Vol measures elevated pre-election

November 1, 2024

*******************

–Nonfarm Payrolls today expected 105k, though storms and strikes will make data less useful. In general, labor market indicators have been resilient. ISM Mfg expected 47.6 from 47.2.

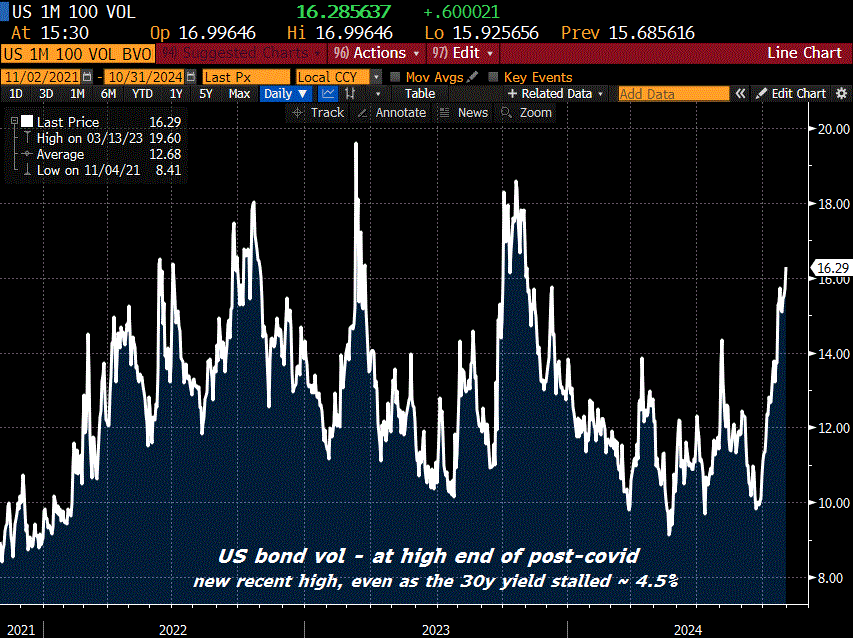

–Yields little changed yesterday, with 10s 4.278% up about half a bp. However, red sofr contracts were -2 and greens -2.5. While the increase in implied vol has corresponded with the yield rise, the attached chart shows a new recent high for bond vol even as prices stagnated. Of course, the election bid could easily subside as November progresses. It appears as if positions have been pared going into next week, with open interest in TY down 71k (about 1.5%). FV -61k, UXY -18k, US +19k and WN -3k. End of October is also the fiscal year-end for many hedge funds.

–5/30 made a new recent low, marked at 32 bps as of futures settle. This spread was 51 bps a couple of weeks ago (10/21). An interesting CBOT block trade yesterday faded the spread weakness:

FVZ4 106.75p -15k 32.5 (-0.42d equiv -6.3k FV)

FVZ4 106.50p -7.5k 27 (-0.36d equiv -2.7k FV)

USZ4 116.0p +7.5k 1’30 (-0.39d equiv +2.9k US)

I see yield ratio as ~3.2 FV to 1 US, so bond side is a bit light. However, in my opinion FV vol slightly rich compared to US, so makes sense from that standpoint as well.

–Minor bounce in stocks this morning with little impact from AAPL and AMZN. Oil is up a couple of dollars from settlement as Iran warns of retaliatory attacks.