Merry New Year

December 29, 2024

*********************

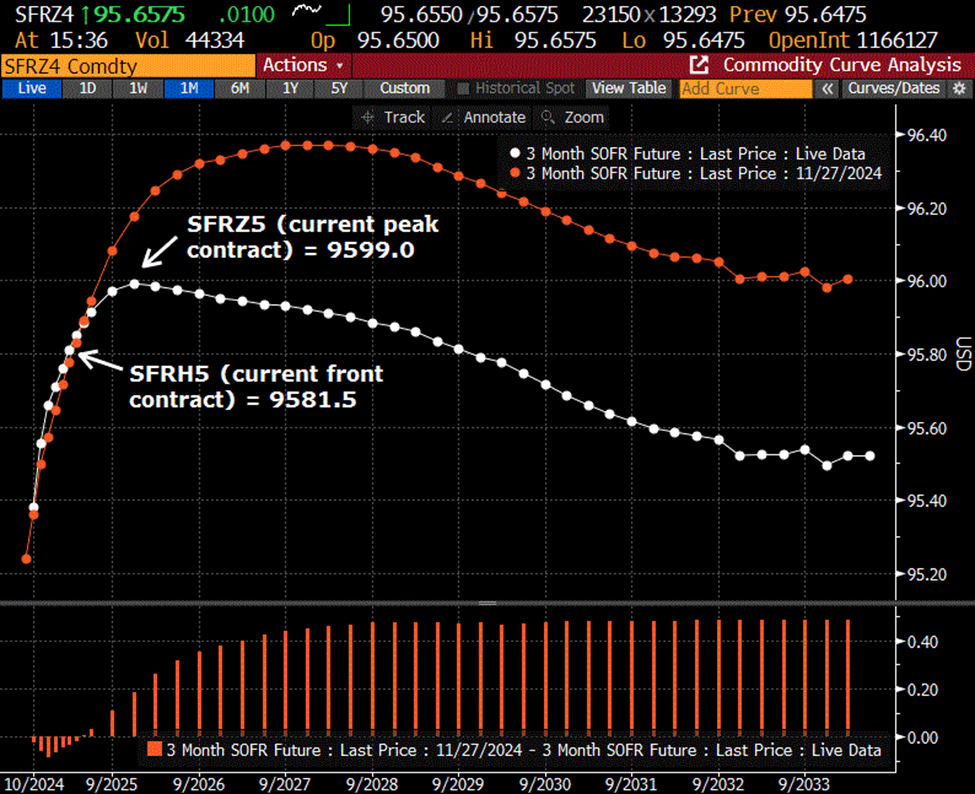

Chart below is the SOFR futures curve. The white dots are from late Friday. The red dots are from one month ago. The obvious change is the shift to lower prices (higher yields). On November 27, the peak contract was SFRU7 at 9637. On Friday SFRU7 settled 9593. The high of this contract on Sept 10 was 9709. As we all know, there’s been a wrenching sell-off in rate futures since the September 18 FOMC.

There are a few other things to notice. First, not a single SOFR contract now is above 9600. That is, all forward rates are above 4%. Secondly, and perhaps more subtle, is that the peak contract on the strip has moved forward in time as back contracts have shifted lower with the steepening curve. The peak contracts as of Friday’s settle were SFRZ5 and SFRH6 at 9599. That means that every calendar spread from March’26 forward is now positive.

I’ve marked the current lowest quarterly contract, SFRH5 at 9581.5 and the peak at 9599, a spread of just -17.5 over a shortened timeframe of just nine months. The implication, if the trend continues, is reduced liquidity going forward. Higher forward rates, stronger USD, cracks in equities… the last signal will be widening credit spreads.

Before the Sept 18 FOMC, the 2nd to 6th one-year SOFR calendar was -130 bps. Of course, since then we’ve had 100 bps of ease, so perhaps the SFRM5/M6 spread at -5.5 (9592/9597.5) makes sense; the front easing has substantially occurred. The issue, as I have repeated, is that asset prices are dependent on lower forward rates discounting future cash flows.

In corroboration with the steepening SOFR curve, 2/10 made a new high for the year of 29.5 bps (4.324%/ 4.619%). The high in 2021 was 158 bps. The low on March 8, 2023 was -108.7. The halfway point is 24 bps which has now been breached. The 0.618 retrace is 55 bps, which is likely the next target. It’s worth noting that while cash tens did NOT make a new high for the year (the April high was 4.706%), thirties did, taking out April’s 4.813% by a bp or so (marked at 4.82 on BBG).

OTHER THOUGHTS/ TRADES

As stocks slid Friday from a ridiculous early week surge, there was a new buyer of 50k SFRM5 9612.5/9662.5cs vs 9556.25p for 3.0 to 3.5 covered 9592. 9612.5c 13.0s OI +43.5k. 9662.5c 6.0s OI +54k. M5 9556.25p 4.0s, OI +42k. Spread settle 3.0 ref 9592.0 settle.

June SOFR options expire 13-June. The FOMC is the 18th. Meetings prior to June are 29-Jan, 19-March, 7-May.

Happy New Year to all! With inflation threatening again, may we all enjoy good health and the prosperity to afford the little luxuries

| 12/20/2024 | 12/27/2024 | chg | ||

| UST 2Y | 431.4 | 432.4 | 1.0 | |

| UST 5Y | 438.0 | 445.6 | 7.6 | |

| UST 10Y | 452.6 | 461.9 | 9.3 | |

| UST 30Y | 471.8 | 481.0 | 9.2 | |

| GERM 2Y | 202.7 | 210.0 | 7.3 | |

| GERM 10Y | 228.5 | 239.6 | 11.1 | |

| JPN 20Y | 185.5 | 189.5 | 4.0 | |

| CHINA 10Y | 171.8 | 170.1 | -1.7 | |

| SOFR H5/H6 | -20.5 | -17.5 | 3.0 | |

| SOFR H6/H7 | -1.0 | 4.0 | 5.0 | |

| SOFR H7/H8 | 1.0 | 3.5 | 2.5 | |

| EUR | 104.30 | 104.25 | -0.05 | |

| CRUDE (CLG5) | 69.46 | 70.60 | 1.14 | |

| SPX | 5930.85 | 5970.84 | 39.99 | 0.7% |

| VIX | 18.36 | 15.95 | -2.41 | |

| MOVE | 90.41 | 95.20 | 4.79 | |