Bottlenecks

February 4, 2021

–Several tweets on Wednesday, along with auto mfrs trimming production due to a shortage of computer chips gives rise to concerns of more [temporary] inflation pressures the Fed may have to “look past”.

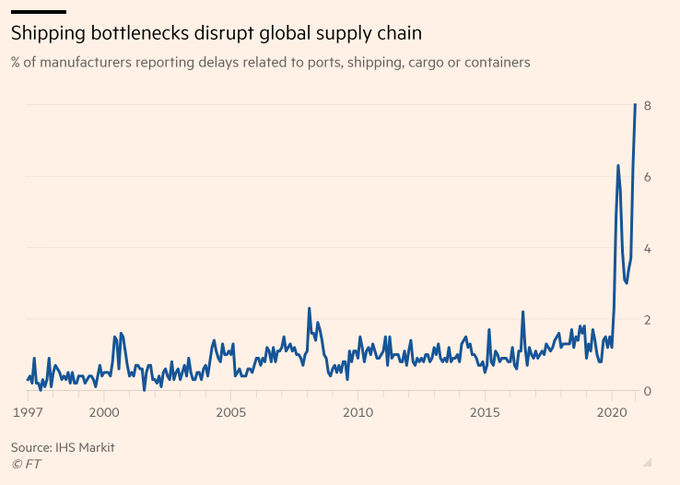

–There was a time not too long ago when just-in-time manufacturing processes were all the rage. Not so in the time of covid. Although every delivery service promises rapid, and in some cases same day gratification, it appears as though bottlenecks aren’t fading away, giving rise to more expensive shipping etc. My inclination is to suspect that redundancies and insurance ‘on-hand’ supplies will filter through to final prices.

–Long end continues to lag as Biden presses the case for stimulus. Treasury announced a record auction of 3, 10 and 30 year notes for next week in aggregate size of $126 billion, raising approximately $63 billion in new cash. There is still put buying in deferred euro$ contracts, example EDZ3 9850p 9 paid 2500 and 2EM 9925p 1.5 paid (against 9958.5/60/60.5)) for about 30k.

–Red/gold euro$ pack spread again made a new high at 105.625, up 2.5 on the day. 2/10 and 5/30 also made new highs as the curve continues to gradually steepen. 101.6 (+2.8) and 145.4 (+2.1) respectively. The controlled nature of this move is keeping vol in line; treasury vol just slightly firmer yesterday despite weak futures prices on low volume. There were a couple of upside plays, most notably a buy of 30k EDU1 9987.5/9993.75/100 c fly for 0.5.

–BOE today. In the US Jobless Claims expected 830k. NFP tomorrow expected 100k. New highs WTI crude. DXY 2 month high as a rise in US rates provides support.