Linked-in post from weekend…$/yen

The FOMC is December 18. BOJ is December 19. On Friday (11/29) Ueda said the time for a hike is “approaching”. According to several articles, the probability of a hike is around 60% from the current 0.25% rate. (3m TIBOR fixing has moved from just above 25 bps to 36 bps since early November). On Thursday $/yen was 151.50, and after Ueda’s interview was published on Friday it touched 149.47.

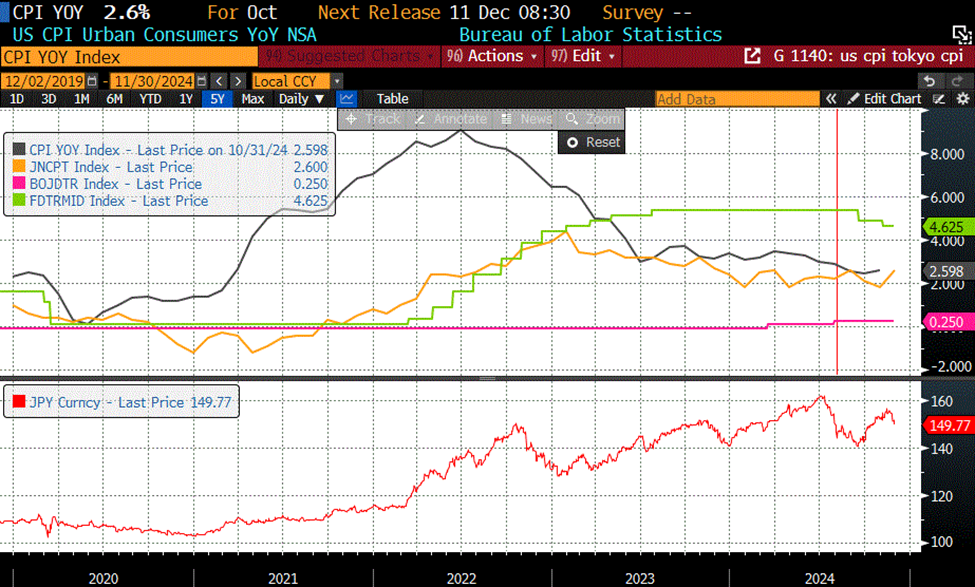

The chart below shows US CPI in black, Tokyo CPI in amber, US FF midpoint in green and Japan’s base rate in pink. $/yen is in lower panel. According to these measures, inflation in both Japan and the US is 2.6%. The US FF mid is 200 bps above, and Japan’s base rate is 235 bps below. In terms of ‘recalibration’ it would appear more urgent on the side of Japan.

My guess is that the Fed will stand on the sidelines rather than ease, and that the BOJ will hike.

Why the emphasis on Japan? The red vertical line on the chart above shows the last BOJ hike. The yen had already been strengthening, from over 161 in early July to 150 by the end of the month. BOJ hike was August 5; $/yen hit 141.70 on the panicked unwind of yen-carry positions. In early July when $/yen was 161, SPX was around 5630. On August 5, the low was 5920, 5% lower. Over the same timeframe VIX exploded from 13 to 38. MOVE went from 94.8 on July 24 to 121 on August 5. Conditions became volatile. Of course, the monetary authorities immediately assured us that everything was going to be just fine, and that was the low for SPX.

The chart below shows $/yen in lockstep with the US 10y treasury yield since the beginning of August, and even prior there is a high degree of correlation. Since Nov 14, $/yen has moved from 156.50 to Friday’s low 149.50. The 10y yield has cratered from 4.45 to Friday’s 4.17. The pattern is similar to the period leading up to the BOJ’s last hike. Also similar is SPX blithely rallying into the possibility of choppy seas.

What if the US cuts and Japan hikes? $/yen to sub-145? Ten year yield sub-4%? A 5% sell-off in SPX would lead to the horror of 5730. Sure, that would be above every price since late September, but can we really all live with a year-over-year gain of just 20%? Shudder.