SOFR curve won’t adjust all the way to Fed’s projections

September 21, 2023

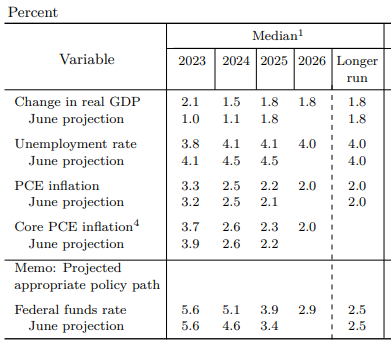

–For a long time, long dated assets were underpinned by the idea that Fed rate increases would be significantly reversed in the coming year. That assumption was crushed yesterday as the Fed raised the FF end-of-2024 dot from 4.6 to 5.1. The 2023 estimate for FF remained at 5.6, same as June, indicating one more hike this year. I marked tens yesterday (at the time of futures settle) at 4.345% but this morning the yield is over 4.42%. SPX down nearly 1% yesterday and is lower as of this morning, with ESZ printing 4428, down 19.

–There had already been a large adjustment to higher yields in red SOFR contracts as mentioned yesterday. So, the red pack barely changed on yesterday’s settle at +0.75. SFRZ4 was down 1 at 9538 and SFRH5 was +0.5 at 9568, with more deferred contracts settling +2 to +3. Even as the Fed’s FF projection took the 2023 to 2024 spread from -100 bps to -50 bps, the SFRZ3/SFRZ4 spread was unch’d at -86 (9452/9538). It might be more reasonable to ‘split the difference’ and move Z3/Z4 towards -75, but the market does not currently think the Fed can carry through on keeping the rates high for another year given deterioration in some economic data. Perhaps more interesting is the 2024 to 2025 FF spread. The Fed kept that at -120 bps, from 4.6 and 3.4 estimates made in June to 5.1 and 3.9 yesterday. SFRZ4/SFRZ5 did make a new low at -70, down 3 on the day (9538/9608). The Fed’s dot plot suggests the 2023/2024/2025 butterfly at +70 bps -(5.6 – 2*5.1 +3.9). While the Z3/Z4/Z5 fly has recently barreled higher and settled yesterday at a new high of -16 (9452/9538/9608), a move into positive territory would be surprising.

–There was a buyer of about 10k 0QH4 9525/9425ps for 14.5 (ref 9577) yesterday in a nod to the Fed. Settled 16.25 (18.75/2.5) ref SFRH5 9568.0. So, on settlement H4 is still at a rate of only 4.32%.

–The economy has simply been more resilient than the Fed had anticipated. The risk is that this SEP is over-correcting and the guidance embedded in the projections will tighten financial conditions (lower stocks, higher rates, stronger USD, wider credit spreads) such that the June estimates would have ultimately been more accurate.