Bonds and Wheat

February 14, 2025

**********************

–PPI was also higher than expected, with yoy 3.5% vs 3.3 exp, but rather than extend the sell-off from Wednesday’s hot CPI, the market completely erased the move. On Tuesday, TYH5 settled 108-305. On Wed (CPI) 108-085. Yesterday, 108-31. Similar in SOFR, for example SFRH6 9601.5, 9591.0, 9598.5. Today’s news includes Retail Sales for Jan, expected -0.2 but +0.3 ex-auto.

–Perhaps part of the move is related to the surge in swap spreads, with the 30-yr pictured below. This move is being attributed to possible relaxation of G-SIB surcharges and a loosening of SLR (Supplemental Leverage Ratio) rules, according to BBG:

https://blinks.bloomberg.com/news/stories/SRMK84T0G1KW

–Rally has been similar in the ten-yr swap spread. I take marks at the time of daily futures settles, of 10y cash (PX1) and 10-yr swap (page IRSB ). On Jan 3, I marked 10y 4.61 and the swap at 4.133, a spread of negative 47.7. Yesterday, 10y 4.523% and swap 4.146 or negative 37.7. In other words, the 10y yield fell by 8.7 while the swap was up nearly 2 bps in yield.

–Wheat threatening new recent highs, up 9 cents to 601. “BREAKING: Ukraine says Russia has struck the Chernobyl nuclear plant with a drone attack.” The 1986 Chernobyl incident sparked a hard rally in grains (at the time, April 1986, front wheat 289 to 360 in ten sessions). Of course, we don’t know who hit the plant, but it’s being reported as Russia, with no radiation leak. Silver also seeing an upside breakout.

–Yes, I know the new administration is scary and corrupt, so it’s nice just to retreat back into Illinois politics:

NY Times: ‘Mike Madigan, former Illinois House Speaker, found guilty in corruption trial’

Chicago Tribune: Three top city officials stepping down after Mayor Brandon Johnson’s message: ‘If you ain’t with us, you just gotta go’

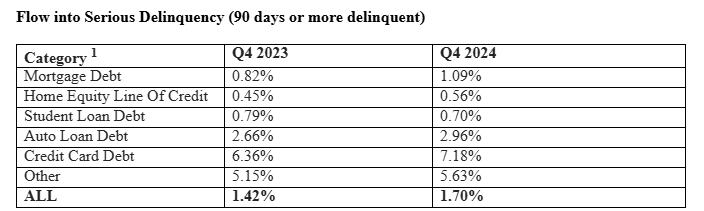

–Below the chart is a table from Fed’s Consumer Delinquencies. All moving higher, notably auto loans and credit cards.