Won’t risk a backslide

March 5, 2023 – Weekly Comment

On Thursday, Waller gave a speech with this line:

Last month we received a barrage of data that has challenged my view in January that the Federal Open Market Committee (FOMC) was making significant progress in moderating economic activity and reducing inflation.

On Saturday, the SF Fed’s Mary Daly gave a speech with the following excerpt (same idea):

Overall inflation remains well above target and contributions from each of the components of inflation—goods, housing, and other services—remain well above their historical trend (Figure 2). Moreover, the incoming data have been bumpy. The recent PCE reading is a good example. After months of decline, headline and core inflation both ticked up in January on a 12-month basis, and the monthly inflation rate rose at its fastest pace in seven months. This suggests that the disinflation momentum we need is far from certain.

Putting all of this together, it’s clear there is more work to do. In order to put this episode of high inflation behind us, further policy tightening, maintained for a longer time, will likely be necessary.

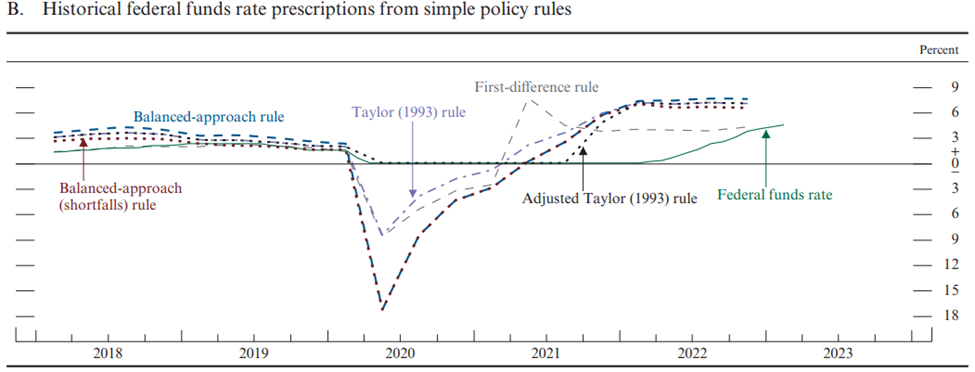

On Tuesday, Powell delivers semi-annual testimony to Congress. The report was released Friday, link is at bottom. It’s a long paper, but one notable section is on page 44 of the report (or page 50 of the pdf). It shows this chart with the current FF target, as compared to several rules-based policy prescriptions.

The rules-based models would have the FF target significantly higher than the current 4.5 to 4.75% range.

Powell’s message is likely to build on Waller and Daly. The labor market remains resolute, disinflation has started in goods, but the job is not done. The Fed can’t tolerate an inflation backslide which would risk an unmooring of expectations. On that point it’s worth noting that in December of last year and the start of 2023, the ten-year inflation breakeven was around 215 bps, and on Friday it posted the high of the year at 252 bps, though still well below the 2022 high of 302.

Daly’s speech noted four challenges which could counterbalance or offset deflationary trends of the pre-covid era.

1) A decline in global price competition. “Globalization has been a key driver of past goods deflation in the US… a trend toward less global competition could mean more inflation in the goods sector and more pressure on overall inflation going forward.”

2) Domestic labor shortage

3) Higher costs associated with the transition to a greener economy

4) A rise in inflation expectations

Markets have reacted dramatically to hotter than expected data in February. On Feb 2, SFRM4 notched a high of 9674.5. On Thursday the low was 9528.5, a plunge of 146 bps (settled 9540.5 on Friday). The largest net closing decline on the week was in SFRU4 which settled -11 at 9579.0. That contract traded as high as 9708.5 on Feb 2, and as low as 9566 on Thursday March 2 (142.5 bps). Obviously the reds (second year forward), had the largest moves in order to price the evaporation of the Fed pivot. Well, evaporation is not the correct word, as a review of a few one-year calendars makes clear. SFRH3/H4 was -104 on Feb 2 and +2.5 on March 2. SFRM3/M4 over the same period: -155 to -73.5. SFRU3/U4 -166.5 to -114. On Friday settles were -2.25 (9498.75/9501), -81 (9459.5/9540.5) and -122.5 (9456.5/9579.0). So the period from the middle of this year to mid-2024 is still pricing somewhere around 75 to 125 bps of ease.

Every so often, big name pundits proclaim the Fed is losing credibility or is way ‘behind the curve’. Obviously, the Fed was late in starting this hike cycle. However, it has been an incredibly aggressive year in terms of Fed adjustment. At the end of 2021 mortgage rates were sub-3%. On Friday the 30-yr fixed was 7.1%. The 2/10 spread is unambiguously reflecting tight policy, at a low for the cycle at -89. On Friday, Larry Summers was on BBG tv: “The Fed right now should have the door wide open to a 50 bp move in March. A reasonable assessment of where the Fed is would say that they have not been this far behind the curve for a year or so.” That is NOT a reasonable assessment, it’s blather for tv. The Fed just started to hike one year ago. The ’rules-based’ chart above shows how much the Fed has closed the gap. In any case, it’s worth noting that the Fed has more to think about than Larry. For example, there’s this clip from the Monetary Report Summary under ‘Financial Stability’:

Valuations in equity markets remained notable and ticked up, on net, as equity prices increased moderately even as earnings expectations declined late in the year. Real estate prices remain high relative to fundamentals, such as rents, despite a marked slowing in price increases. While market functioning remained orderly, market liquidity—the ability to trade assets without a large effect on market prices—remained low in several key asset markets, including in the Treasury market, when compared with levels before the COVID-19 pandemic.

For a while there, Financial Stability was almost thought of as a 3rd mandate for Fed policy. Now it’s back to the dual mandate of inflation and employment, dominated of course by considerations relating to the former. However, a couple of big blow-ups can put stability right back on the front burner.

OTHER THOUGHTS/ TRADES

April Fed Funds settled 9511.5. There is no FOMC in April, so FFJ3 prices the March 22 FOMC. A hike of 25 would cause a likely final settle of 9517 in FFJ3 (4.83%) and a hike of 50 at 9492 (5.08%). Half way would be 9505….sort of depends on Powell.

In the past few sessions, there has been a buyer of approx 80k SFRH4 9625/9725c spreads 9-9.5 and 20k of the 9612.5/9712.5cs. Settles 9.0 and 10.25 ref 9501.0. While most attention has been to the downside, it’s worth recalling that there have been several large call spreads accumulated over the past month. Apart from SFRH4, on Feb 1 there was a buyer of at least 100k SFRZ3 9550/9750cs for 33-35; this spread settled 11.25 vs SFRZ3 9471.5.

The week before last there was a buyer of 100k 2QZ3 9775/9875cs for 7.0 to 8.0 ref 9653.0 in SFRZ5. Settled 8.0 on Friday ref 9648.0. And on Friday there was a buyer of 82k SFRU4 9850/9950/10050 put flies for 0.5. Strangely done as a put fly, settled 0.25 (271.25/371.0/471.0); the max value is still at middle strike with a yield of 0.5%.

Obviously there are a few participants either worried about stability or thinking that past and current tightening will all at once cause a sharp reversal in rates.

Payrolls Friday expected 200-210k

Treasury auctions 3s, 10s and 30s Tuesday, Wednesday, Thursday.

| 2/24/2023 | 3/3/2023 | chg | ||

| UST 2Y | 480.7 | 485.6 | 4.9 | |

| UST 5Y | 421.0 | 425.1 | 4.1 | |

| UST 10Y | 394.7 | 396.2 | 1.5 | |

| UST 30Y | 393.2 | 388.5 | -4.7 | |

| GERM 2Y | 302.9 | 321.4 | 18.5 | |

| GERM 10Y | 253.7 | 271.5 | 17.8 | |

| JPN 30Y | 143.8 | 141.4 | -2.4 | |

| CHINA 10Y | 291.6 | 292.1 | 0.5 | |

| SOFR H3/H4 | -8.0 | -2.3 | 5.8 | |

| SOFR H4/H5 | -124.0 | -124.0 | 0.0 | |

| SOFR H5/H6 | -24.5 | -27.0 | -2.5 | |

| EUR | 105.86 | 106.35 | 0.49 | |

| CRUDE (CLJ3) | 76.32 | 79.68 | 3.36 | |

| SPX | 3970.04 | 4045.64 | 75.60 | 1.9% |

| VIX | 21.67 | 18.49 | -3.18 | |

https://www.federalreserve.gov/monetarypolicy/files/20230303_mprfullreport.pdf