Tiffany for Breakfast

February 19 2020

–In October, Tiffany’s share price was around $90. In late November the company was acquired for just over $16 billion at a share price of 135 by LVMH. In early February, LVMH issued bonds, in part to pay for the TIF acquisition. Almost Daily Grants reports: “The deal, Europe’s largest corp bond sale [€7.5b] in nearly four years, saw two of the tranches priced to yield less than zero and the highest coupon at 0.45% for an 11 year tenor.” The ECB was a buyer of those bonds.

–Let’s switch gears for a second. Cass Transportation headline on its freight data: “North American freight shipments experience largest decline since 2009”

–Yellen last week suggested the Fed could buy equities and corporate bonds to help in a downtown.

–Why is Palladium up $200 an ounce this morning to 2700? Why can’t stocks fall given coronavirus? Given the negative real economic impact of the virus, one might think stocks would take a breather. “Am I the only one who gives a sh-t about the rules?” Hmm, the ECB is funding companies at zero rates to make acquisitions. That’s why stocks can’t go down. As Trump says, “Let’s have some of those negative rates.” Let me get this straight. ECB can fund LVMH to buy TIF at 45 bps or less, but the US govt has to pay 100 bps more to buy something really useful like cruise missiles?

–Well the eurodollar market is on board. There was a buyer of well over 150k EDM0 9887.5 calls yesterday at 2.0 to 2.25. Settled 2.25 vs 9847.5, with open int up an incredible 238k. EDM0 contract added 33k. There was a smattering of other call buying: +40k EDJ 9887c for 1.25, +10k EDZ0 9950c 2.5. Also a buyer of 50k EDZ0 9825/9812/9800p fly for 1.5 covered 9859. The ten year treasury yield yesterday fell 3.3 bps to 1.554%, while the thirty year bond is at 2% and Greek tens are sub-1%. Dallas Fed’s Kaplan isn’t going with the flow. He says he sees no change in rates this year.

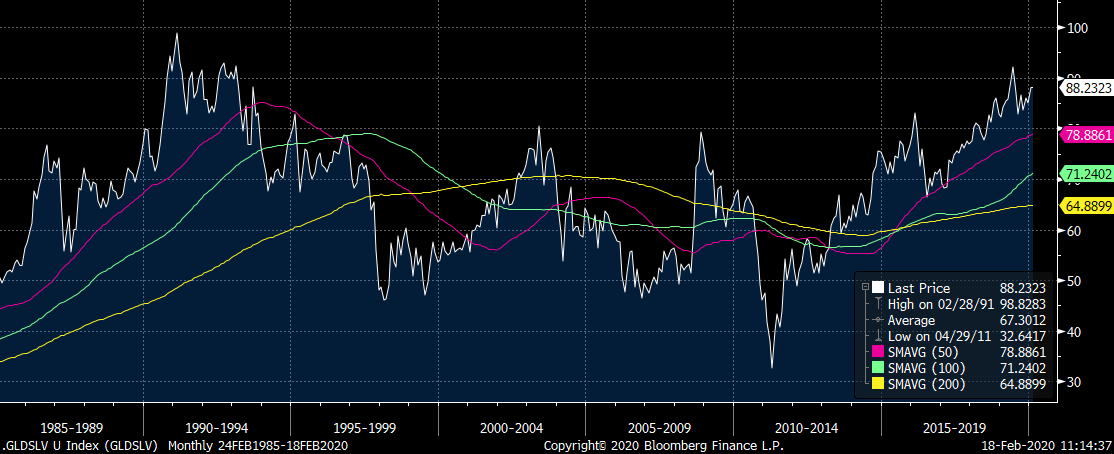

–I’ve attached a chart of the gold/silver ratio below. Near all-time highs above 88. Hasn’t really looked back since the Great Central Bank Liquidity Pump in 2011.

–Speaking of gold, at least Illinois got its beloved former governor Rod Blagojevich back, as Trump commuted his sentence. (Many former governors and other politicians in Illinois have had to serve out their full jail terms). Here’s a quote by Blago referring to the Senate seat he wanted to sell: “I’ve got this thing and it’s (expletive) golden. I’m not just giving it up for (expletive) nothing.” (That was secretly recorded by Federal agents. You know, when they actually cared about the sale of gov’t seats).

–PPI today along with Housing data. FOMC minutes this afternoon.

–Mark it zero Smokey.