Funding

January 29, 2023 – Weekly Comment

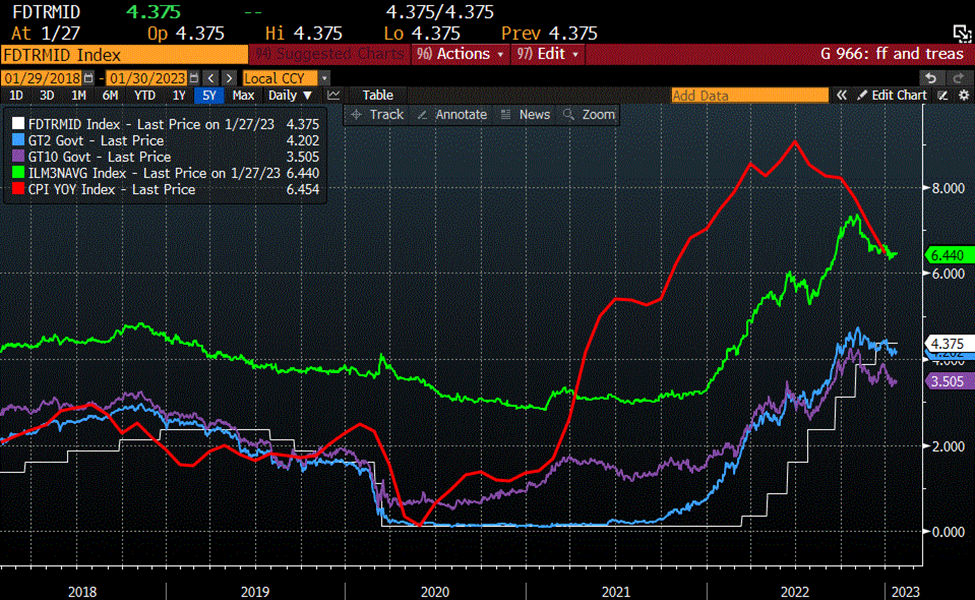

The above is a chart of various rates. White is Fed Funds midpoint, blue is the 2y treasury, purple the 10y, green the bankrate avg 30y mortgage, and red is yoy CPI.

Next week the Fed is going to raise the FF range to 4.5-4.75% with a midpoint of 4.625% and EFFR of 458 bps. It’s already the case that FFs are above everything on the treasury curve, and that negative carry is going to get a bit more extreme with the increase in overnight funding. Regarding CPI and the 30y mortgage, there has been a small crossover there as well. This probably is NOT the appropriate way to think about it, but I sort of imagine CPI as being a rough proxy for housing. If the 30y mortgage rate exceeds the appreciation rate of housing, it likely works to stifle prices.

Powell is going to emphasize at the press conference that easing is NOT likely to occur this year. To me, it doesn’t much matter whether he says it aggressively or gently, the fact is, high funding costs are restrictive. Core PCE prices (yoy 4.4%) are already below the new FF target of 4.625%. As macro guru Ted Nugent might say, “Got you in a stranglehold baby.” Powell has already alluded to the idea that it’s not the exact level of terminal rates the Fed needs to achieve, it’s the duration. All he has to do is convince the market of the Fed’s resolve and let it happen.

Below are some excerpts of Market Huddle’s (Kevin Muir) interview of Nomura’s Charlie McElligott. Quotes are lightly edited for brevity.

McElligott refers to “…immaculate disinflation” and asks “…what does that mean? It means relative to where we were on terminal rates a few months ago, that the faster than expected disinflation that we’re seeing means past peak inflation, past peak Fed, means a lower terminal rate, and that is a defacto rate cut. So you’re seeing a big resumption in vol selling strategies again…and that feeds into the behavior of meme stocks, behavior of high yield etc.”

Below I have inserted a chart of the MOVE/treasury vol index, which is nearing the lows of last year. VIX is also at the low end of last year’s range.

While the clip above identifies what is currently happening, in the excerpt below McElligott notes that the rapid shift in financial conditions supporting better growth may elicit a more hawkish tone from Powell:

“.. nobody had anticipated… this growth stabilization globally and how quickly it happened and how all three forces aligned at the same time, and when you’re talking about, in the span of a couple of weeks as I said, you’re seeing 200 bps tighter in hi-yield spreads, you’re talking 90 bps lower in 30yr jumbo mortgage, seeing re-acceleration in housing data, and durable goods and jobless claims still beating and nominal GDP is at 7 or 8%! If housing re-stabilizes and that kicks off animal spirits and a wealth effect back into the market, all of the good work that you’ve done with regard to trying to lean into demand-side inflation is very much at risk and then that whole ghost of Arthur Burns situation starts coming up again…it is the velocity of this FCI easing into the recent data beats has changed the calculus on Powell next week.”

He also noted that 0 to 1 DTE (days to expiration) options in SPY are around 68% of total volume. If short on time, listen from about 1:20 forward.

https://twitter.com/TheMarketHuddle/status/1619164583486279681

With respect to real estate and animal spirits, it’s worth noting a twitter thread on Wednesday by Redfin CEO Glenn Kelman saying that housing is recovering, better than expected. He concludes, “The market could still easily falter. But housing in January has been stronger than anyone could’ve hoped.” Redfin (RDFN) stock was up 19.7% on Friday. High since Sept.

Big week for news, with FOMC result Wednesday, ADP, ISM Mfg and JOLTs also on Wednesday. Employment Report on Friday, with rate expected 3.6% and NFP 190k.

OTHER THOUGHTS /TRADES

FFG3 settled 9542.5; the market is locked on a hike of 25 which should make FFG3 final settle 9542.9. The next FOMC is March 22. April is a ‘clean’ month; FFJ3 settled 9521 or 479 bps. Another 25 bp hike in March would make EFFR 483 (9517 for FFJ3).

SFRM3/Z3 settled -48 (9511, 9559, +6.5 on the week), a rough indication that the market expects 50 bps of ease in 2H.

SFRZ3/M4 settled -93.5 (9559, 9652.5, +10 on the week). Still inverted by nearly 1%, though going into FOMC the market is gingerly paring back easing expectations.

0QM3 (June 16, 2023 expiration on SFRM4 underlying) 9550p settled 4.5 vs 9652.5. These puts have the highest open interest of any midcurve at 213k, up nearly 16k on Friday. An original 40k block was bought paying 5 ref 9661, so vol has obviously declined. Low print last week was 3.5 ref 9664. SFRZ3 is 9559, so if the Fed renews its assault on growth and inflation, a roll-down in SFRM4 could approach strike. Delta is -0.11.

Feb SOFR midcurves expire one week from Friday on Feb 10. SFRH4 settled 9608. I wouldn’t be surprised to see demand for 0QG3 9587.5p going into the Fed, settled 3.5. 9575p settled 1.5.

On January 6, SFRZ3 settled 9559.5 and the 9562.5^ settled 86.5. Three weeks later, on Friday, SFRZ3 settled 9559.0 and the 9562.5^ at 69.5, a 20% decline.

Just a couple of commodity notes: At the beginning of September the front NatGas contract was $9. Now it’s just over $3. In March, Lumber was over 1400, now it’s just under 500. In June, BCOM (bbg commodity index) was over 135, now 111. In June WTI was over 120, now 80. Perhaps these moves spur a disinflationary mindset, but Powell still might feel the need to press against strength in the labor market and housing. Again, from Nugent’s stranglehold, “And if a house gets in my way baby/You know I’ll burn it down.”

| 1/20/2023 | 1/27/2023 | chg | ||

| UST 2Y | 412.0 | 420.5 | 8.5 | |

| UST 5Y | 354.2 | 362.1 | 7.9 | |

| UST 10Y | 348.2 | 351.8 | 3.6 | |

| UST 30Y | 365.3 | 363.4 | -1.9 | |

| GERM 2Y | 257.7 | 258.0 | 0.3 | |

| GERM 10Y | 217.7 | 223.9 | 6.2 | |

| JPN 30Y | 152.3 | 157.3 | 5.0 | |

| CHINA 10Y | 292.8 | 292.8 | 0.0 | |

| SOFR H3/H4 | -104.0 | -92.0 | 12.0 | |

| SOFR H4/H5 | -100.0 | -99.0 | 1.0 | |

| SOFR H5/H6 | -3.5 | -7.5 | -4.0 | |

| EUR | 108.57 | 108.69 | 0.12 | |

| CRUDE (CLH3) | 81.64 | 79.68 | -1.96 | |

| SPX | 3972.61 | 4070.56 | 97.95 | 2.5% |

| VIX | 19.85 | 18.51 | -1.34 | |