The price is right. For today, anyway.

October 25, 2024

******************

–Yields eased a bit, with 10s down 4 bps to 4.20%. No particular meaning associated with that yield level, though everyone might want to take a toke over the next two weeks for medicinal purposes. November treasury options expire today. TYZ4 settled 111-09 and the X4 111.25^ settled 16/64. Not looking for much action associated with today’s Durables or U of Michigan numbers. Peak open interest in Nov calls is the 112 strike with 58k open. On the put side there are 74k open at the 111.25 strike (atm).

–There was a late block in TYZ options: -16k 109.5p at 26, -9k 110p at 35, +33.5k 114c for 14, -17.5k TYZ4 at 111-07. Delta was heavy (would have been ~11.5k futures delta neutral), though on Wednesday there was also new long open interest added to the 114c strike. Yesterday OI was up 39k in the TYZ 114c to 80k. 15 delta option, settled 14/64, it’s the peak point of open interest in TYZ calls. Though vol has gone bid on the move to higher yields, long 114 calls provide some insurance against something crazy happening, (which seems to occur every other day).

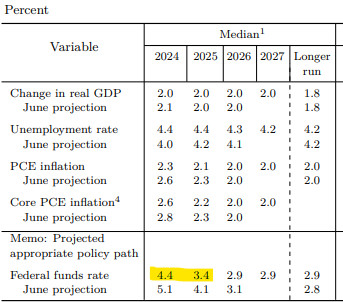

–FFX4 settled 9535.5, essentially pegging a 25 bp cut at the next meeting (final settle would be 9536.2 on a quarter point ease). That contract has traded as low as 34 past few days, but there’s little inclination (at this point) to really push for the Fed to stand pat. Current EFFR is 4.83 and FFV4 is right there, at 9517, so a price of 9535.5 might be looked at as a cheap put, BUT, what if there’s another 50? On the SOFR strip, the lowest quarterly is still front Dec, with SFRZ4 settling 9561.5. The peak quarterly is SFRH6 at 9651.5. So 1.25 years apart, yields 90 bps apart, around 4.4% and 3.5%. If I just saw these prices without the context of the election and international strife, I would think it’s reasonable pricing for a gently slowing economy and decelerating inflation. In fact, these SOFR prices hew to the last Fed SEP, which projected end-of-2024 FF at 4.4% and end-of-2025 at 3.4%. The problem is, I can paint scenarios for wildly different outcomes in both directions.