Oct 21. Indigestion

The September 2018 eurodollar contract settled at 97.6612 going into the expected tightening at the FOMC meeting on September 26. This week, the December 2018 contract settled at a new low of 97.230, down 9.5 bps from the previous Friday, while January 2019 Fed Funds settled 97.60, down just 2 bps on the week. So the Dec ED contract is over 43 bps higher in yield than Sept, obviously more than the 25 bp hike expected on December 19. In the vast universe of financial products, perhaps this pricing is inconsequential. However, many interest rate spreads globally are raising the possibility of dislocations across markets.

Real yields, as shown by five and ten year inflation indexed notes, are at new highs north of 1%. The five year closed at 1.06%, highest since September of 2009 and the ten-yr at 1.08%, highest since 2011. The last time the five year inflation index note was here, the five year treasury was 2.53% (as inflation was on its way down), while the current five year yield is 3.05% (highest since 2008).

Open interest in EDZ8 was up nearly 100k contracts on Thursday and Friday to 1.842 million. The only contract with greater open interest is EDZ9 at 1.994m. As OI is increasing on new lows, it indicates that hedging demand is also growing, in part because many option strategies had targeted the 9737.5 strike for expiration, and are now in ‘forced adjustment’ mode. As mentioned above, the forward libor/ois spread as indicated by EDZ8/FFF9 spread, blew out to 37 bps after having spent the last couple of weeks around 28-30. Previous widening episodes of libor/ois have been connected to increased t-bill issuance, increased credit concerns, and regulatory changes. I don’t know exactly what the driving force is this time around, but I will touch on a couple of factors that aren’t showing much sign of reversal.

First, according to the Q4 Treasury Borrowing Advisory Committee, every t-bill auction from Nov 4 forward is raising new cash. That is, the amount being auctioned is greater than the maturing amount. Over Q4 the total new cash being raised in t-bills is $120 billion. The astonishing number is this: from the November 12 to December 24 auctions in 4 week, 3mo, 6mo and 12mo bills, the amount of new cash being raised is $181 billion. I am just taking this data from the TBAC site, but I urge readers to double check issuance for themselves. These are huge numbers which are perhaps modified by the upcoming 8 week bill auction on Oct 29, but the point, of course is that there is a LOT of NEW issuance. This week’s auctions of 2, 5, and 7 year notes and 2y FRN of over $111 billion are raising over $15 billion in new cash. All while the Fed is letting $50 billion per month roll off the balance sheet, and the Trump team is working on another tax cut. Pass the Rolaids; I have indigestion.

Another factor which can cause a funding scramble is vulnerability in the banking system. Drama surrounding Italy’s budget is enhancing this theme, and Moody’s downgrade of Italy’s sovereign bonds to Baa3 late Friday doesn’t help (although Moody’s helpfully added that the outlook was stable. At just a notch above junk). Germany/Italy ten year spread exploded over 330 this week but came back to close nearer to 300.

Credit concerns seem to be cropping up at an increasing pace. This little excerpt is from BBG on Oct 16: “The rout in Chinese equities is throwing the spotlight on $613 billion of shares pledged as collateral for loans. Loans extended to company founders and other major investors who pledged their shareholdings as collateral emerged as a popular financing channel in recent years. But given the losses in equities — Shenzhen’s stock benchmark is down 33% in 2018 — there’s a growing risk that brokerages will be forced to sell the shares, accelerating the downturn.”

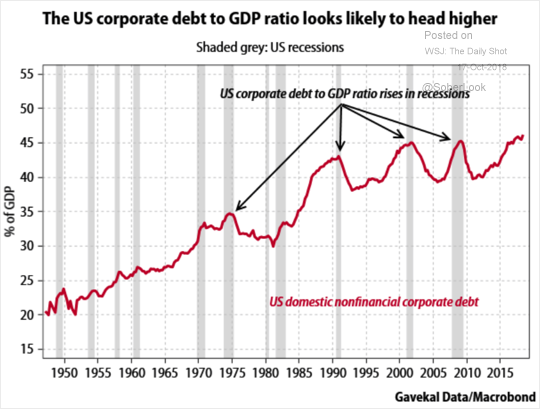

In the US, last week I highlighted a BBG story that noted how much corporate debt was on the precipice, barely hanging on to investment grade status. A chart from the Daily Shot adds further evidence to this risk, showing that corporate debt as a percent of GDP is in record territory.

A friend of mine that’s a physical trainer once said to me, “People come to me that have gotten in progressively worse shape over ten years of inactivty, and expect me to change it all in six months. It took a long time to get out of shape, it’s going to take time and work to get into shape.” Problems that have built up in the markets over time also don’t improve instantly; the rapid move typically isn’t improvement, it’s usually the other way, a spiral down. These are the unintended consequences of ZIRP and QE and the reach for yield, and it seems as if the current Fed is trying to get the market to shape up and focus on risk. Low rates encouraged corporates to borrow and engage in share buybacks and other financial engineering, thus diluting balance sheets. Low US rates encouraged emerging markets to borrow in dollars. On the investing side, it sparked an increase in covenant lite structures. The reach for yield also took a more exotic turn with strategies like selling volatility as an asset class. It starts with an innocent ‘buy/write’ strategy of trying to pick up a few bps by selling calls against long stock holdings and morphs into “We’ll just sell premium on everything and pick up the carry, because the time value in options always goes to zero.” Sounds pretty good when you say it that way, but the idea is to receive adequate compensation for potential volatility. “But we haven’t had any volatility” says the Wealth Manager. Right.

There’s another obvious problem with the strategies that have built up, and it’s circular. When rates are very low, throwing caution to the wind and trying to pick up yield to keep clients makes sense, and if you can wrap up the sales pitch with a few equations and a five year history, it might even seem compelling. But higher risk-free rates, courtesy of both the Fed and and endless supply of deficit-inspired government bonds, necessarily provides competition for the searcher of incremental yield. And some of us remember further back than five years. The supply of vol sellers should be siphoned off, at the margin. RFY, reach for yield, in reverse. For a second it reminded me of an old friend with the trading floor badge acronym, RFB. He was commonly known as Re-Fried Beans. RFY in reverse, YFR. You’ll Feel Regret?

In terms of Fed tightening, we all know that the labor market is strong and has given cover to rate increases. But the JOLTS chart below is really pretty amazing. In spite of robotics and fast food restaurant kiosks, in spite of cheap overseas labor, the increase in job openings in the US appears to be accelerating. Although official measures of inflation are only slowly creeping higher, this data would suggest that the wage part of the equation should begin to kick into higher gear. Evidence of inflation (and Khashoggi’s disappearance) that is eluding President Trump, no matter how hard he looks, may soon become a lot more obvious.

The 2/10 treasury spread flattened by a little over 1 bp on the week, due to supply and weakness in the front end of the eurodollar curve. The S&P 500 was more or less unchanged on the week, with bouts of volatility in between. However, financial conditions are tightening.

This week brings auctions of 2, 5 and 7 year notes. Beige Book Wednesday, Durables Thursday, Q3 GDP on Friday. Atlanta Fed GDP Now is 3.9% and NY Fed is 2.13% for Q3 estimates currently.

Large earnings reports from Microsoft on Wednesday after the bell, followed by Alphabet and Amazon on Thursday. AMZN is up 51% on the year and has added nearly $300 billion in market cap as of Friday. MSFT is up about 26%, but GOOGL is up only marginally.

| 10/12/2018 | 10/19/2018 | chg | |

| UST 2Y | 283.6 | 290.8 | 7.2 |

| UST 5Y | 299.3 | 305.1 | 5.8 |

| UST 10Y | 313.9 | 319.8 | 5.9 |

| UST 30Y | 331.6 | 338.2 | 6.6 |

| GERM 2Y | -56.0 | -58.0 | -2.0 |

| GERM 10Y | 49.8 | 46.0 | -3.8 |

| JPN 30Y | 90.6 | 90.9 | 0.3 |

| EURO$ Z8/Z9 | 51.5 | 50.5 | -1.0 |

| EURO$ Z9/Z0 | 3.0 | 2.5 | -0.5 |

| EUR | 115.60 | 115.14 | -0.46 |

| CRUDE (1st cont) | 71.18 | 69.28 | -1.90 |

| SPX | 2767.13 | 2767.78 | 0.65 |

| VIX | 21.31 | 19.89 | -1.42 |

https://www.treasury.gov/resource-center/data-chart-center/quarterly-refunding/Pages/Latest.aspx