Lockdown

January 24, 2020

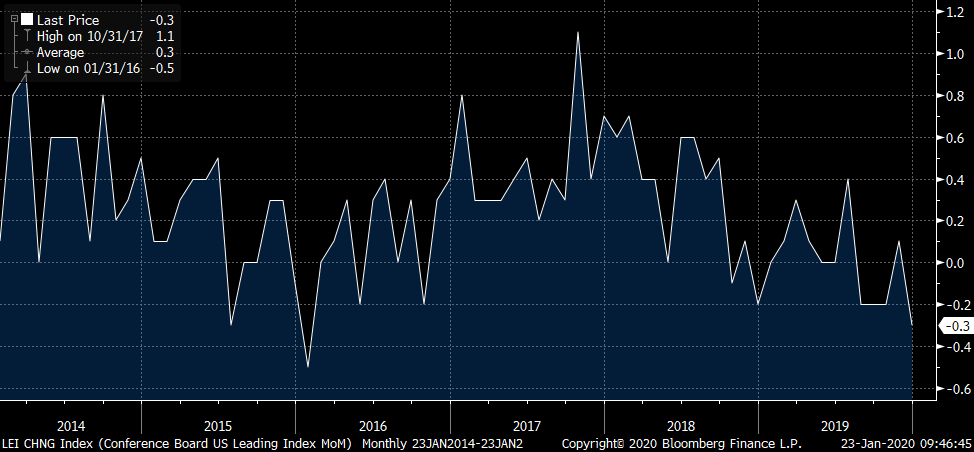

–40 million people on lockdown in China due to Wuhan virus according to BBG. Stocks yesterday reversed early losses and closed higher; this morning ESH is at 3333 like a magnet. Yields eased yesterday with tens down 2.8 bps to 1.738%. As the chart below shows, Leading Indicators were -0.3, the weakest since early 2016. TYH posted a high of 130-01, shy of the Jan-8 high of 130-06 associated with Soleimani.

–On the euro$ curve, near one-year calendars made new recent lows, with EDH0/H1 still the lowest at -27.0 (down 0.5 yest). EDM0/M1 fell 1 to a new low of -20.5. The peak euro$ contract has moved slightly out the curve to the third red, EDU21 at 9857. The front end is capped by Fed talk that policy is in the right place, while the back end edges higher. The ten year inflation-indexed yield was barely above zero late yesterday at 0.007, the low since early Sept of last year. Real yield at zero pushes money out the risk horizon, ADG notes that the average yield on BB Corp debt (the top rung of junk) is just 3.47%. EDH0 to FFJ0 (lib/ois proxy) settled at a new low of 15 bps.

–Implied vol was slightly bid. Feb treasury options expire today.

–Next Wednesday is the FOMC. As mentioned on my weekly note, the four month surge at the end of 2017 into 2018 peaked on Jan 26, the gain was near 20% over that time frame due to the tax package. The past four months of Fed t-bill buying have seen a similar percentage move higher. Does Powell give the green light to more liquidity or signal that he’s going to drain the swamp? FOMC date is Jan 29. Financial conditions appear quite loose…

–Interesting note by Joe Carson on ZH says that operating profits have not grown in the past five years. Another post from this morning blares that the “World’s richest are Stashing Large Sums of cash in vaults as Swiss bankers rage against negative rates.” Maybe that’s why EURCHF is at new lows, closing in on 106; it was at 120 in Q2 2018.

https://www.zerohedge.com/economics/2019-5th-consecutive-year-no-operating-profit-growth