Collateral goes bad AND funding is pulled

March 7, 2022

–From Zoltan Pozsar: “Crises happen either because collateral goes bad or funding is pulled away – that’s been the central lesson in every crisis since 1998.”

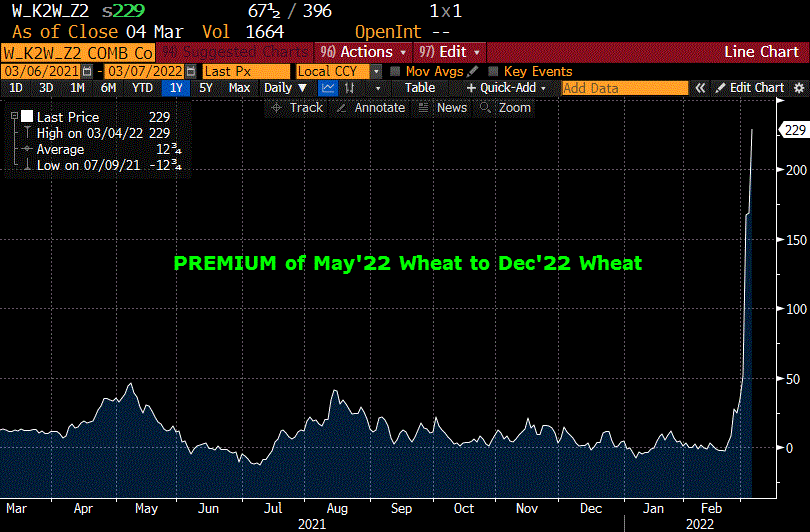

Pozsar’s latest note concerns the stress being felt in commodity markets, with emphasis on the energy sector. I would just note that not only is oil +6.84 at 122.52 this morning, but May Wheat is just shy of $13. Last summer this contract was $5 to $6. I have attached a May/December wheat spread (from Friday’s close – higher now). That moonshot (from 0 to 2.29) represents a premium > 23% of May over December. Imagine the producer who has sold forward in the May contract but needs to finance the short margin call. As everyone knows from the Duke brothers, the exchange does not finance margin debits. Pozsar’s point is that commodity markets could cause a cascading funding crisis, or at least create significant stress. That angst is apparent in all sorts of futures calendar spreads. For example, last prints this morning: April WTI 122.57 while September is 102.10. And it’s apparent in the behavior of EDH2, which is down another 7.75 bps this morning to 9911.25 while March SOFR is not even down 1 bp at 9953.5. (Treasury collateral doesn’t go bad). On March 1, EDH2 was trading 9937.0. So three-month libor which supposedly prices to the best credits in bank-to-bank lending, has jacked up a quarter percent premium in the past week. Does this cause the Fed to move inflation concerns to the back burner? Of course it does. Do commodity concerns mean inflation will get worse? The answer there is yes as well — as just about every news page I’ve skimmed this morning features a picture of gas station prices.

By the way, EDH2 settles to three-mo libor one week from today. Friday’s setting was just over 61 bps. This morning’s future price is 28 bps higher.

–As mentioned in my weekend note, new historic lows in red/green ED pack spread at -20.125 (down 6.5 on the day) and red/gold at -23.875 (down 7.25). These spreads signal recession ahead.

–Friday’s employment report is now pretty much of an afterthought, with a huge NFP of 678k and rate of 3.8%. Hourly Earnings were much weaker than expected at 5.1% yoy. Treasuries rallied with tens down 12 bps to 1.722% and thirties down 7.8 bps to 2.147% as weekend risks related to financial stability grow. Treasury auctions of 3s, 10s and 30s this week starting tomorrow.