Oct 19. Up in smoke

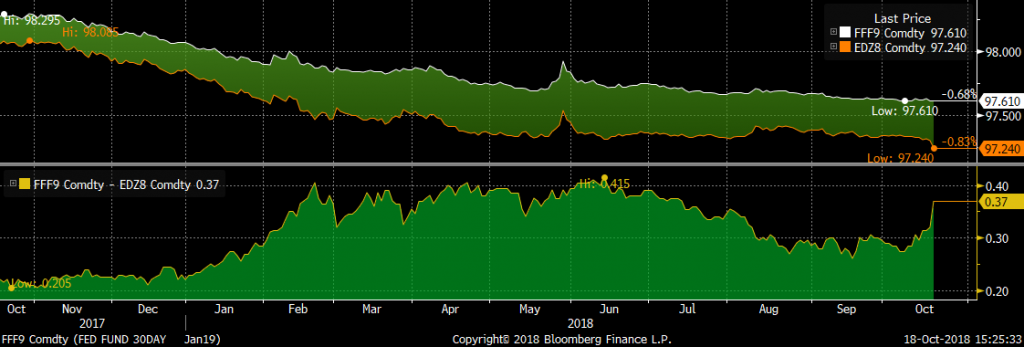

–Action in front end of the eurodollar curve as EDZ8 traded over a million contracts, more than twice as much as the next heaviest, as libor/ois spread surged. EDZ8 closed -5.5 at 9724 while Janunary’19 FF contract was unchanged at 9761.5 (spread of 37.5). Near calendar spreads made new lows, with EDZ8/EDH9 settled 16.5. Also heavy trade in EDZ8 puts (9725 and 9712) with total EDZ put open int up nearly 100k and EDZ8 futures +75k. Increases in open interest suggest this move is not over. Option plays had targeted the 9737 strike. Up in smoke.

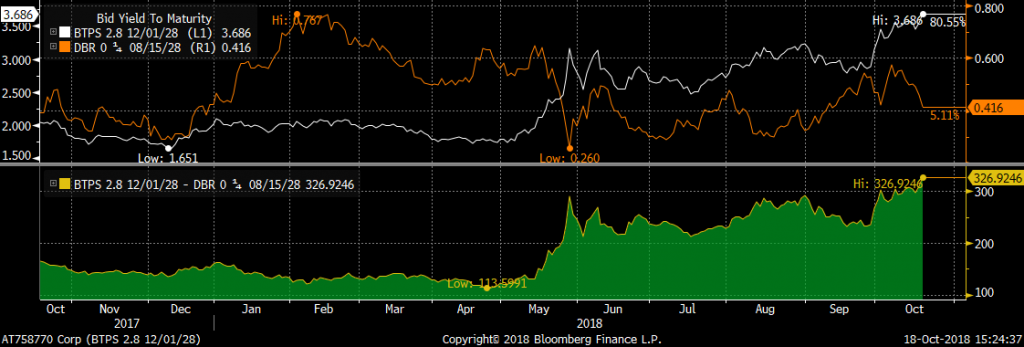

–Perhaps contributing to stress is the Italy budget situation, which has taken bund/btp spread to a new high of 335. The Italy bank stock index is at a new low this morning below 8000; it has fallen 37% just since May. Perhaps part of the stress comes from China, where officials are advising the public to remain calm in the face of SHCOMP’s 30% fall from the high in January. Capital flight, capital preservation. It really only leaves one sane choice: weed stocks. Think about this for a second: if the US equity market lost 30% of its value, it would be the equivalent of about 44% of US GDP. What would that do to the budget deficit? How many corporate bonds would be downgraded to junk?

–Existing home sales today.

Charts below are EDZ8 to FFF9 (libor/ois) and Italy/Germany 10 year. Spreads are in lower panels of each chart