Equity in Household Real Estate Growing

March 16, 2021

–Rate futures retraced a part of Friday’s sell off, with tens down 2.5 bps to 1.607%. Large trade in dollars was a buy of about 45k 0EU 9962.5p for 7.5 covered 9967.5 with 40 delta. Settled 7 vs 9968.0; the straddle settled 19.5. I looked back to September of last year (prior to the libor extension announcement), and the 0EU 9975^ was the exact same price, 19.5, with 6 months of additional time value. Clearly premium is reflecting a much healthier distrust of certainty for the path forward, though vol eased slightly yesterday. The underlying contract on the 0EU put buys is EDU’22, which expires in 18 months. It’s highly unlikely that the FOMC meeting tomorrow could signal tightening in that time frame, however, it is completely plausible that forecasts for 2023 move higher.–Today’s news includes Retail Sales, expected -0.7%.

–The NY Fed released a Credit Survey (SEC Credit Access) which noted,

The The mortgage refinance application rate reached a new series high of 25 percent (of households with a mortgage), up from 16 percent in October 2020.

· The overall rejection rate for credit rose slightly from 18 percent to 19 percent, the highest reading since October 2018. Rejection rates for new credit card applications and for requests for credit card limit increases reached new series highs, while those for auto loans were at a series low. Mortgage refis likely to slow with the move to higher rates. It’s somewhat interesting that credit rejections are increasing even as the economy re-opens.

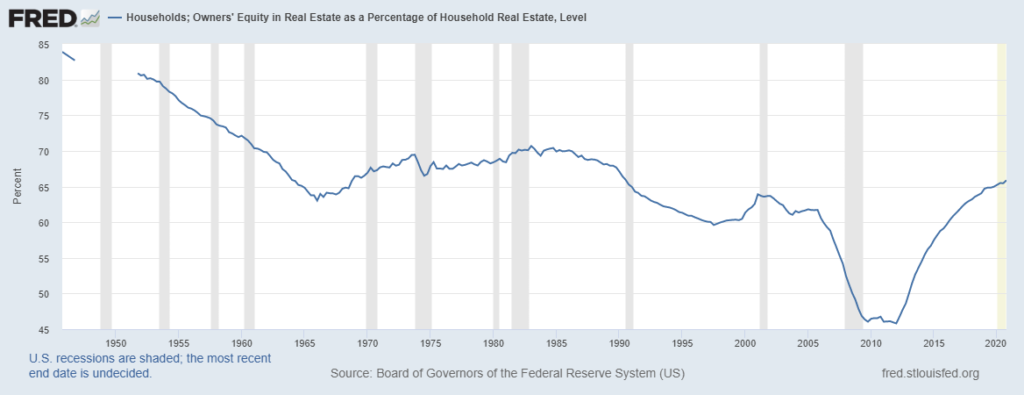

–I’ve attached a chart which I find surprising: Households: Owners Equity in Real Estate as a % of HH Real Estate. This chart shows equity at over 65%, the highest since 1990! This is an indication that leverage in the Household sector in aggregate isn’t all that high. In fact, the home ownership rate at 65.8% is higher than it was in the 1990’s, though below the peak of 69.2% in 2004.