Income flows vs savings stocks

February 22, 2022

–Oil above $94/bbl this morning. New highs in nickel and aluminum. May Corn is 667. Putin’s decision to send troops to Ukraine is adding to inflationary pressure on input prices. The US curve is flattening. From Friday I noted that June’23 SOFR and the ten-yr treasury yield were equal. This morning SRM3 is -5.5 at 9802.5 or 1.975, and TYH is up 3/32’s vs Friday’s closing cash yield of 1.93. Adding to flattening pressure is today’s 2-yr auction. Other news includes Markit PMI with Composite 51.1 last. Also, Consumer Confidence which has held up much better than U of M sentiment. Confidence expected 110 from 113.8. Low at beginning of 2021 was 87.1.

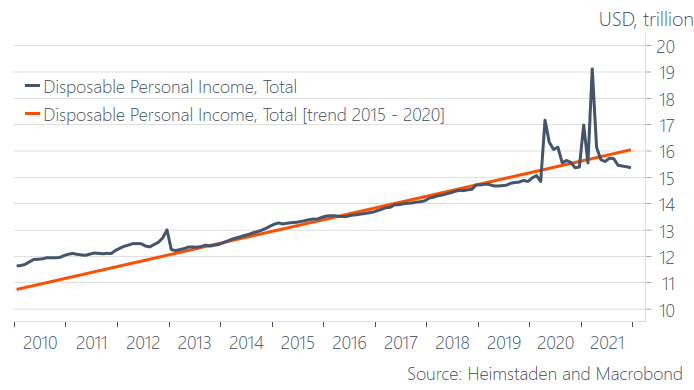

–Below is a twitter chart showing that Disposable Personal Income has fallen well below trend. A lot of commentary has touched on the idea that Household Balance sheets are strong and that consumers have built up savings to cushion any slowdown in consumption. I would counter that the US today is a pay-as-you-go society. Everything is subscription based or financed. This is where the distinction between stocks and flows matters. The flow of monthly income is critical to cost of living, especially when portfolios are slipping.