Full Steam Ahead

September 26, 2024

*********************

–There was a BLOCK seller of 118k SFRZ4 at 9606.5 yesterday, but the contract held (had been trading slightly higher at time of block post) and settled 9606. On huge volume of 650k in Z4, open interest was up 15.6k. Perhaps the guy was long 60k and doubled up to now get short. Yields were mostly up 4 to 4.5 across the board. 10y rose 4.5 to 3.781%. SFRZ4/Z5 made a new high at -104. Even with the large sale in SFRZ4, it only closed down 1.5 at 9606 while SFRZ5, still the peak contract on the strip, settled -4 at 9710.

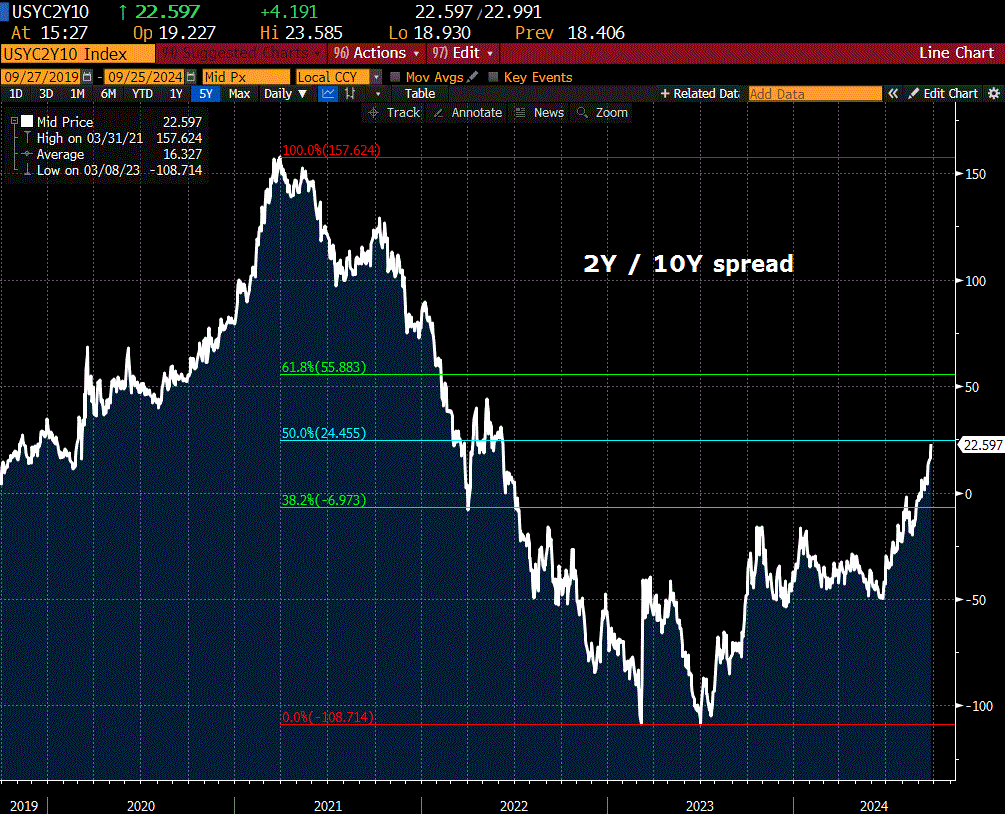

–Treasury spreads continued to make new highs, with 2/10 now testing the 50% retrace from 157 high in 2021 to -109 low in 2023. 5/30 made a new high at 62…this is just slightly thru the 50% level (163 to -46).

–There is a Treasury Market Conference at which Powell is making pre-recorded comments at 9:20. Some additional Fed speakers as well. Other news includes final Q2 GDP, expecting no change from the second estimate of 3%. Durable Goods, Jobless Claims expected 223k.

–SNB delivered a “dovish” 25 bp cut (little reaction in CHF). Saudi Arabia is considering abandoning its $100 price target in order to reclaim market share (CLX4 down 1.54 at 68.15). China continues to announce massive stimulus; SHCOMP from 2700 to 3000 in the past week and +3.6% today. Of course, US equities are in rally mode as well.

–From Fed Governor Kugler yesterday:

“The labor market remains resilient, but the FOMC now needs to balance its focus so we can continue making progress on disinflation while avoiding unnecessary pain and weakness in the economy as disinflation continues in the right trajectory. I strongly supported last week’s decision and, if progress on inflation continues as I expect, I will support additional cuts in the federal funds rate going forward.” Nothing in the speech about asset prices except for “…high levels of household wealth relative to income.”

–Supportive Fed, stimulus from China, lower energy prices. Firing on all cylinders. Does inflation follow? Or is it just financial asset inflation again? New high Dec Gold $2692, and Dec Silver making a run as well, now printing 32.54.

–Interesting post below, citing the plunge in the ratio of the Conference Board’s leading to lagging indicators. “We have seen 8 plunges like this since the 1960s and each one flagged a recession.” [thanks TS]

https://x.com/JeffWeniger/status/1838690956331163975