June 17. A Courtesy Nod to Economic Projections

-You try to gimme your money / you better save it babe / save it for your rainy day

Jimi Hendrix / Fire

One of the interesting things about the Fed’s Summary of Economic Projections (SEP) released last week is the forecast for the unemployment rate. For the end of 2018 it’s projected at 3.6% and for 2019, 3.5%. Know when the last time unemployment was 3.6%? Nearly 50 years ago in 1969. So what else was going on in 1969? Woodstock. The iconic Woodstock poster echoes last week as Trump and Kim Jong-un hailed the white dove of peace and denuclearization. It’s astonishing that it’s been only 9 months since yields plunged to their lows (Sept 2017) as impending conflict loomed with N Korea. Now, that particular risk has evaporated and the market seems to treat other risks as if they too, will fade into the background.

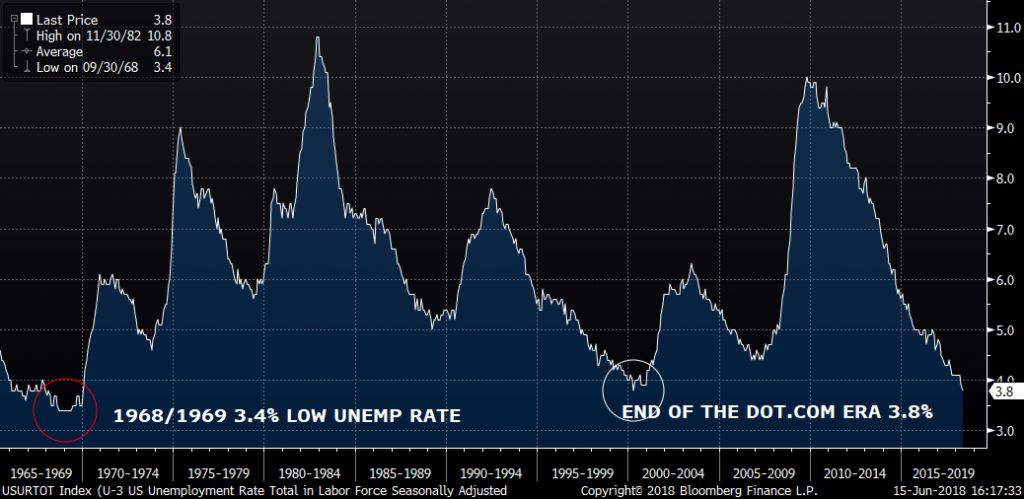

According to the site thebalance.com, in 1969 the unemployment rate was 3.5%, GDP 3.1% and Inflation 6.2%. As recession ensued, in 1970 unemployment leapt to 6.1, GDP sank to 0.2% and inflation to 5.6%. Wikipedia has an interesting post on the recession of 1969/70. [With unemployment rate chart below]

The Recession of 1969–1970 was a relatively mild recession in the US. According to the National Bureau of Economic Research the recession lasted for 11 months, beginning in December 1969 and ending in November 1970 following an economic slump which began in 1968 and by the end of 1969 had become serious, thus ending the second longest economic expansion in U.S. history which had begun in February 1961 (only the 1990s saw a longer period of growth).

At the end of the expansion inflation was rising, possibly a result of increased deficit spending during a period of full employment. This relatively mild recession coincided with an attempt to start closing the budget deficits of the Vietnam War (fiscal tightening) and the Federal Reserve raising interest rates (monetary tightening).

Sound familiar? Deficit spending during a period of full employment corresponding with rate increases from the Fed? Perhaps better to save it for a rainy day…

The other feature of the Fed’s SEP was the increase in rate hike projections, to 2.4 by the end of 2018 (2 more hikes), 3.1 by the end of 2019, 3.4 by the end of 2020, and 2.9 longer term. While not outright dismissive, the Eurodollar curve isn’t fully buying into these forecasts. One-year forward EDM19 settled 9709, or 2.91%, less than 60 bps above the current 3 month libor rate. The following one-year calendars shave 1/8% every three months: EDU18/U19 settled 51, EDZ18/Z19 37.5 and EDH19/H20 25.0. Where the ED curve does give a nod of acknowledgment to the Fed is the idea that the longer term rate is BELOW the peak 2020 projection. The lowest ED contract out four years is, coincidentally, EDZ20 at 9693.5 or 3.065%, and for the next year, prices invert. EDU0/U1 and EDZ0/Z1 both posted new lows for all one-year spreads at -1.5 bps. I would also mention that in terms of the rest of this year, the July/January Fed fund spread, which captures hike odds, closed at 37 bps, essentially pricing a 50/50 chance of one or two more moves. All ED contracts from the 4 years between Dec’19 (96.96) to Dec’23 (96.91) are with 5 bps of each other, so just north of 3%.

The longer end of the curve also flattened to new lows for the cycle. Below is an updated chart of the red/gold ED pack spread and 2/10 treasury spread. Red/gold (2nd year forward vs 5th year frd) is below the low of the last hiking cycle 2004/06. 2/10 closed at 37 bps, having been negative in 2006.

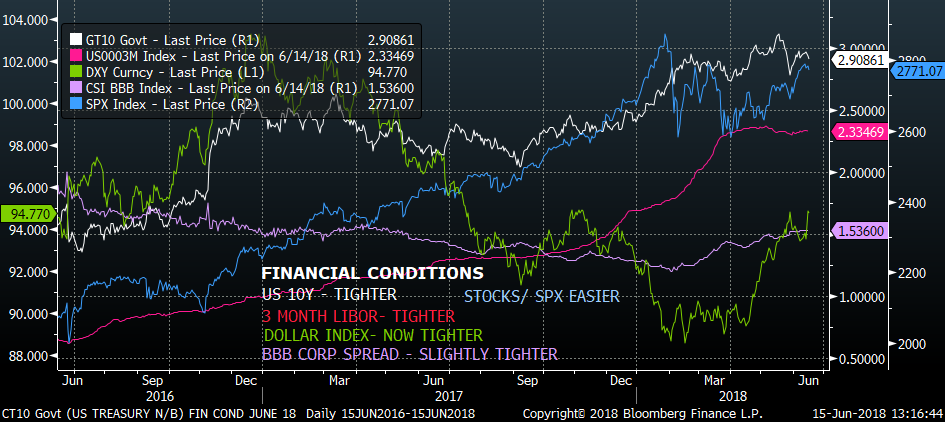

Over a longer timeframe, the Fed wants to prevent overheating and a surprise surge in inflation due to wage increases. Articles abound bemoaning the lack of skilled workers, and during the press conference Powell said that business contacts repeatedly identify labor shortages as an issue. The broader topic of financial conditions (championed by the NY Fed) is shown in the chart below. While conditions generally eased as Yellen’s Fed raised the FF target, more respect for tightening is being shown to Powell.

It might not be completely clear on the chart, but there are 5 lines. The short term rate, 3-month libor, has obviously shown tightening. Since last September the ten year yield has risen by 90 bps, also tighter, and a notable change from Yellen. While fairly modest, the spread between BBB corporates and treasuries has also widened since Powell took over. The dollar index has surged in Q2, leading to tighter conditions, especially for Emerging Markets. Odd man out is stocks, blithely ignoring these other factors.

Investors have been paid to fade every risk from Brexit to Trump’s election, to escalation of armed conflict, to trade wars. However, the back end of the euro$ curve and skew favoring calls is an indication of unease with the roadmap going forward. Indeed there was heavy buying of TY calls over the past week, and on Friday commodities took a tumble. On the political front there’s a chance that Merkel could be bounced as chancellor this week. Pressure in Emerging Markets threatens to boil over with EEM and EMB at new lows for the year. Ditto for Shanghai Composite, off over 15% from the high in January. Week over week US yields were little changed, SPX was exactly unchanged, and VIX rolled marginally lower. Sometimes it’s not the week that EVERYONE knows could be a big one, but the one where no one expects anything. Seasons change; summer solstice on June 21.