Oct 7. Creative Destruction

“The urge to destroy is also a creative urge” – Picasso (as tweeted by banksy)

“We are prepared to destroy that which we have created because we believe more than any of them in the power of the picture, the poem, the prayer, or the person.” – Mishka Fyodorovich, in the novel A Gentleman in Moscow, describing the Russian psyche as compared to the Europeans’

As everyone knows by now, the underground street artist known as banksy apparently installed a shredder into the frame of one of his paintings, Girl with Red Balloon, so that if it were ever to come to auction, it could be destroyed. On Friday, Sotheby’s auctioned the painting for more than £1m. The frame began to shake; the shredder was deployed. (And now the painting might even be worth MORE!)

In the markets on Friday, the US employment report was released. It showed lower payrolls than expected at 134k, but the previous month had a robust revision higher, and the rate, at 3.7%, was the lowest since 1969. Yoy wages were +2.8% as expected. However, after a brief headline rally, treasuries were shredded and closed at new lows, with the ten year note ending at 3.22%, up 3 bps on the day and 17.5 on the week, while the 30-yr bond closed 3.396%, up 4.2 on the day and 20.2 on the week! Highest ten year yield since 2011, and the highest 30-yr since 2014. The end of the day was fairly quiet, with our office, like many throughout the city, riveted to the televised verdict of the Chicago policeman accused of murdering Laquan McDonald. I recall the old chairman of the CME, Jack Sandner, once giving a speech where he shouted, “the business of the CME is NOT trading futures, it’s RISK MANAGEMENT”. The City of Chicago, County of Cook, has taken that lesson to heart for disruptive protests (not so much for its own financial affairs). Chicago police and fire personnel were on extended shifts and high alert to control risks in case the verdict resulted in a destructive cauldren of rioting. As Mayor Richard Daley said in a famous malapropism in a 1968 press conference (linked below), “Gentlemen get the thing straight, once and for all. The policeman isn’t there to create disorder, the policeman is there to preserve disorder.” In this case, the verdict was guilty of second-degree manslaughter. The city remained calm.

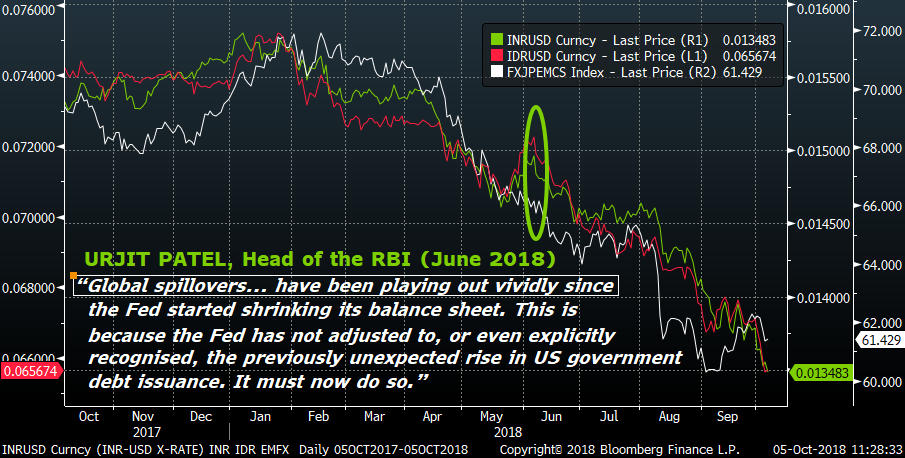

As mentioned in my note on Friday, during the summer, Urjit Patel, head of India’s central bank, complained that the Fed’s balance sheet normalization was adding undue pressure on EM economies as liquidity was drained at the same time that increased US debt issuance was crowding out other borrowers. The chart below shows the rupee in green along with the rupiah in red and the JPM EMFX index in white. Conditions persist. From BBG: “The US budget deficit expanded to an estimated $782b in Donald Trump’s first fiscal year as president, which would be the widest fiscal gap since 2012 when the country was still emerging from the Great Recession.” …The deficit was equal to an estimated 3.9% of GDP, up from 3.5% in the prior year.” Interest expense in fiscal ’18 was a record $523 billion.

With risk-free rates going up on treasuries, competition increases for flows of funds that previously funneled into US equity markets. Additionally, with the somewhat uncreative destruction of global supply chains due to trade policy, input costs and inflation in general are increasing. WTI Crude hit a new high for the year last week, and although it pared back gains into Friday, it still ended up over $1/bbl at $74.34. While the NYFANG index is off nearly 13% from the high posted at the start of summer, US equities are still well higher than the start of the year. Not so with China. Shanghai Comp, Hang Seng and S Korea’s Kospi are all lower. While the US Fed signals continued hikes, the PBOC cut reserve requirements. Sell US and buy China? The time might be getting close.

The sea change has been bear steepening of the curve. The five-year yield was up only 12.8 bps while the thirty-year surged over 20. Uncertainties about term premia and the neutral rate have increased as various Fed officials have discussed the topics. A few weeks ago ten year treasury vol was at historic lows. This week implied vol necessarily firmed. Risk is perhaps once again about to be priced into ‘risky assets’ without the Fed’s backstop. Oh, and perhaps it’s worth inserting a reminder here that the King of Debt suggested as recently as May of 2016 that if the US got into trouble as a result of borrowing, he could negotiate a haircut. Candidate Trump “…told the cable network CNBC, ‘I would borrow, knowing that if the economy crashed, you could make a deal.’”

Below is a chart of 5/30 treasury spread which begins in late 2015, when the Fed began to hike. There have been a few false bottoms in the curve over this period (yes, I’m guilty), and a true change in trend typically doesn’t occur until the market perceives the Fed being close to the end of the hiking cycle. However, this chart certainly appears to indicate a bottoming process.

An interesting piece on WolfStreet.com this week (link at bottom) notes that since the Fed began its balance sheet unwind, holdings of MBS have declined by $89 billion to $1.682T. The high late last year was $1.780T. The Fed doesn’t hedge MBS risk. Private holders do, which can also lead to risk-management demand for options.

In short, the Fed is slowly dismantling the architecture put in place after the crisis, and allowing the market to create new risk parameters. In the long run, it’s a healthy process. At the same time, the administration has injected fiscal stimulus. Both of these policies operate with variable lags. Increased inflation expectations are beginning to take hold.

This week the treasury auctions 3’s, 10’s and 30’s (re-open of 10’s and 30’s) in size of $36, $23 and $15 billion respectively, raising $45 billion in new cash. Threes and tens on Wednesday; PPI is also released on Wednesday. 30-yr bonds on Thursday, after CPI is released. Although fixed income markets have already encountered selling pressure, these auctions might cause a bit of indigestion.

******************

Now I just want to sketch out a few thoughts about the supposed large spec short in the ten year futures that various commentators think (thought?) would have an influence on the market. First, hat tip to the shorts. You’ve been right. Second, I’ve done a few barroom napkin calculations for this next bit; if anyone is really interested I may dig deeper. I looked at three years, 2007, just prior to the GFC, 2012 and 2017. The Federal debt outstanding in 2007 was $6.074T. Five years later it was $12.848T and in 2017, $16.455 with our fearless administration set to blow it up further. The duration of the debt was around 55 months in 2007, 64 months in 2012 and 71 months in 2017 according to BBG. So in ten years, the amount of debt grew 2.7x and was extended by over one year. So now let’s look at the amount of open interest on treasury futures. In 2007 it was about 7.586 million contracts (I doubled the 2 year amounts since they are $200k notional compared to $100k for other contracts). In 2017 it was 14.45 million. Call it 2x. The point is, that even with the introduction of the Ultra ten year note and the Ultra bond contract in the last ten years, the open interest on the exchange hasn’t kept pace with the explosion in government debt. Yeah, I know that there are a million reasons for this, including the Fed siphoning off treasuries and MBS for its balance sheet. There have also been other competing etf products introduced. My point is this: if you use the Commitment of Traders reports as the cornerstone of your analysis, I don’t think it’s anywhere near as valuable as it once was. One other interesting side note: Even though ultra bond options never trade, there is more open interest in the ultra bond (WNZ8) than in the classic 30-year bond (USZ8) with 1.057m in the former and .935m in the latter. It’s been that way for a while, but increased interest in longer dated assets will likely grow. (I still don’t know why Mnuchin squashed the idea of 100 year bonds when he had the chance at lower rates).

| 9/28/2018 | 10/5/2018 | chg | |

| UST 2Y | 281.3 | 288.5 | 7.2 |

| UST 5Y | 294.3 | 307.1 | 12.8 |

| UST 10Y | 305.0 | 322.5 | 17.5 |

| UST 30Y | 319.4 | 339.6 | 20.2 |

| GERM 2Y | -52.4 | -51.4 | 1.0 |

| GERM 10Y | 47.0 | 57.3 | 10.3 |

| JPN 30Y | 90.3 | 94.1 | 3.8 |

| EURO$ Z8/Z9 | 48.0 | 59.5 | 11.5 |

| EURO$ Z9/Z0 | 2.5 | 5.0 | 2.5 |

| EUR | 116.05 | 115.23 | -0.82 |

| CRUDE (1st cont) | 73.25 | 74.34 | 1.09 |

| SPX | 2913.98 | 2885.57 | -28.41 |

| VIX | 12.12 | 14.82 | 2.70 |

https://wolfstreet.com/2018/10/04/feds-balance-sheet-normalization-reaches-285-billion/