Tighter conditions can lead to unexpected snaps

September 17. 2023 – Weekly Comment

******************************************

The FOMC meeting is Wednesday, widely forecast to be a skip. The current Fed Effective rate is 5.33% and FFV3 settled 9466.5 or 5.335%. The Nov 1 FOMC is still in play with FFX3 closing 9459.5 or 5.405%.

The ECB raised the policy rate this week, but significantly lowered forward growth projections to 0.7% from 0.9% for 2023, and 1.0% from 1.5% for 2024. Lagarde: “…we are going through a period of about five quarters of very, very sluggish growth…”

The Fed’s Summary of Economic Projections (SEP) should provide a contrast, as growth forecasts will be revised higher. In June, the change in Real GDP was raised from March, from 0.4 to 1.0 for 2023. The projection for 2024 was lowered by 0.1 to 1.1%. The first two quarters of 2023 printed 2.0 and 2.1, and the Atlanta Fed GDP Now is 4.9% for Q3 and 2.9% Blue Chip consensus. So 2023 will have to be raised, and 2024 is likely to see a bump up as well. The FF rate projections in June were revised up to 5.6% in 2023 from 5.1 in March, and 4.6% for 2024, from 4.3.

Interestingly, the SFRZ3/SFRZ4 one-year calendar spread settled Friday at -97.0 (9455.0/9552.0) almost exactly in synch with the Fed’s SEP, which indicates 100 bps of cuts in 2024. However, if growth projections are raised, then it’s also probable that the 2024 FF forecast will be ratcheted up from 4.6%. Indeed, SFRZ4 posted a new contract low settle on Friday of 9552.0 or 4.48%. (New low settles as well in SFRM4 at 9487.0, U4 at 9518.5, and H5 at 9580.5. SFRM5 didn’t quite settle at a new low, but the price is 9600, exactly at 4%). On new contract lows, open interest in the above-mentioned contracts marginally declined with U4 falling 13k. In my opinion, this part of the curve is not seeing new panicky hedges; price action is more indicative of a shoulder tap to lighten up on longs going into a meeting where Powell is likely to emphasize higher for longer.

There was heavy buying Friday of SFRZ3/H4 3-month calendar spread, about 125k, reflecting the same sort of sentiment. The spread settled at a new high for the year at -10 (9455/9465) but open interest fell small in both contracts, -7k and -9.8k. In early May this spread had settled at a low of -56 post-SVB, on the idea that financial stress would spark aggressive Fed cuts. Those perceived cuts have obviously been squeezed significantly lower. For all the recurrent talk about the Fed losing credibility, here’s an instance where Powell showed a steady hand in guiding expectations away from knee-jerk easing. If there’s a loss of credibility, it’s with the Federal Gov’t budget, and long yields pressing against new highs are an obvious marker. 30y yield ended 4.41%, just slightly lower than the year’s high, posted in August at 4.45%

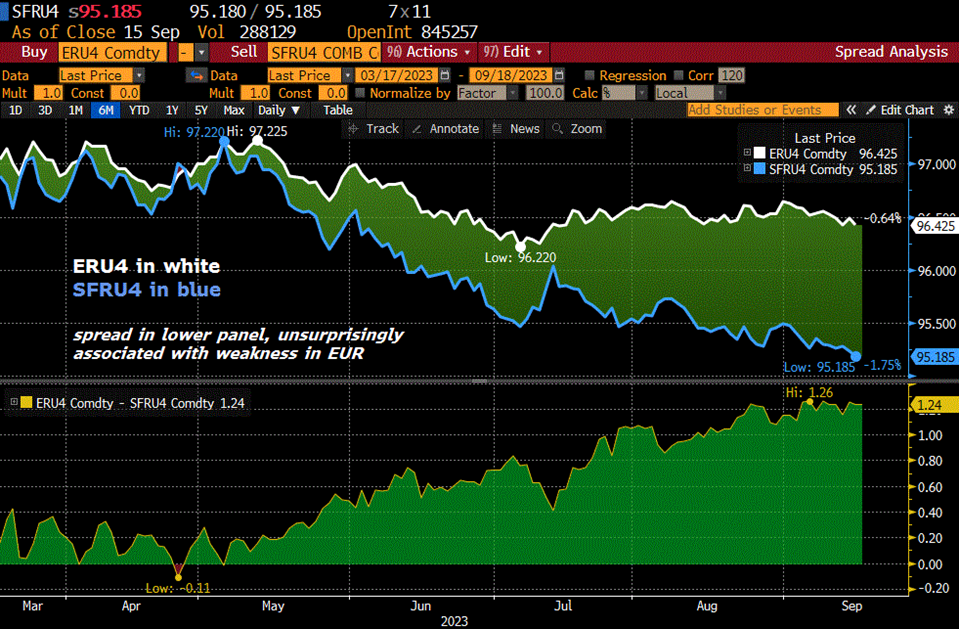

The spread between SFRU4 and ERU4 is making new highs near 1.25% (9642.5/9518.5). EURUSD has slipped from 112 to 106.5 since July as the forward interest rate differential widened. At the same time, USD vs JPY made a new high for the year this week at 147.85 and likely would have done the same against the renminbi if not for strong verbal intervention by the PBOC on Monday.

USD strength translates into tighter financial conditions, as does higher rates at both the short and long end. Another signal is credit spreads. On that score, here’s a clip from El-Erian’s Friday interview on BBG:

“If you look at high yield, if you look at commercial real estate, there’s massive refinancing needs next year. Massive… There are things that have to be refinanced in this economy that cannot be refinanced in an orderly fashion at these rates.”

From another BBG article, “This week Moody’s said the default rate for speculative-grade companies worldwide is expected to hit 5.1% next year, up from 3.8% in the 12 months ended in June. Under the most pessimistic scenario, it could jump as high as 13.7% – exceeding the level reached during the 2008/09 credit crash.”

Everyone knows that the markets have priced easing but that those expectations have been pounded lower since May. There has recently been more commentary about self-sustaining elements of higher inflation, noting for example that net interest expense for households and corporates has declined on balance, leading some to call for significantly higher rates. My view is that the Fed is done or almost done, but will attempt to hold out against cuts as long as possible. The topic of the Federal Gov’t’s unsustainable spending will likely come up at the press conference, and it will be interesting to see whether Powell is more expansive in outlining some of the issues or will simply give the boilerplate response of the Fed staying in its lane.

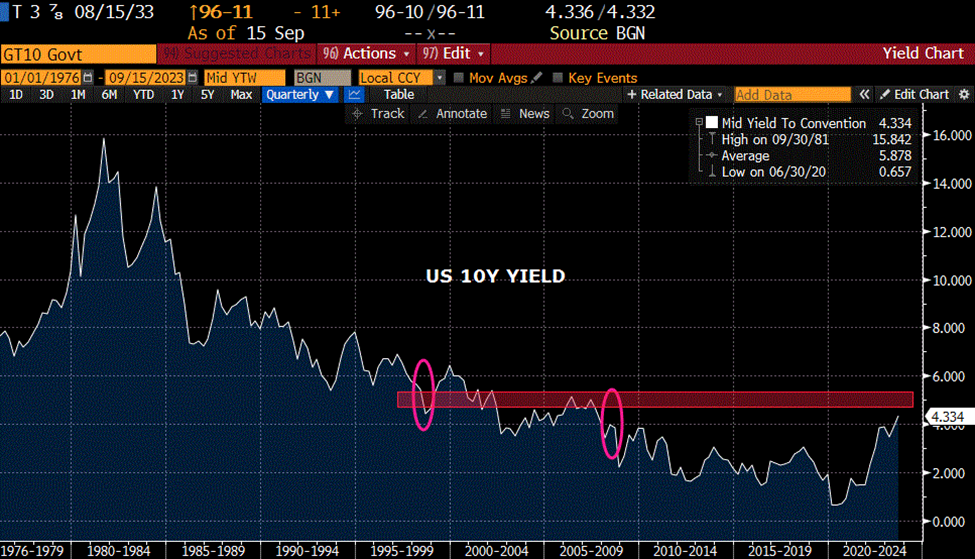

One last note relating to financial conditions and unanticipated snaps. Fifteen years ago we had Lehman in Sept 2008. Twenty-five years ago, the Russian default contributed to the demise of LTCM in Sept 1998. On the long term chart of the 2y yield, this area from 5 to 5.5% seems to be a level associated with potential stress. By contrast, the ten year yield isn’t there yet. Let’s see how the 20-year auction is absorbed on Tuesday…

Two-year above, ten-year below.

OTHER THOUGHTS/ TRADES

I skate to where the puck is going to be, not where it has been. -Wayne Gretzky

One interesting trade last week was a buyer of SFRZ3 9468.75/9493.75/9518.75 call fly for 0.75. The low strike is 5.3125% which compares to current Fed Effective of 5.33. If the Fed does NOT hike again this year, and the market perceives an ease at the first meeting of 2024 on Jan 31, then SFRZ3 will likely close between the bottom and middle strikes. Note that SFRU3 settled 9460.75 Friday. What happens on no ease in Sept and Nov, but a 50bp cut in Dec? That scenario would entail some pretty bad things occurring, and the market would likely price additional cuts in the beginning of 2024, which could cause SFRZ3 to blow through the upper strike. Low probability. Dec FOMC is 13th, while the options expire on the 15th.

The 4% call strike has been popular buy in both March’24 and now June’24, with 9600/9700 call spreads trading in good size. Last week it was June, paying around 9 bps. In SFRH4 the 9600c settled 6.0 with 285k open and the 9700c at 3.25 with 258k open (ref 9465s). In SFRM4 the 9600c settled 13.5 and the 9700c 5.75 with OI 152k and 189k. So the call spread settled 7.75 ref 9487s. The March call spread was also originally purchased over 10 bps. Both of these buys are obviously under water, but the idea that the Fed may have to reverse some of the 500 bps of tightening by Q2 is clearly possible.

| 9/8/2023 | 9/15/2023 | chg | ||

| UST 2Y | 498.0 | 503.5 | 5.5 | |

| UST 5Y | 439.4 | 445.3 | 5.9 | |

| UST 10Y | 425.7 | 432.2 | 6.5 | |

| UST 30Y | 433.2 | 441.2 | 8.0 | |

| GERM 2Y | 308.1 | 321.5 | 13.4 | |

| GERM 10Y | 261.0 | 267.5 | 6.5 | |

| JPN 20Y | 139.7 | 142.8 | 3.1 | |

| CHINA 10Y | 266.7 | 266.8 | 0.1 | |

| SOFR Z3/Z4 | -108.0 | -97.0 | 11.0 | |

| SOFR Z4/Z5 | -59.0 | -63.5 | -4.5 | |

| SOFR Z5/Z6 | -6.0 | -9.0 | -3.0 | |

| EUR | 107.03 | 106.60 | -0.43 | |

| CRUDE (CLX3) | 86.81 | 90.02 | 3.21 | |

| SPX | 4457.49 | 4450.32 | -7.17 | -0.2% |

| VIX | 13.84 | 13.79 | -0.05 | |

https://blinks.bloomberg.com/news/stories/RY1ZJ5DWLU68

*****************************************************************

I’m not sure if there’s much of an overlap between short term interest rates and guitar soloists! But if anyone is interested, my nephew Julian offers remote lessons:

Julian Manzara

I transform intermediate guitar players into confident, expressive soloists (improvisers)! Music College Grad + 100s of gigs and international tours – See my coaching testimonials!

https://www.linkedin.com/in/julianmanzara/