July 29. ACRONYMS. BOJ, PBOC, FAANG

On the trading floors, exchange members wore large badges, with 2 to 4 letter acronyms. In some cases they were simple initials, or they might be like vanity license plates. For example, my friend Art Nolan just told the membership department to use their imagination and give him an acronym with some style, so they came up with (duh) STYL. Of course, human nature, or perhaps just trading floor nature, is to come up with alternative monikers for badge initials. Let’s just say that having an ‘F’ in one’s acronym invited a specific word. So PMF, who was using his initials, was known by a different name. BWR sparked a spontaneously funny (but not exactly flattering) nickname as well. It’s not really politically correct to go into specifics, but I did have a favorite acronym story. There was a tall sandy-blond woman that was a market maker in Eurodollar options, named Mary Ohno. She was pretty, in a wholesome girl-next-door way, the type that would have gladly played in a pick-up game of softball with her brothers. Her badge was OHNO. There was a long aisle leading from the back month area of the Eurodollar pit, near the main floor entrance, to the option pit. On one side were the tiered booths of various brokerage firms, and on the other were cat-calling pit clerks facing out toward the desks I have no idea when this started, but one day Mary was walking down the aisle and a bunch of clerks in unison shouted, “Oh, No…” and after a second or two they all came back with “Ohhhhhh, YES!” She just gave a half smile and looked straight ahead as she walked to the pit.

I’ve titled this note with a few acronyms that refer to central banks and stocks. The Bank of Japan, or BOJ, is perhaps going to elicit the ‘OH, NO’ fear of reduced accommodation and liquidity, with the complimentary pit rejoinder conspicuously absent. The other themes are China and the PBOC, and FAANGs, stock market darlings that are looking long in the tooth.

One of the standout moves in rates this past week was the 30 year Japanese Government Bond, which rose nearly 13 bps from 68.5 to 81.3 bps. From BBG (July 26) “The BOJ’s steps to buy fewer bonds has seen the annual increase in its debt holdings slow to 44.1 trillion yen ($397 billion) versus its guidance of 80 trillion yen. Last quarter the reductions were entirely focused on so-called super-long bonds, which are the most attractive to insurers. What happens next in the world’s second-largest bond market has the potential to cascade globally given Japanese investors hold $2.4 trillion of overseas debt.”

At this week’s policy meeting, the BOJ is expected to “tweak” its policy, perhaps raising the yield target on the ten-year by 20 bps, and changing its yield curve control policy regarding super long bonds. According to the Bbg article, many Japanese insurers would consider switching their purchases from foreign bonds to longer dated JGBs as the yield hits 1%. Doug Noland of Credit Bubble Bulletin added, “the BOJ may also adjust its ETF purchase program, viewed as distorting the Japanese equities market.”

Some of the spillover was seen in US rates, as the ten year yield rose 7 bps to 2.96%. However the 30 yr only rose 5.7 bps to 308.7 and the 5/30 spread declined a couple of bps on the week to 24.1. Implied vols firmed slightly at the end of the week, but I still marked TYZ8 at just 3.8 and USZ8 at 7.3. Is it possible that a change by the BOJ could spark a “taper tantrum” type move of mid-2013 when US 10y yields surged over 120 bps? I’ll tell you who better hope not, and that’s the relentless seller of long dated puts in Eurodollar options. I’ve written a few notes about this seller over the past 2 weeks (if you want further details email me at amanzara@rjobrien.com) so for now I will just note a few representative sales. EDU20 9637/9600p 1×3 sold lower strike at 0.5 credit, EDZ20 9637/9587p 2×7, sold the lower strike flat. EDZ20 9600/9550p 1×4 sold lower strike flat. EDH21 9625/9575 p 2×7 sold lower strike at 1 credit. From Friday’s open interest sheets it’s pretty easy to identify top shorts: EDM20 9600p 130k, EDU0 9600p 339k, EDZ21 9587p 249k, 9550p 168k, EDH21 9587p 169k, 9575p 38k. Various reports note that this player is short “millions” of puts, which I believe is a stretch. A Bbg article by Edward Bolingbroke notes that the positions reflect the view that terminal rates are capped. What is indisputable is that long-dated puts have been sold at very cheap levels in size. Could a “tweak” turn into a global “tantrum”? Not too likely, but insurance is cheap. BOJ meeting Monday/Tuesday.

By the way, US supply remains an issue. Even the White House Office of Management and Budget is ratcheting up deficit estimates to levels more in line with other forecasters. From Friday: OMB estimated that new legislation enacted since the release of its February budget — alongside new projections on other spending and receipts — would add $101 billion more to the 2019 deficit, pushing it above $1 trillion. “That figure would amount to 5.1% of the US’s gross domestic product…”

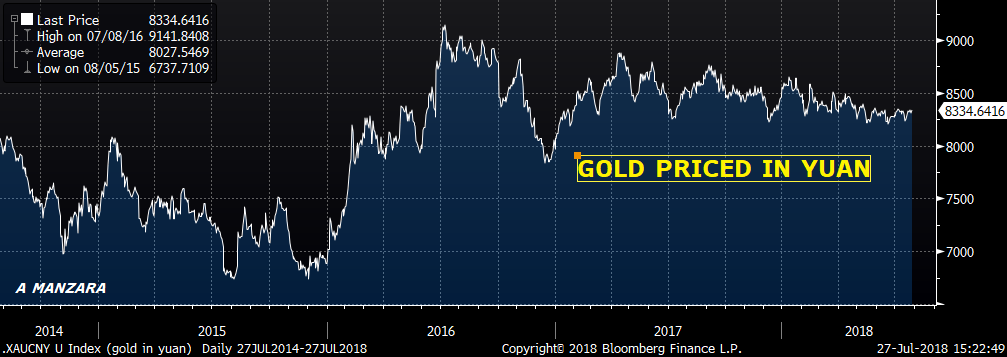

The next topic concerns China. While there were signs of a thaw in EU/US trade frictions last week, the situation in China continues to deteriorate. The Chinese yuan prints new lows vs USD almost every day, having moved from 6.3 in late March to 6.81 on Friday. Whether due to massive amounts of China debt and malinvestment, or concerns about trade wars, evidence is mounting that serious problems are growing. The government has taken several steps to loosen policy and make it easier for small firms to borrow. So we potentially have the BOJ tightening and the PBOC easing. Both can be considered as a negative on the US long end (China selling US reserves). Of course, China’s devaluation could also be considered to be deflationary, but an inflation ‘premium’ in the US long end is pretty much non-existent anyway. I add here a chart and idea from The MacroTourist, gold priced in yuan. http://www.themacrotourist.com/posts/2018/07/25/gold/

In August 2015, China devalued. It’s clear on the chart above, as gold in yuan made its high at the end of 2015. Over the past year there seems to be a pretty solid peg between CNY and gold. There are some who say that protectionist measures will inevitably be inflationary. The price of gold and other commodities argue differently. In any case, recent easing by China has helped to steady the plunge in the Shanghai Composite. Does the gold peg help bring a measure of stability? Or does the debate hearken back to William Jennings Bryan, “You shall not crucify mankind upon a cross of gold.” My bias is that trade tensions with China will continue to worsen. Probably negative for commodities; perhaps positive for bitcoin.

The last topic is FAANG stocks. There have now been a couple of high profile, high tech, thrashings, notably FB and TWTR this week. In some ways, these stocks have acted as safe havens, must-own assets, with many like AAPL sporting huge cash reserves. After the FB disaster, I saw an analyst on CNBC making the case to buy the stock (or to average in, as he had already been touting it). He said that FB knows more about every individual than any other organization, and can therefore be extremely specific in targeting sales pitches.

Recall in the late 1990’s, the valuation of tech companies was all about ‘clicks’ and ‘eyeball views’. Now, the goal for tech companies like FB and other social media firms is to capture more of your time. The mega companies either drive mega-trends (AAPL, NFLX), or drill down with intimate knowledge for sales targeting (FB, GOOGL). But Facebook’s Zuckerberg, on the quarterly conference call, alluded to the wall that these companies must now hurdle: “Looking ahead, we will continue to invest heavily in security and privacy because we have a responsibility to keep people safe. But as I’ve said on past calls, we’re investing so much in security that it will significantly impact our profitability. We’re starting to see that this quarter.” Translation: the value of our company is based on intimate knowledge of our users. There is a privacy backlash that is risking our core asset. We are spending what we must to make sure that this asset doesn’t seriously depreciate, and to change the perception of the public regarding our use of this core asset. Boom. It’s not just FB that has data–mining as the core value.

Will the sell-off of last week turn into something more meaningful? I add a couple of charts below. The leadership has been big-cap big tech defined by FAANGs. The chart at the top is Nasdaq, which sort of looks like a normal pullback in the context of a bull market. The chart below is the NYFANG index. While Nasdaq surpassed the mid-June high, NYFANG did not. While Nasdaq remains well above the late June low, NYFANG closed below that level. This is a pretty significant divergence given huge capital weightings of FAANG. Will it resolve in a broader based rally, or a leadership inspired retreat?

NY FANG Components: FB, AAPL, AMZN, NFLX, GOOGL, BABA, BIDU, NVDA. TSLA, TWTR

NASDAQ

NYFANG INDEX

On the domestic front, US news this week includes Personal Income and Spending on Tuesday, with the Core PCE Price Index expected 2.0%, right at the Fed’s target, also ECI. ISM Mfg Wednesday along with ADP, followed by the August FOMC. Factory Orders on Thursday. Payrolls Friday.

MARKET THOUGHTS AND POSITIONING

There’s been consistent buying of EDU8 calls and spreads, with the contract settling at 9757 on Friday. The one-year EDU8/EDU9 calendar spread closed at a new high of 59, up 8.5 bps on the week and just a few bps shy of the peak for the constant maturity one-year which was 63.75 set in May. There was buying last week of EDZ8 9750/9762 c 1×2 for 0.25, a roll-up trade if the Fed feels compelled to halt the tightening cycle after Sept’s FOMC.

Long dated puts are very cheap as noted above. EDZ0 9587p settled 4.5 with 11 delta.

There was a buyer last week of TYU 120/121c spread for 11, 30k. There is a LARGE long position in the 120 call strike, with open interest 323k. Position primarily related to long 120/122 call spread. Settlements and call OI as follow: TYU8 119-14s, 120c 14s, 30 delta, OI 323k. 121c 3s, 8d, OI 199k. 122c 1s, 2d, OI 259k.

Way back in mid-April, USU bond option trading was kick-started by a seller of USU 143 puts at premium of 1’37 to 1’21 in size of 36 to 40k. There was never much evidence that the position was pared back; it’s still the peak open interest put with 47k; settled 1’04 with USU 142-30s. Talk about pegging a strike. There are 4 weeks left in Sept treasury options.

| 7/20/2018 | 7/27/2018 | chg | |

| UST 2Y | 260.7 | 267.3 | 6.6 |

| UST 5Y | 276.7 | 284.6 | 7.9 |

| UST 10Y | 289.1 | 296.0 | 6.9 |

| UST 30Y | 303.0 | 308.7 | 5.7 |

| GERM 2Y | -61.8 | -59.9 | 1.9 |

| GERM 10Y | 37.0 | 40.3 | 3.3 |

| JPN 30Y | 68.5 | 81.3 | 12.8 |

| EURO$ Z8/Z9 | 33.5 | 39.0 | 5.5 |

| EURO$ Z9/Z0 | 0.0 | 0.5 | 0.5 |

| EUR | 117.22 | 116.56 | -0.66 |

| CRUDE (1st cont) | 68.26 | 68.69 | 0.43 |

| SPX | 2801.83 | 2818.82 | 16.99 |

| VIX | 12.86 | 13.03 | 0.17 |

http://creditbubblebulletin.blogspot.com/