Going to the Mattresses

March 22, 2020 – Weekly Comment

Everything you really need to know is in The Godfather. Mostly you just need Clemenza.

Michael: How bad do you think it’s gonna be?

Clemenza: Pretty goddamned bad. Probably all the other Families will line up against us. That’s all right. These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood.

This is a great summary of charts and spreads on the week

https://www.zerohedge.com/markets/stocks-suffer-worst-week-lehman-despite-biggest-fed-bailout-ever

It was an extraordinary week. Despite herculean efforts by the Fed and the administration, culminating in the Fed announcing $1 T in overnight repo ops daily through the end of March, SPX closed on the low Friday, ending the week down 15%. The peak to this week’s low has been 32% in 21 trading sessions. By comparison, the 2007 to 2009 sell-off was 57% and took 17 months. A similar draw down would put SPX at 1460, a bit higher than double the 2009 low.

I have to confess I thought by the middle of last week that the various rescue packages would be enough for a tradable bounce in stocks. In light of Friday’s close, I am thinking more about the WeWork episode. Early last year, the company was valued at $47 billion, but shortly after the IPO papers were filed in August it imploded. Why? Because the funding for a cash-hemorrhaging company dried up. The Saudis wouldn’t keep pouring money into Softbank to prop up We. In essence, the MODEL WAS BAD. As noted by the Guardian, “The company is essentially renting long and subleasing short, leaving itself exposed to the same risk as financial institutions that fund themselves with short-term borrowing while maintaining long-term funding commitments.” Classic liquidity mismatch, with the added bonus feature of growing losses. One might ask, “Couldn’t it have continued if the financing just kept coming through?” Yeah, but the model was always a cash-losing proposition.

I saw a stat that 17% of the world’s 45000 public companies haven’t generated enough cash to cover interest costs for at least the past three years. These are the zombies. The Fed’s (and other CBs) low rate policies that drove investors to reach further out the risk curve gave rise to the living dead. It’s a bad model. Now we need to get rid of the bad blood. New financing at low rates to uneconomic agents isn’t the answer. That, I believe, is what the stock market is concluding.

The hits keep coming. On Friday Ronin Capital couldn’t meet its margin and was closed, with positions auctioned to other firms on Friday. Though the problem for Ronin was said to be VIX, the firm was also a large market maker in ED options. A downgrade for short-end liquidity.

I wouldn’t be surprised if some ETFs are shuttered in coming days, especially the levered doubles and triples. From Jonathan Tepper of UnHerd.com, “While the ETF shares trade daily by the second, the underlying bonds are not easy to trade on their own. In the old days, insurers and pension funds bought these bonds, put them away in a drawer and never traded them. Today investors expect instant liquidity from an illiquid investment. Liquidity mismatches are as old as banking itself….the problems of ETFs have been known all along, and the outcome has been inevitable.” The underlying fragility of this system is now exposed. My guess is that the double and triple levered ETFs will be declared illegal in a year or so. “In the words of Christopher Wood from Jeffries, ETFs ‘commoditize equity and bond investing in an insidious way which ultimately creates a dangerous illusion of liquidity. True, ETFs are cheap. But so is fast food.’”

Reuters reports that Goldman injected $1 billion of its own funds into its prime money market funds after heavy withdrawals. It immediately made me think of Bear Stearns using its own capital to prop up a couple of its mortgage funds in 2007. Bear who? As Clemenza said, “Oh Paulie? Won’t see him no more.” I’m sure it’s not the same thing, as GS just bumped CEO David Solomon’s pay 19% to $27.5 million. Probably felt like they had to plug the hole left from D-Sol not being able to DJ at his side-gigs. (Of course, that’s a little unfair, as he donates all earnings from DJ gigs to charity). The point is, how tone-deaf can GS be? The Marcus division of Goldman is offering a one-year CD at 1.85%, and on its ads shows Chase at 0.01%, Citi at 0.50% and Wells at 0.15%. A plea for funding?

The Fed Chairman makes $203,500 per year. Mark Cuban says any US company that gets a bailout should never again be allowed to buy back their own stock. Jeffrey Gundlach tweeted, “I don’t think gov’t bailouts of overleveraged companies that got over leveraged via share buybacks at all-time highs, enriching executives and hedge fund investors, will sit well with the American people.” Here’s my rant: the admin and Fed (if they are to buy corporate debt or shares) should name the companies prior to any action. If a company accepts the investment bailout, then the board and c-suite should not be allowed to make any more than the Fed Chairman for two years. No bonuses. No deferred stock compensation. If a company declines help, and thinks they can survive on their own, they were probably well managed in the first place, and can continue doing whatever they were doing.

Leave the gun. Take the cannoli.

OTHER MARKET/TRADE THOUGHTS

EDM0 9950 straddle settled 31.5 ref 9945.5. EDU0 9962 straddle settled 24.5 vs 9960.5. 7 bp inversion of atm straddles. Well, I haven’t seen that before. Actually, EDM0 9950 straddle is just one bp below the atm straddle a year later: EDM1 9962 straddle is 32.5 vs 9961.0 settle.

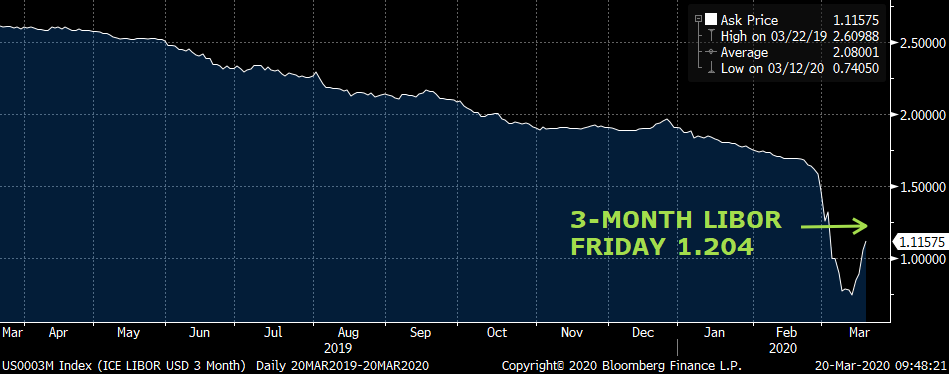

From Guy LeBas on twitter: “The t-bill issuance this will entail is going to be absolutely insane.” He’s referring to the tax date change from April 15 to July 15. This will likely weigh on the short end of the curve. Three-month libor is already going up due to funding and credit concerns. The low was 0.74% on March 12, and on Friday it was nearly 50 bps higher at 1.20%. EDJ0 has been tremendously volatile and settled Friday at 99.14 or 0.86%. So that’s a spread of 34bps to Friday’s 3m libor. EDM0 settled 99.455, a spread of 31.5 to EDJ0. The low in EDJ0 in Feb was 98.325 and the high tick on March 16 was 99.635, an astonishing 131 bps. Makes the EDM straddle at 31.5 seem cheap, and the EDU0 9962.5^ at 24.5 seem ridiculous. EDM0/EDU0 futures calendar spread settled -15.0.

Treasury options have been pretty liquid. However, we’re now at the point where you can fit the June Five-Yr straddle inside the bid/offer of the June US straddle. I marked USM atm straddle 13’45/15’34 late Friday, or 1’53 bid/ask while the FVM 124.75^ settled 1’31. Volume will start to decline now as the forced moves become less frequent.

| 3/13/2020 | 3/20/2020 | chg | ||

| UST 2Y | 48.0 | 35.0 | -13.0 | w/I 33.3 |

| UST 5Y | 70.6 | 51.1 | -19.5 | w/I 54.3 |

| UST 10Y | 94.6 | 93.4 | -1.2 | |

| UST 30Y | 155.7 | 157.2 | 1.5 | |

| GERM 2Y | -87.0 | -67.7 | 19.3 | |

| GERM 10Y | -54.4 | -32.1 | 22.3 | |

| JPN 30Y | 32.7 | 42.9 | 10.2 | |

| EURO$ M0/M1 | -3.5 | -15.5 | -12.0 | |

| EURO$ M1/M2 | 26.0 | 9.0 | -17.0 | |

| EUR | 111.04 | 106.97 | -4.07 | |

| CRUDE (1st cont) | 31.73 | 22.63 | -9.10 | |

| SPX | 2711.02 | 2304.92 | -406.10 | -15.0% |

| VIX | 57.83 | 66.04 | 8.21 | |

https://www.zerohedge.com/markets/stocks-suffer-worst-week-lehman-despite-biggest-fed-bailout-ever

theguardian.com/business/2019/dec/20/why-wework-went-wrong