Lumber was 1600 in 2021. Now 348.

May 12, 2023

–PPI yoy just 2.3% yoy. Core 3.2%, both lower than expected. Yields fell immediately but ended only marginally lower. 10s fell 4.3 bps to 3.394%.

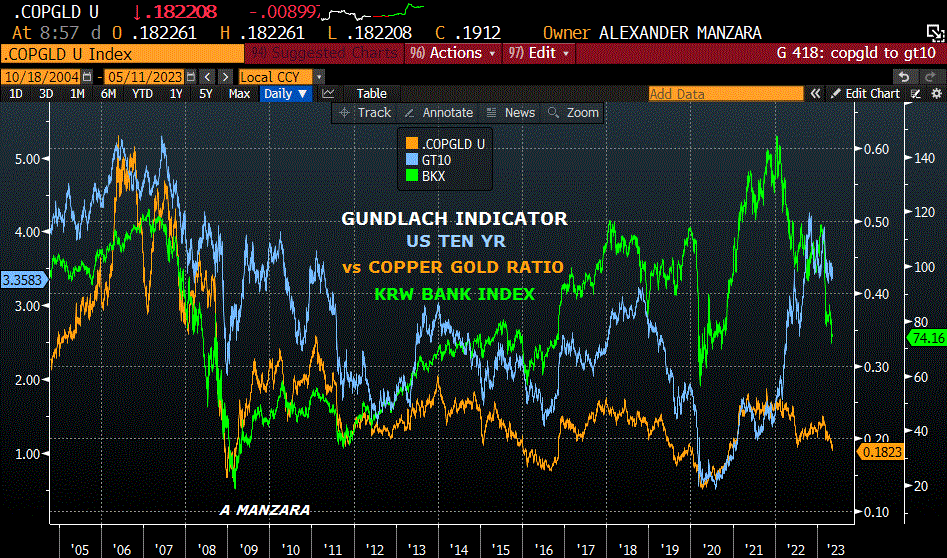

–Copper futures fell to their lowest level in 2023 (HGN3 3.71). As can be seen on attached chart, lumber is back at 2018 level, less than one-quarter of the high price set in 2021. Ten year breakeven (treasury/tip) ended yesterday at a new recent low 217 bps. An indicator Gundlach has cited is the copper/gold ratio vs the ten year yield. The latter should be crashing, not that 3 3/8% is high.

–New low in SFRU3/U4 at -177 bps. SFRM3/M4 settled -183.5; the front spread is the most inverted. A twitter clip from yesterday said the ratio between tech stocks and S&P 500 is 2 standard deviations above the historical mean. Not even sure why I am adding that snippet, except to say that it’s all about big tech, which trade like long-dated bonds.

–May SOFR option expiration today. SFRM3 is trading 9494.5, pegging the 9493.75 strike. There are 82k May 9493.75c open, settled 2.0 and 226k 9493.75 puts open, settled 1.25.

Gundlach indicator below…added BKX, a regional bank index

Lumber