but of course real estate will be marked higher.

–On the SOFR curve, it was the same story in terms of flattening. Red pack (Z4 start) -4.125, greens +1.875, blues +4.5, golds +5.625. Near contracts settled down on the day in position squaring prior to tomorrow’s NFP. Once again, near SOFR call flies and condors being bought:

+40k SFRF4 9587.5/9500/9512.5c fly 1.75 to 2.0

+40k SFRJ4 9537.5/9575/9612.5c fly 4.5 (these appear to have been buying back shorts on the bottom strikes)

–CLF4 (Jan WTI) settled below $70, marking a roundtrip starting in July with an intermediate high of $90 in late Sept. Copper is also showing signs of weakness. After a surge higher on Dec 1 it has had three big straight-down days in a row, from 3.9315 on Friday down to 3.7345 yesterday. Industrial commodities are reflecting weak conditions.