Payroll Friday!

January 10, 2025

******************

–Payrolls today expected 165k with rate of 4.2%. LA fire damage now estimated $150B and going higher. Likely inflationary at the margin.

–On a half day there were some fairly large trades. In the long end, weighted to the downside. In SOFR there were some decent size call buyers.

[half day due to Carter’s Day of Mourning. Treasuries were closed]

The big trade was a new buyer of >50k TYG5 107.5/106.5ps for 11. Settled 12 vs 108-07.

SFRZ6 9700c 26 paid for 15k (new, settled 25.5 ref 9598)

SFRZ5 9650c 23 paid 5k (23.0s ref 9605)

SFRZ5 9625/9675cs vs 9525p 2.75 paid 8k for cs (new)

–Yields ended a bit lower with a steeper curve. Once again, new highs in deferred SOFR calendars. Reds +4.125 (9602.25), Greens +2.875 (9591.25), Blues +2.0 (9582) and Golds +1.875 (9573.25). On Wednesday I marked tens at 4.691%. This morning 4.698% ref 108-03.

–In yesterday’s note I mentioned SFRH6/H7 spread and SFRH6/H8 spread, both of which have rallied to highs since early Dec. Here’s a trade which appears profitable exit, synthetic sales of those calendars.

+0QH5 9587.5p cov 9606 34d (2x)

Vs -2QH 9587.5p cov 9597, 40d with 3QH 9587.5p cov 9587.5 50d

Ppr bought 0QH (6k) and sold 2QH and 3QH (3k each), took 10.5 credit

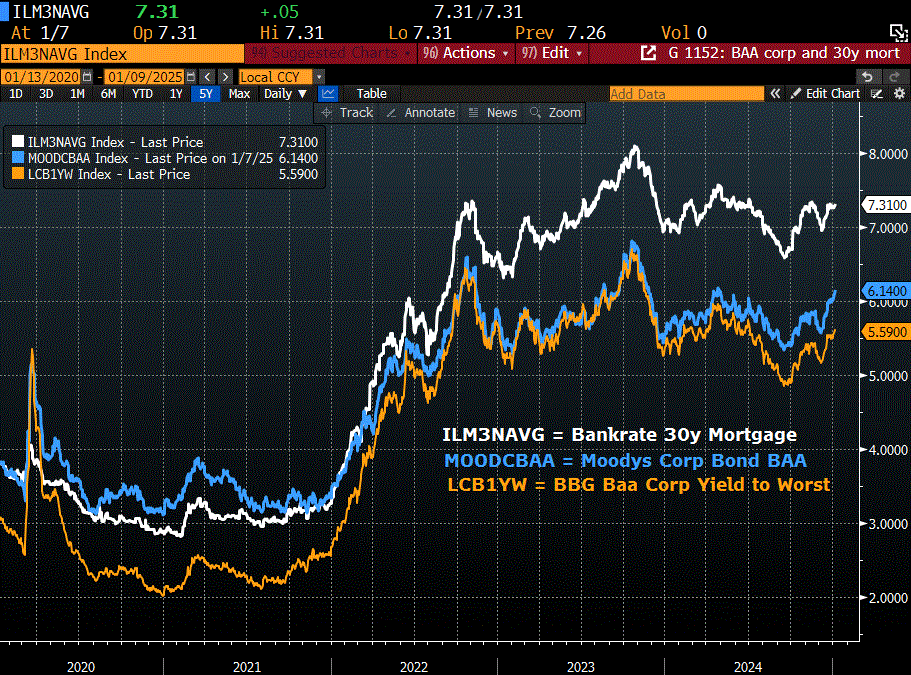

–Attached chart Baa yields and 30y mortgage. In late 2021 the 30y mortgage was approx 3% and Moody’s Baa Index was 3.25%. Now 30y BankRate Mortgage 7.08% and Baa is 6.14.

–Oaktree Capital, Howard Marks missive : Bubble Watch. Comprehensive and balanced warning signs. EVERYONE PANIC

https://www.oaktreecapital.com/docs/default-source/memos/on-bubble-watch.pdf?sfvrsn=ab105466_4