July 11. Trump admin pokes China while preparing for NATO/Putin

–Late yesterday, the Trump administration ratcheted up the trade war with China by threatening fresh tariffs, causing an immediate sell off in stocks. Russell 2000, on a technical basis looks particularly vulnerable, with the index setting a slight new high early in the day (1708 cash index), creating a double top with June 21 high, had an outside day and closed lower. Ultimate target measures to 1550-1560.

–The big trade of the day was a buy of 150k TYU8 120/122 call spread for 33 to 34 ref TYU8 120-01 to 02. This same spread was bought 100k on June 11 for 29/30, and then on Friday’s employment data 100k TYU 121/122 call spreads were sold at 15. Settlement was 39 and 5 for 34, versus 120-005. Delta is 39, so this represents 58,500 contracts. One full point in the contract is worth about 13.25 bps, so with the ten year yield at 2.871, the upper strike is about 26.5 bps away, or a yield of 2.605-2.61. Open interest in strikes +141.5k and +165k; the 120 strike has a whopping 281k open. Also, OI was up in all treasury futures with FV and TY both +22k. Today the treasury auctions $22 billion tens; 150k contracts is notional $15 billion.

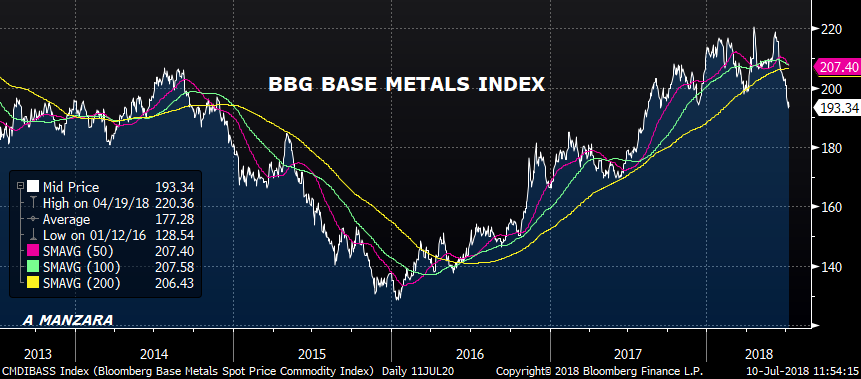

–There has been a decent amount of coverage of last Friday’s COT report, which reported that as of July 3, the net speculative short was a record 500k contracts, I suppose one can think of the call spread as a significant counterweight. I would also note that the chart of base metals along with other factors, suggests that demand for industrial commodities is waning (BBG base metals index at its lowest level since Q3 last year). In addition, while some latam currencies have bounced, India rupee, Indonesia rupiah and Thai baht are all near new lows. (This morning USD stronger across the board). Further, comments by Italian European Affairs Minister Paolo Savona warning that the country had to be ready for “all eventualities” on Eurozone membership was a weight on the Italian banking sector (IT8300). In short, there are many factors suggesting that fixed income should see safe haven flows, in spite of supply considerations like today’s auction.

–New low close in red/green euro$ pack spread yesterday at 0.0; red/blue and red/gold both slightly inverted. New low in 5/30 just below 20 bps.

–News today includes PPI expected +0.2 both headline and Core, with yoy Core +2.6%.