Transitioning

February 3, 2023

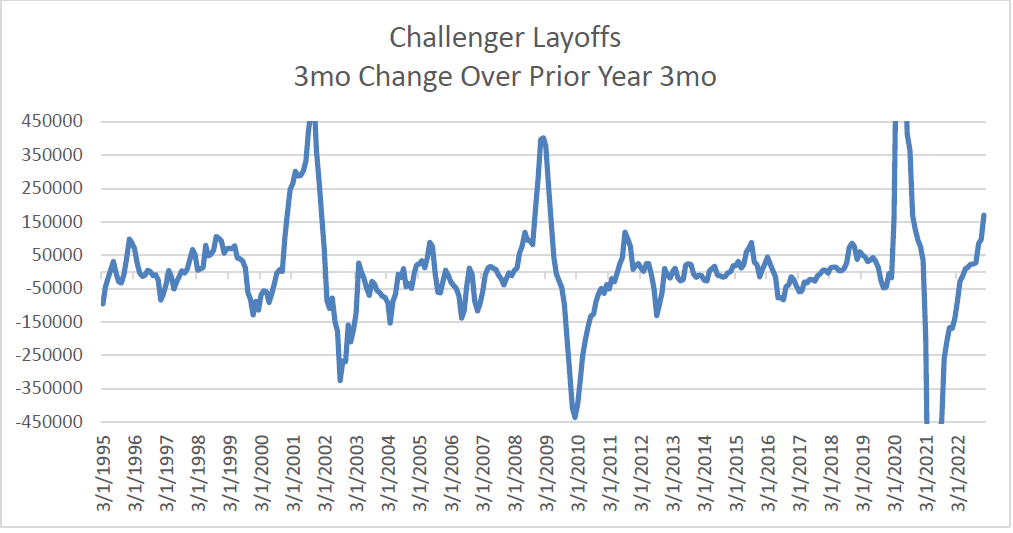

–Employment data today with NFP expected 190k and Avg Earnings yoy at 4.4% (from 4.6 last). Jobless Claims were again low yesterday at 183k, but Challenger layoffs jumped. I’ve attached a chart and link from Chris Long, “Excluding 2020, we haven’t seen anything like this since Nov 2008 and January 2001.” At the cusp of a hard slowdown in the labor market?

–Post-close earnings reports by AAPL etc, put a lid on frothy price action during the day. A headline on ZH says it was the largest trading day for options of all time. Currently ESH down 34.50 at 4157.

–In the wake of the BOE meeting, Sonia March’23/March’24 spread plunged from -32.5 Wednesday to -61.5 yesterday! In the US Sofr March’23/’24 is -104, down 2 on the day (9518/9622).

–In the US, the ten year yield was little changed at 3.398%, but 2s fell 2 bps. Worth noting, as futures ‘transition’ into SOFR from ED, is that SFRH3/EDH3 spread has collapsed to a new low for the cycle at 13 bps. The transition adjustment is double that. Does that mean that rates on the futures curve are being artificially set 1/8% lower than they ‘should’ be? Probably not, but the compression in the only libor-based futures spreads that actually trade with a spread, March at 13 and June at 16.5, sort of enhance the ‘risk-on’ cocktail.

–SOFR straddles also continue to compress. Not that there’s much trade in the long greens, but those straddles were marked down by 3.5 to 5 bps. What DID trade was SFRZ3 9568.75^, which was sold (new) 25k, settling 66.75 ref 9570. Dec atm straddles have been sold heavily since December. There is a LOT of open interest in both calls and puts in SFRZ3, more than 2.5 million in both.