If you’re renting from Blackrock and can’t make the payments, but the guy across town owns his home outright, how many 0DTE options should you buy?

August 14, 2023

–Continued slide in TY and US futures Friday. 10y yield +8.6 bps to 4.164% and 30s +3.4 bps to 4.27%.

–On the SOFR curve the pivot point had been reds (rally the hardest, sell off fastest) and in turn the red midcurve straddles had been more expensive. However, given weakness in the greens and blues, nominal straddle prices are now all fairly close:

0QU3 9550.0^ ref SFRU4 9554.5 is 35.5

2QU3 9625.0^ ref SFRU5 9621.0 is 37.0

3QU3 9637.5^ ref SFRU6 9637.5 is 38.0

Given the pricing inversion in futures, it probably makes 3QU calls relatively expensive.

–(Reuters) – Chinese property giant Country Garden’s debt problems deepened after its onshore bonds were suspended, sending its shares plunging 16% to a record low on Monday in a fresh blow to policymakers trying to shore up confidence in a stuttering economy.

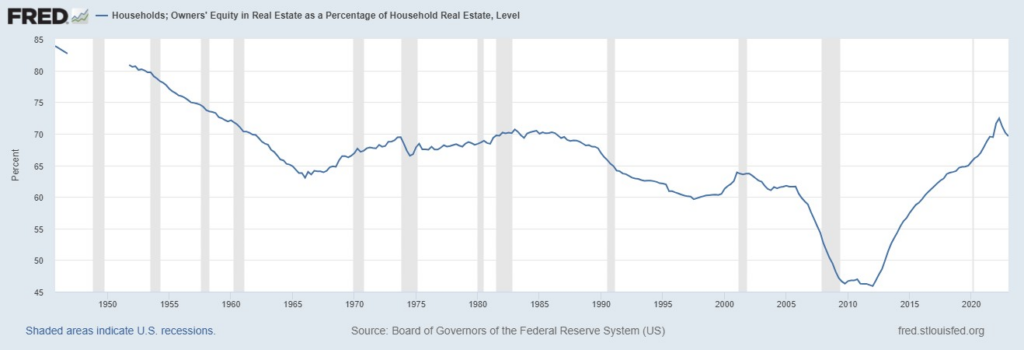

–China’s property markets remain stressed as the quote above attests. Consider this contrasting US image: Homeowner’s Equity in Real Estate around 70%. But it was still relatively high in 2005/06 in the low 60s before the housing bust. Is the bulk of the population just renting? I’m not drawing conclusions from one chart but perhaps it points up the split in the economy when considered against the idea of credit card balances surpassing $1 trillion.

By the way, according to the last Fed Z.1 quarterly report, Home Mortgages were $12.5 trillion in Q1. The level during the GFC, Q1 2008 was $10.7 trillion. Up 17% in 15 YEARS.