Does M2 Matter?

November 24, 2019

On Monday, President Trump called an unscheduled meeting with Fed Chairman Powell. Here’s what Powell could have said in that meeting:

Mr. President, I have

taken several strong steps in support of your re-election campaign. Beginning in the second half, we’ve cut rates

three times. It’s well known that

monetary policy acts with a lag of six to nine months, so this should help

power up the economy throughout 2020. In

addition, we’ve implemented new stealth QE by buying $60 billion in t-bills per

month. This action should provide plenty

of liquidity to keep equities firm going into next year. While we’ve continued to downplay inflation

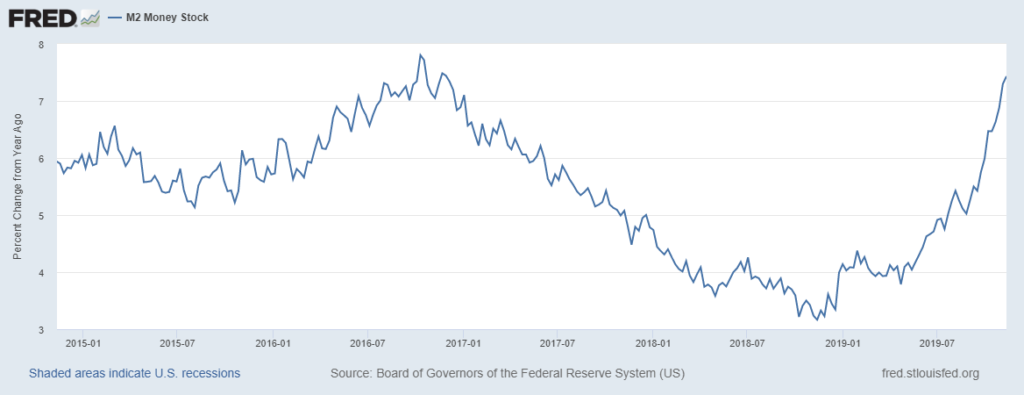

threats, we’ve engineered a surge in money supply. As of November 11, the growth of M2 is 7.4%

annualized. However, in the last quarter

we’ve really ramped it up: from August 12, 2019 to November 11, the annualized

growth rate is 10%. In fact, this is the most rapid acceleration since our response

to the great financial crisis. Again,

the effects from this acceleration will likely kick in for the new year, just

after what will clearly be a somewhat soft Q4, which you can blame on

uncertainties related to wealth taxes and medicare for all. Because of the hiccup in late 2018, year over

year data comparisons are about to improve.

We’ve guided the market to expect a pause in rate cutting at the

December FOMC; this was done in order to make sure we don’t let a trend in yield

curve steepening take hold. It’s

essential for the housing market that long end rates don’t jump. This is yet

another way that we can ensure that the market can absorb increased treasury

supply from your excellent pro-growth policies. In short, the Fed has taken

concrete steps to accelerate economic growth as the election nears. Good luck

Mr President.

Trump’s tweeted response: “Just finished a very good & cordial meeting

at the White House with Jay Powell of the Federal Reserve…”

above: M2 % change from year ago over the past five years

There was a time, believe it or not, when the Thursday afternoon release of money supply was a big deal. That was in the late 1980’s and early 1990’s. However, in Congressional testimony in 1993, then Chair Greenspan said, “The historical relationships between money and income, and between money and the price level have largely broken down, depriving the aggregates of much of their usefulness as guides to policy. At least for the time being, M2 has been downgraded as a reliable indicator of financial conditions in the economy, and no single variable has yet been identified to take its place.”

Well, break out your Whitney Houston ‘I will always love you’ (which was the top song of 1993). Because M2 is back. Or if you’re feeling a bit disenfranchised, go with Creep (Radiohead) or Loser (Beck), which has this prophetic line, “The forces of evil in a bozo nightmare…” Interpret however you wish.

Is M2 really back? Well, former NY Fed President Bill Dudley doesn’t explicitly say so in his Bloomberg op-ed of November 20, ‘Two risks to stability are building amid short-term calm’, but he does say, “…the low bond term premia are unlikely to persist much longer. The Fed’s actions have reduced the risk of recession and increased the risk of higher inflation. Yet this has barely been priced into bond market valuations.” This is one of the risks that Dudley points out: “Low Treasury bond yields are not sustainable.” Calling a top in bonds hasn’t exactly been a money printer recently… But here’s the other risk: “…the buildup of corporate debt – especially in the BBB rated and high-yield areas.” This topic has been simmering for quite some time. Back in May, Powell referenced it saying, “Among investment-grade bonds, a near-record fraction is at the lowest rating – a phenomenon known as ‘the triple-B cliff’”. So, while it’s been an issue for some time, it now appears to be coming closer to a boil.

But there is another interesting note in Dudley’s piece: “…some of the changes made in the 2017 Tax Cuts and Jobs Act will increase the stress on highly leveraged companies. In particular, the law eliminated companies’ ability to offset losses during an economic downturn with refunds of federal corporate income taxes paid in earlier years. Also the law limits the deductibility of interest relative to Ebitda. As Ebitda falls in recession, those constraints will become more binding, further restricting the cash flow of highly leveraged companies.”

Combine this with the new FASB current expected credit losses methodology (CECL) which goes into effect after Dec 15, 2019. CECL requires expected losses on loans and leases are to be estimated over the remaining life of the loans, as opposed to incurred losses of the current standard. The impact on financial institutions, according to Wikipedia:

- Larger allowances will be required for most products. It is argued that this effect alone can change the structure of the products to scale down the impact.

- As allowances will increase, pricing of the products will change to reflect higher capital cost.

- Losses modeling will change. This will impact both data collection (data need to be more granular) and modeling methodology (backward-looking over a short period of time to forward-looking for the life of the loan).

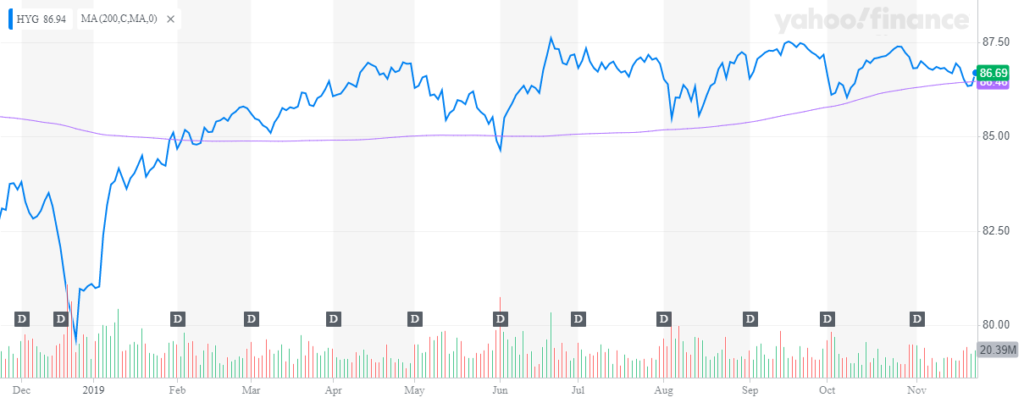

I’m no accounting and regulation expert, but it sounds to me like these two rule changes could be considered a future headwind and tightening of financial conditions. Perhaps this is why both HYG and JNK, the high-yield etfs, have moved sideways since April, and last week pierced 200 DMAs even as SPX made new highs. (However, both popped back above the 200 DMA on Friday).

above: HYG with 200 DMA

If we accept Dudley’s thesis that bond yields can go up due to higher growth and inflation sparked by current Fed policy, and then extend that line of thought to postulate that higher rates will set the stage for recession, causing a corporate bond bust, both stocks and bonds could be in for a period of poor returns. On Monday evening, Powell will again address his views of the economy, with a speech titled, Building on the Gains from the Long Expansion.

Happy Thanksgiving.

OTHER MARKET/TRADE THOUGHTS

The curve ended the week on a flatter note, with 2/10 treasury spread ending at just 14.5, down 7.5 on the week as the treasury prepares to auction 2’s, 5’s and 7’s on Monday, Tuesday and Wednesday. Implied vol remains in the doldrums, especially in the front end, as EDH0 9825 straddle settled at just 15.0 bps with three and a half months to go.

One year euro$ calendar spreads weakened. EDH0/EDH1 settled -26.5, down 6 bps on the week. However, current pricing indicates low odds for near-term easing. For example, April ’20 Fed Funds settled at 98.52 or 1.48%, while the expiring November contract is 98.44 or 1.56%. There are FOMC meetings on January 29 and March 13. If it DOES appear as if the economy is in need of further stimulus, the Fed will likely move early in the year as opposed to closer to the election.

Eurodollar option pricing still reflects fear of easing as opposed to tightening. For example, 50 bp risk reversals are as follow with futures just above halfway; EDM20 settle 9839.5, 9800p 1.0 and 9875c 4.75 for RR settle 3.75. EDM22 settle 9851.5, 2EM 9812.5p 6.75 and 9887.5c 9.50 for RR settle 2.75. There has been plenty of put selling up front to finance long call spreads as the market remains convinced that chances of tightening are essentially zero. This is less of an effect in contracts further out the curve, but puts still remain cheap.

EDZ9 ended at the low of the week, settling 9808.25. Since Oct 14, there have been seven daily lows at 9807.5, 10/17, 10/25, 10/28, 10/29, 11/5, 11/12 and 11/13. I have to believe that a break below that level will cause heavy liquidation. EDZ0 9800 puts settled 0.75, but were well offered against a smaller 0.5 bid. Perhaps the odds of cascading sales in the front contract aren’t particularly large, but just remember it’s a holiday week and conditions could be a bit thinner than usual.

| 11/15/2019 | 11/22/2019 | chg | |

| UST 2Y | 161.0 | 162.6 | 1.6 |

| UST 5Y | 164.8 | 162.6 | -2.2 |

| UST 10Y | 183.1 | 177.1 | -6.0 |

| UST 30Y | 230.8 | 222.2 | -8.6 |

| GERM 2Y | -63.3 | -63.6 | -0.3 |

| GERM 10Y | -33.4 | -35.9 | -2.5 |

| JPN 30Y | 44.5 | 42.1 | -2.4 |

| EURO$ Z9/Z0 | -36.0 | -40.3 | -4.3 |

| EURO$ Z0/Z1 | -2.0 | -5.0 | -3.0 |

| EUR | 110.53 | 110.23 | -0.30 |

| CRUDE (1st cont) | 57.83 | 57.77 | -0.06 |

| SPX | 3120.46 | 3110.29 | -10.17 |

| VIX | 12.05 | 12.34 | 0.29 |

https://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html

https://www.federalreserve.gov/newsevents/speech/powell20190520a.htm