Felection

November 3, 2024

*******************

It’s FOMC week and the election: Felection. Sound stupid? It’s supposed to.

In the old days, there was no Fed statement. No press conference. There were legions of “Fed watchers” who interpreted policy moves. On the CBOT floor, “Fed time” was around 10:30 to 10:35. Repos or matched sales were big clues on policy.

Elections were pretty much counted and known. Now we have legions of election watchers and we probably won’t know who won for days.

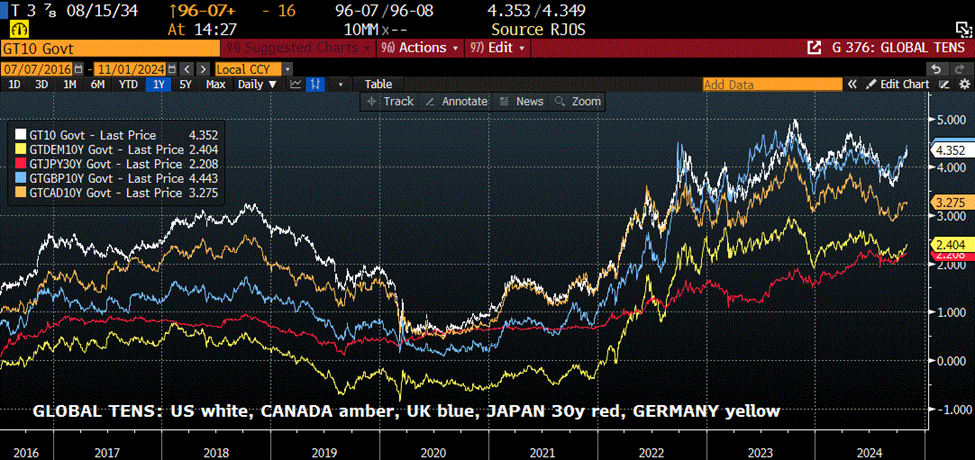

Image is global long-end yields. Last October the refunding announcement favoring t-bills as the financing choice, sparked a yield drop in tens. This October yields have risen.

I just don’t know how to handicap the election. What I do know is that the 10-yr yield rose about 65 bps since the 50 bp ease in September (as the above chart shows). The Nov FF contract is locked in on another 25 for this meeting. So, if we hold true to form, by the end of November the 10y should be about 30 to 35 higher, right? The current 10y is 4.36%. The irony of another Fed cut that spurs long-end selling would put the 10y yield right around 4.70%. A Fed cut takes EFFR to 4.58 and there would be positive carry on tens, a helpful condition in terms of placing debt.

FFX4, November Fed Funds, settled 9535.75. I calculate an ease of 25 will obtain final settlement of 9536.2. FFF5, Jan FF, settled 9563.5. Jan is not a “clean” month, as the first FOMC meeting of the year is Jan 29. Current EFFR is 4.83%. A cut this week takes it to 4.58% and another 25 bp cut in Jan to 4.33% or a price of 9567.0 (ignoring a potential Jan cut). SFRZ4 settled at 9563.0. The market appears comfortable projecting 25 bp cuts.

EFFR 4.58, and another cut into year-end puts us at 4.33. If inflation is around 2.25 and the neutral rate is 2% we’re there. (PCE yoy prices released Thursday were 2.1% with Core 2.7%). There are many who question how the Fed can cut into relatively loose financial conditions (tight corporate spreads, elevated stocks). Those conditions can change rather quickly as evidenced by October’s USD surge. On 9/30 DXY was 100.78. On Friday it was 104.28. This, as SFRZ5 rose 70 bps in yield from 9700 on 9/30 to 9630 on Friday. A rise in forward rates is what will tighten financial conditions. Note that a price of 9630 equals 3.70% for the end of next year which still reflects easing, just not as much. Long-end yields have responded to the idea of a less generous Fed and a government with voracious borrowing needs.

This week brings 3, 10 and 30 year auctions Monday, Tuesday, Wednesday. Sizes $58b, $42b and $25b. If the election is a mess, there’s a risk that the 30y could be sloppy. Note that the MOVE index closed at the high of this year, 132.58. The high in 2022 was 160.72 and the high in 2023 associated with the collapse of Silicon Valley Bank was 198.71.

| 10/25/2024 | 11/1/2024 | chg | ||

| UST 2Y | 408.4 | 419.7 | 11.3 | |

| UST 5Y | 405.3 | 420.6 | 15.3 | |

| UST 10Y | 423.0 | 435.5 | 12.5 | |

| UST 30Y | 449.9 | 455.5 | 5.6 | |

| GERM 2Y | 211.7 | 224.7 | 13.0 | |

| GERM 10Y | 229.1 | 240.5 | 11.4 | |

| JPN 20Y | 177.9 | 177.7 | -0.2 | |

| CHINA 10Y | 215.8 | 214.3 | -1.5 | |

| SOFR Z4/Z5 | -81.0 | -67.0 | 14.0 | |

| SOFR Z5/Z6 | -0.5 | 1.0 | 1.5 | |

| SOFR Z6/Z7 | 4.5 | 2.5 | -2.0 | |

| EUR | 107.99 | 108.35 | 0.36 | |

| CRUDE (CLZ4) | 71.78 | 69.49 | -2.29 | |

| SPX | 5808.12 | 5728.80 | -79.32 | -1.4% |

| VIX | 20.33 | 21.88 | 1.55 | |

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that R.J. O’Brien believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. Copyright 2024. Alex Manzara.