Variable Lags

Weekly Comment – December 19, 2021

At the FOMC press conference, Steve Liesman asked an interesting question about long and variable lags inherent in monetary policy, adding that actions on the taper might not have an effect on inflation for six months to a year. Powell’s response was reasonable, noting that deliberative, methodical changes best served the goals of monetary policy. But he added something a bit more nuanced, which is that in this world of interconnectedness, perhaps the lags aren’t nearly as long. He said that financial conditions in the markets almost immediately adjust; they “…can change very quickly.” Then he said something else.

“But in addition, when we communicate about what we’re going to do, the markets move immediately to that. So, financial conditions are changing to reflect, you know, the forecasts that we made and — basically, which was, I think, fairly in line with what markets were expecting. But financial conditions don’t wait to change until things actually happen. They change on the expectation of things happening. So, I don’t think it’s a question of having to wait.”

Now that’s an interesting take. It almost sounds as if Powell thinks the Fed is out in front of the market. Powell had not strongly signaled the possibility of rate increases until Nov 30. The markets had already adjusted, based on data, to the idea that there could be three hikes in 2022. That’s pretty clear from the one-year calendar FFF’22/FFF’23. It really started to move higher after the Sept 22 FOMC. At that time the dots nudged up…the FF expectation for the end of 2022 went from 0.1% to 0.3%. However, the calendar spread went from 20 to 60 in the next 5 weeks, a projection of less than one hike over 2022 to nearly two-and-a-half. That is, it’s not that the Fed made a correct forecast and the market adjusted. Rather, it’s that the Fed was forced to change its forecasts at the margin due to markets already reacting to incoming data. On Nov 24 FFF2FFF3 had settled at a peak of 71. On Friday Dec 3, it was 61.5. The next Friday, Dec 10 at 66.5 and on this past Friday 69. That is, the markets had been telegraphing 2.5 to 3 hikes since the middle of November, well before Powell articulated a change.

There are two points here. One, is that monetary policy lags are shorter, which makes perfect sense given today’s instant information flow and 24 hour trading. But the second is that the market is leading the dance with the Fed, not the other way around.

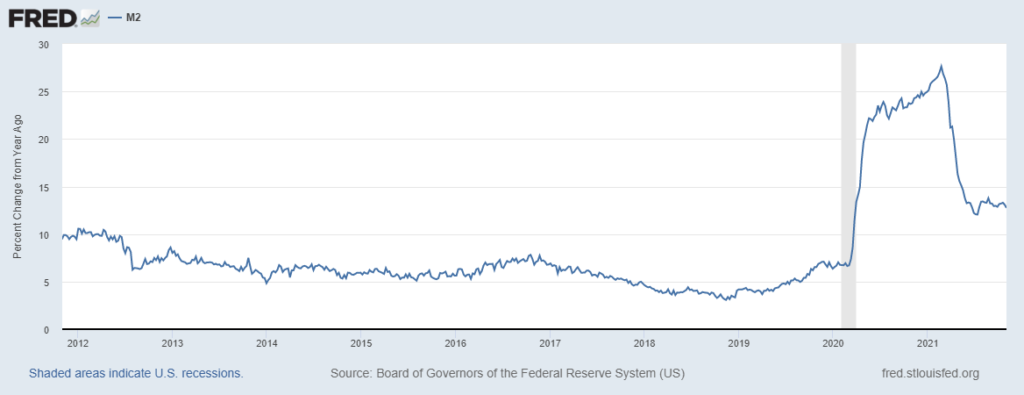

This second point is something that could be quite important going forward. According to former NY Fed chief Dudley, financial conditions consist of five major factors, short and long term interest rates, the value of the dollar, corporate bond spreads, equities. The pace of change in the shape of the yield curve has been extraordinary. From a high of 182 at the end of March the red/gold pack spread is now 25. The 2/10 treasury spread at 76 is less than half the March high of 156. The dollar index is at the high of the year, about the same level it was in late October 2018, when the Fed was hiking and tapering the balance sheet simultaneously (and stocks tanked in Q4). The BBB-10yr spread is 125 bps, relatively low historically but still at the high of the year. Perhaps not dramatically, but financial conditions have tightened. Below I have added a chart of the yoy change in M2. Obviously it’s still expanding at an elevated rate, but the inflation associated with monetary growth may begin to ease. That is not to say that the rate of inflation is going to magically gravitate to the Fed’s 2% target. The wheels have been set in motion for price increases, partially due to monetary and fiscal policy, partially due to green initiatives and the move away from (and lack of investment in) fossil fuels, partially due to other changes inspired by covid. [At bottom I’ve linked a short article by Doomsberg about magnesium and its importance as a structural alloy in metals, which cuts overall weight while maintaining strength integrity. Its production is energy intensive and centered in China. New magnesium production isn’t instantaneous and isn’t cheap. It’s the type of article that leads one to conclude that inflation will continue].

The idea is that the long end of the market is reflecting concern about a possible overreaction by the Fed. On the week, the five-year yield fell 8 bps to 1.173% and tens fell 8.5 to 1.40%. EDH’22/EDH’23 one-yr calendar fell 8 bps to 81.5, still indicating 3 hikes from Q1 2022 to Q1 2023, but EDH’23/EDH’24 dropped 11 from 50 to 39; 2 hikes to 1.5. Currently the Fed seems to be somewhat deaf as to warnings provided by the back end. In fact, when asked about low long-term yields Powell sort of fumbled around. He pointed to lower JGB and Bund yields, and added “there may be some assessment in there of what the neutral rate is or what the terminal rate is. I don’t know about that.” He continued with a couple of sentences about the neutral rate and concluded, “…we’ll make policy based on what we’re seeing in the economy rather than based on what a neutral – what a model might say the neutral rate is.” Let me translate: “We’re flying by the seat of our pants.” A final thought by Powell on the topic, “So, I’m not troubled by where the long bond is.” As they say in Uncle John’s Band, “Cause when life looks like easy street, there is danger at your door.”

Well, here’s what might potentially make you worry: less demand and wider tails at bond auctions. On Tuesday the Treasury auctions $20b of 20-year bonds. (Re-opening, when-issued yield was 1.86% on Friday at futures settlement time). Yields fell last week; there has been no concession, and the Fed is affirming that it will no longer be the marginal buyer. I perceive a bit of risk for this auction.

An underlying view within the Fed seems to be that the accelerated taper buys optionality on rate hikes to follow. Indeed, Waller specifically articulated that concept in his hawkish speech on Friday (he would like the Fed to move soon after taper ends). However, he also specifically hedged with the Omicron variant. Here is the summary, wrapped up nicely in the last sentence of his speech:

So, by choosing to speed up our reductions in asset purchases, the FOMC is providing flexibility for other adjustments to monetary policy, if needed, as early as spring to accommodate changes in the economic outlook. Omicron, as I said earlier, could slow the recovery or exacerbate inflation pressures, so we will have to be ready in the coming weeks to adjust as needed.

Every news outlet now seems to be fixated on Omicron and its transmissibility, and government reactions. Waller might have more precisely said, “Omicron…could slow the recovery AND exacerbate inflation pressures…” We’re probably not far from a whole new set of edicts. Biden speaks Tuesday.

| 12/10/2021 | 12/17/2021 | chg | ||

| UST 2Y | 66.0 | 64.0 | -2.0 | |

| UST 5Y | 125.2 | 117.3 | -7.9 | |

| UST 10Y | 148.5 | 140.0 | -8.5 | |

| UST 30Y | 188.2 | 181.6 | -6.6 | |

| GERM 2Y | -69.2 | -72.0 | -2.8 | |

| GERM 10Y | -34.6 | -37.8 | -3.2 | |

| JPN 30Y | 66.7 | 65.5 | -1.2 | |

| CHINA 10Y | 287.6 | 289.5 | 1.9 | |

| EURO$ H2/H3 | 89.5 | 81.5 | -8.0 | |

| EURO$ H3/H4 | 50.0 | 39.0 | -11.0 | |

| EURO$ H4/H5 | 4.5 | 5.0 | 0.5 | |

| EUR | 113.18 | 112.39 | -0.79 | |

| CRUDE (active) | 71.48 | 70.72 | -0.76 | |

| SPX | 4712.02 | 4620.64 | -91.38 | -1.9% |

| VIX | 18.69 | 21.57 | 2.88 | |

https://doomberg.substack.com/p/magnesium-pi