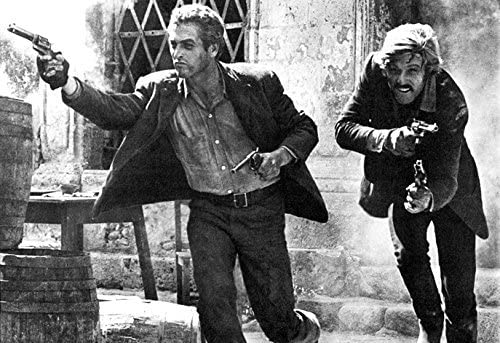

That’s what you’re good at Butch

August 2, 2020 – Weekly comment

There’s a scene in Butch Cassidy and the Sundance Kid, where they’re cornered on a sheer cliff with lawmen closing in on all sides. Butch (Paul Newman) looks over the rocky edge down to a rushing river far below and says, “We’ll jump!” Sundance (Robert Redford) is tensely anticipating the shootout and says no, he’ll stay and fight. Butch, knowing it’s the only chance out, says “What’s the matter with you?” Sundance, in an embarrassed yell, “I can’t swim!” At which point Butch breaks out in laughter and says, “Are you crazy? The FALL will probably kill ya!”

Mnuchin and Powell. The former wants to shave back federal government stimulus to levels that don’t completely distort incentives for going back to work. Powell has mentally taken the jump and will let the river carry him downstream, risking rapids and other dangers because he sees no way out.

As of Friday, the $600/week federal payment program expired and has not yet been replaced. Moratoriums on evictions are coming to an end. Reuters cited a report from CompareCards that from mid-May to July, 25% of credit card holders had an account involuntarily closed and 33% had limits cut. In a July 22 post, CompareCards.com author Matt Schulz noted that the average credit card rate on the most popular 200 cards in the country is 19.28%, up from 19.22%. The St Louis Fed website cites a lower number for all cards, saying that in May the rate was 14.52%. In either case, that’s a pretty juicy spread with funding rates near zero. The only reason for banks to trim this exposure is because they perceive big problems. I suppose it’s up to the Fed to buy paper backed by credit card receivables. For Powell, it doesn’t matter where the flow comes from, the whole task is keeping this thing afloat.

The Reuters article also notes a decline in corporate credit ratings. No surprise there. Fitch announced Friday afternoon that it had revised the US outlook to negative. And treasuries actually ticked HIGHER to the highest ever for a front TY contract, 140-04!

On Wednesday the Fed extended the program of providing swap lines to foreign central banks, and Powell assured continued accommodation of everyone and everything. On Thursday Q2 GDP was reported at a record low -32.9%. Eurodollar futures from the third quarterly back posted new all-time high settles this week, the peak being EDH’22 at 9985.5 or 14.5 bps. SOFR ranged from 9 to 13 bps in July; the two-year note ended at 11 bps. Aside from the 30y bond at 1.19%, all treasuries ended at new low yields. Notably, the ten year inflation-indexed (real) yield ended at a new all-time low of negative 101 bps. Gold closed at a new high of $1975/oz, while silver, though on a recent tear at $24.39, is still only half the price it hit in April of 2011. And bitcoin, now around $11k is lagging its ath of $19500 at the end of 2017.

Though fiscal support is now somewhat endangered, the other record breaker is the amount of upcoming treasury issuance, details of which will be released on Wednesday, August 5. Suffice it to say the auction calendar will be jam packed going forward. If there was ever a time that government might “crowd out” other borrowers, it’s now. Of course, the Fed’s balance sheet has exploded due to purchases of debt, good and bad, and though it has eased the past few weeks, it’s likely only the pause that refreshes before another sprint to the stratosphere. The Fed is going down the monetization rapids.

Data this week includes ISM reports and the Employment situation, with NFP expected up 1.5 million as people return to jobs.

By the way, Butch and Sundance did try a stint at “going straight” in Bolivia, just like Powell did as he tried “normalizing” in 2018. Eventually though, they went back to doing what they were good at, robbing banks. It didn’t end well.

OTHER MARKET/ TRADE THOUGHTS

On the week 2/10 closed near a recent low at 42.6 and red/gold Eurodollar pack spread similarly closed on a new recent low just above 35 bps. The range in the former has been 11.3 in February as stocks were making new highs, to 68.3 in March as stocks crashed. The range in red/gold this year has been 16 in February to 62 in June. If the Fed wants to refrain from being the buyer of last resort of bloated auctions, then it must keep some steepness in the curve so that domestic buyers are confident of riding positive carry.

While reds to deferred on the Euro$ curve flattened to new recent lows, individual pack spreads remain successively steeper. For example whites to reds (first to second year) closed negative 4.75, reds to greens (2nd to 3rd) at positive 5.125, greens to blues (3rd to 4th) at 12.5 and blues to golds (4th to 5th) at 17.5. Whether due to perceived increased inflation further out, or a rebound in economic activity, or indigestion of longer dated supply, it’s somewhat comforting to note some steepness.

One final note, while still low, US straddles firmed into week end. The classic 30 yr bond (US) features fairly tight option markets and better opportunities for movement than other parts of the curve. Worth exploring.

| 7/24/2020 | 7/31/2020 | chg | ||

| UST 2Y | 14.7 | 10.9 | -3.8 | |

| UST 5Y | 27.7 | 21.4 | -6.3 | |

| UST 10Y | 58.7 | 53.5 | -5.2 | |

| UST 30Y | 123.6 | 119.6 | -4.0 | |

| GERM 2Y | -65.1 | -71.3 | -6.2 | |

| GERM 10Y | -44.8 | -52.4 | -7.6 | |

| JPN 30Y | 57.1 | 52.5 | -4.6 | |

| EURO$ U0/U1 | -6.0 | -7.0 | -1.0 | |

| EURO$ U1/U2 | 3.0 | 2.0 | -1.0 | |

| EURO$ U2/U3 | 11.5 | 10.0 | -1.5 | |

| EUR | 116.54 | 117.81 | 1.27 | |

| CRUDE (active) | 41.29 | 40.27 | -1.02 | |

| SPX | 3215.63 | 3271.12 | 55.49 | 1.7% |

| VIX | 25.84 | 24.46 | -1.38 | |