Puke

October 6, 2024 – weekly comment

*****************

Friday’s payroll report showed a surge of 254k vs expected 150k, and the unemployment rate fell back to 4.1% from 4.2%. Rate futures plummeted. Curve flattened. Some are now saying that September’s 50 bp cut by the Fed was a policy error.

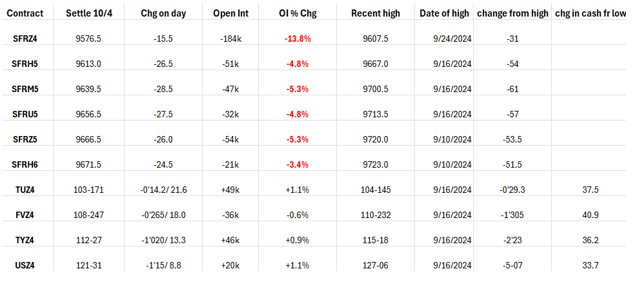

Below is a table of selected futures prices, along with bp changes and open interest changes. I only went as far as SFRH6 in SOFR because that was the peak contract for most of last week. In treasury futures, I marked the daily tick change along with cash treasury bp changes (even though durations are somewhat mismatched). Two main points. 1) There was an absolutely massive position puke in near SOFR contracts. Total open interest on the strip plunged by 432k contracts on Friday. 2) Net changes from mid-September highs (pre-FOMC) have been huge with near SOFR contracts rising in yield by half to 5/8% and cash treasuries by around 3/8%. The last FOMC was 18-Sept, nearly an exact top-tick as most futures prices peaked on 16-Sept.

November Fed Funds, which price the Nov-7 FOMC, settled 9537.0, -6.5 on the day. I calculate that a 25 bp ease at that meeting will result in a final settle of 9536.17. (A 50 bp cut would be 9555.33). As of Friday, the market is close to pricing a 25 bp cut, which one might say had been guided by Powell. The forward shift to a lower glide-path of rate cuts has been extraordinary this week.

As an aside, I’ve heard several commentators remark on huge, uncomfortable, shorts in crude oil, much having to do with COT reports. Just as a comparison, using the sum of the first two contracts in WTI, open interest fell by 6.8% on a price rise in CLX4 of 6.5% from 69.83 to 74.38 from 01-Oct to 04-Oct. However, using COZ4 and COF5 Brent contracts, open interest actually rose a bit from 01 to 03-Oct (04-Oct OI unavailable). Huge moves in oil, rates, and China’s stocks have likely caused large swings in hedge fund returns.

The late September surge in BCOM (Bbg Commodity Index) and in oil have some saying that inflation is likely to reaccelerate. BCOM closed 102.07; high of the year has been 107.24 and low (last month) was 93.33. Front WTI contract settled 74.38 vs this year’s high at 86.91. Last year’s high was 93.68 (in September, so a year later it’s down $19/bbl). In 2022 the high was over 120. We’re not even close to the year’s peak. While inflation may firm a bit from here, the shelter component is likely the most important piece of the forward outlook. CPI is released Thursday and is expected 0.1 with Core 0.2 month/month. YOY expected 2.3% from 2.5% last, with Core 3.2% from 3.2%. In March/April of 2023 when the regional banking ‘crisis’ flared, Powell refrained from easing even though SOFR futures briefly projected aggressive cuts. At the time, yoy CPI was declining, but was still 5.0 in March’23, 4.9 in April and 4.0 in May. If the yoy estimate of 2.3 is correct it will be the lowest since 2021. Pre-covid, the average CPI was 2.45% in 2018 and 1.8% in 2019. PPI is Friday. Also this week are auctions of 3s ($58b), 10s ($39b) and 30s ($22b). As the below chart shows, the low yield of 3.93% on 30s was set on 16-Sept, just two days prior to the FOMC. Since then, the yield has risen 33 bps and has broken a loosely drawn channel. Halfway back of this year’s range is 4.37, which is an appropriate short-term target. In futures terms, USZ4 settled 121-31 vs 4.267% on the long-bond. Ten bps in the contract is approx. 1-11 or a price of 120-20, which should be a solid support area (yield resistance).

Auction demand will be an interesting signal going forward. I believe the Fed wants to make sure that funding conditions are favorable for sustaining US debt, and that means a positive curve with a lower FF rate. In my view, geopolitical conditions coupled with uncertainty around (and just after) the election make an ease in November highly likely. With the market now pricing at 25 bps, I think plays for 50 are advantageously cheap.

Druckenmiller said last week, “Bipartisan fiscal recklessness is on the horizon.” My thought is that post-election, no matter who wins, markets may rebel. No one is talking about fiscal responsibility presently, but that may start to change. There was a quote on X from @SpecialSitsnews: “If you don’t rein in your mind, the market may have to.” -My first boss. Quote actually used “reign” so I guess this guy has a couple of things to work on.

There were a couple of BBG News bullet points that I found interesting last week:

– FRENCH PM BARNIER: REDUCTION OF DEFICIT PART OF POLICY PRIORITIES

– FRENCH PM BARNIER: PILE OF DEBT WILL WEIGH ON OUR CHILDREN IF WE DON’T ACT NOW

– FRENCH PM BARNIER: DEFICIT IS MAKING FRANCE WEAKER IN EUROPE (Tuesday Oct 1)

And on Thursday:

*ITALY PLANS WINDFALL LEVY ON COMPANIES TO NARROW DEFICIT

Perhaps the widening of France to Germany 10y spread this year is a nudge in the right direction. My thought is: when comments/critiques on a topic like excessive deficit spending begin at the periphery, it doesn’t take very long to affect the core. Markets may have to help rein in thoughtless spending. Bond yields will reign.

OTHER THOUGHTS/ TRADES

Last week I mentioned SFRZ4/M5/Z5 butterfly which settled -70 on Friday, 27-Sept. My inclination was to sell the back end of this fly, the M5/Z5 calendar. Obviously, it would have been better to be long the fly, as it exploded to -36 on Friday. SFRM5/Z5 still went from -17 to -27 on the week.

| 9/27/2024 | 10/4/2024 | chg | ||

| UST 2Y | 356.3 | 392.8 | 36.5 | |

| UST 5Y | 350.7 | 381.3 | 30.6 | |

| UST 10Y | 375.1 | 398.1 | 23.0 | |

| UST 30Y | 409.9 | 426.7 | 16.8 | |

| GERM 2Y | 207.6 | 220.3 | 12.7 | |

| GERM 10Y | 213.3 | 221.0 | 7.7 | |

| JPN 20Y | 166.7 | 165.6 | -1.1 | |

| CHINA 10Y | 218.3 | 221.0 | 2.7 | |

| SOFR Z4/Z5 | -104.0 | -90.0 | 14.0 | |

| SOFR Z5/Z6 | 8.0 | 4.0 | -4.0 | |

| SOFR Z6/Z7 | 12.0 | 4.5 | -7.5 | |

| EUR | 111.66 | 109.77 | -1.89 | |

| CRUDE (CLX4) | 68.18 | 74.38 | 6.20 | |

| SPX | 5738.17 | 5751.07 | 12.90 | 0.2% |

| VIX | 16.96 | 19.21 | 2.25 | |