“Just close the f’ing door”

November 10, 2023

–I don’t know if Powell actually uttered those words when confronted with climate activists yesterday, but it sure sounded like it. On the other hand, he continues to close the door on those looking for a quick pivot toward ease. I think everyone agrees that policy is currently restrictive, but Powell quantified it by noting FF at about 5.3% while forward inflation expectations are more like 3%, yields a real rate of around 2.3%. Restrictive. Note that U of Mich 5y inflation expectations are being released today, at 3%, and the ten year tip breakeven is currently 2.35%. When asked about Fiscal policy working at cross currents with the Fed’s monetary policy, Powell was quick to say he doesn’t comment on fiscal affairs [except that he recently pulled no punches in describing the fiscal house as unsustainable]. Lorie Logan (Dallas) speaks this morning.

–Yields soared yesterday as the 30y auction tailed by 5.3 bps, 4.716% pre-auction vs actual 4.769%. At futures settle the wi was 4.77/76.5. Most yields up 10 to 12 bps. Ten year +12 to 4.628. Though there were some that said a ransomware hack on ICBC might have had something to do with poor results, the October 30y auction had also tailed, by about 3 bps. Note that the Week2 110 put, expiring today, was significantly exited by the long. Open interest fell 20k, still 22k open, settled at 2’30, intrinsic vs 107-17. Buyer yesterday of 25k SFRJ4 9525/9537.5cs for 2.75. SFRM4 settled 9488.5. Trade needs cuts of around 3/4% to fill in

–The ransomware attacks seem to be coming more frequent and sophisticated, and are likely a real threat to liquidity. And allegations of fraud go hand-in-hand with hacks, a development that seems to be impacting the mortgage market currently. Navigate around on the Treasury-Direct site for a while (now that the public en masse have opened treasury accounts) and ask yourself if it could possibly be vulnerable to a hack. Just close the f’ing door…now that all the bonds have scurried out the back way…

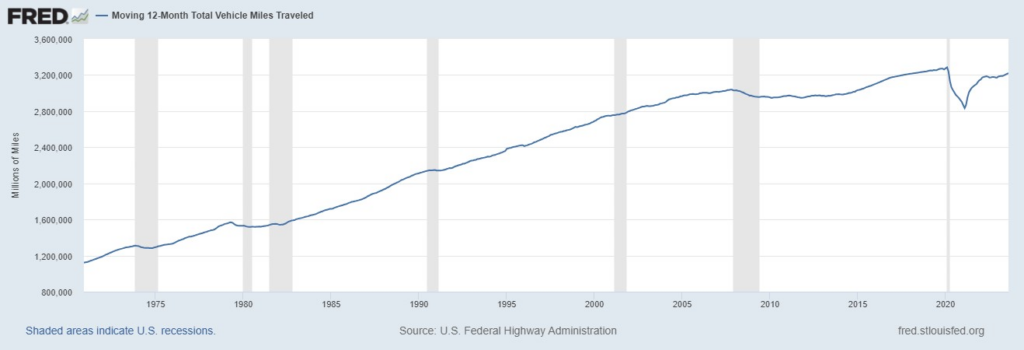

–Chart below is vehicle miles traveled. While we’re often reminded that data points now exceed pre-pandemic levels, miles driven hasn’t. WFH? Maybe.

https://fred.stlouisfed.org/series/M12MTVUSM227NFWA