Pricing looks aggressive…for a reason?

Sept 8, 2024 – Weekly Comment

(NOTE: the Sept 9 daily note is BELOW. Out of order on days)

******************************************************************

Let’s start with October Fed Funds, the contract which most closely prices the September 18 FOMC. It settled 9499.5, down 2.5 on the day and unchanged on the week. Volume was a whopping 935k, but open interest barely changed, down 4k at 571k. Almost seems boring in terms of net price changes. However, Friday’s range was 9497 to 9512. Huge for a one-month contract near expiration.

On a 25 bp cut, EFFR should move from current 5.33% to 5.08% or 9492. On a 50 bp cut, EFFR should go to 4.83% or 9517. So, Friday’s range faded the two extremes by exactly 5 bps either way. The midpoint between 25 and 50 is 9504.5, so the settlement is favoring just 25.

Both Williams and Waller blessed a cut at the September meeting. A couple of excerpts from their speeches:

Williams (clear on a cut, but in terms of size, I would lean towards 25):

With the economy now in equipoise and inflation on a path to 2 percent, it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate. This is the natural next step in executing our strategy to achieve our dual mandate goals. Looking ahead, with inflation moving toward the target and the economy in balance, the stance of monetary policy can be moved to a more a neutral setting over time depending on the evolution of the data, the outlook, and the risks to achieving our objectives.

Waller (overall, more forceful than Williams. If we’re going to start, let’s start with 50. That’s my read. However, the market is suggesting caution on the first cut).

I believe our patience over the past 18 months has served us well. But the current batch of data no longer requires patience, it requires action.

But I also believe that maintaining the economy’s forward momentum means that, as Chair Powell said recently, the time has come to begin reducing the target range for the federal funds rate.

Furthermore, I do not expect this first cut to be the last. With inflation and employment near our longer-run goals and the labor market moderating, it is likely that a series of reductions will be appropriate. I believe there is sufficient room to cut the policy rate and still remain somewhat restrictive to ensure inflation continues on the path to our 2 percent target.

As of today, I believe it is important to start the rate cutting process at our next meeting. If subsequent data show a significant deterioration in the labor market, the FOMC can act quickly and forcefully to adjust monetary policy.

If the data suggests the need for larger cuts, then I will support that as well. I was a big advocate of front-loading rate hikes when inflation accelerated in 2022, and I will be an advocate of front-loading rate cuts if that is appropriate.

It was the “front-load” phrase that popped FFV4 up to 9512, but prices quickly retreated.

Now let’s look at SFRU4. On the day it settled -1.75 bps at 9510.5, up 2.25 on the week. Volume was the most of any SOFR contract at 1.7 million. Open interest fell by 44k to 1.3 million. Though open interest in calls fell by 97k, there are still 6.4 million open, max being the 9525 strike with 620k. That call settled 1.0. Expiration of Sept options is Friday. SFRU4 9500p settled 0.25.

SFRM4 is still trading, but has now been pegged by SOFR settings of the past three months. It settled 9463.0. Simplistically, add 25 or 50 and get 9488 or 9513. Then add about 23% of the expected move for the November 7 FOMC, as that date is a bit more than halfway through the contract term. At extremes, I would say 25 and 25 would yield a final settle around 9494 and 50 and 50 would be around 9524.5. Cuts of 25 and 50 would be in the neighborhood of 9500. In a way SFRU4 appears slightly expensive.

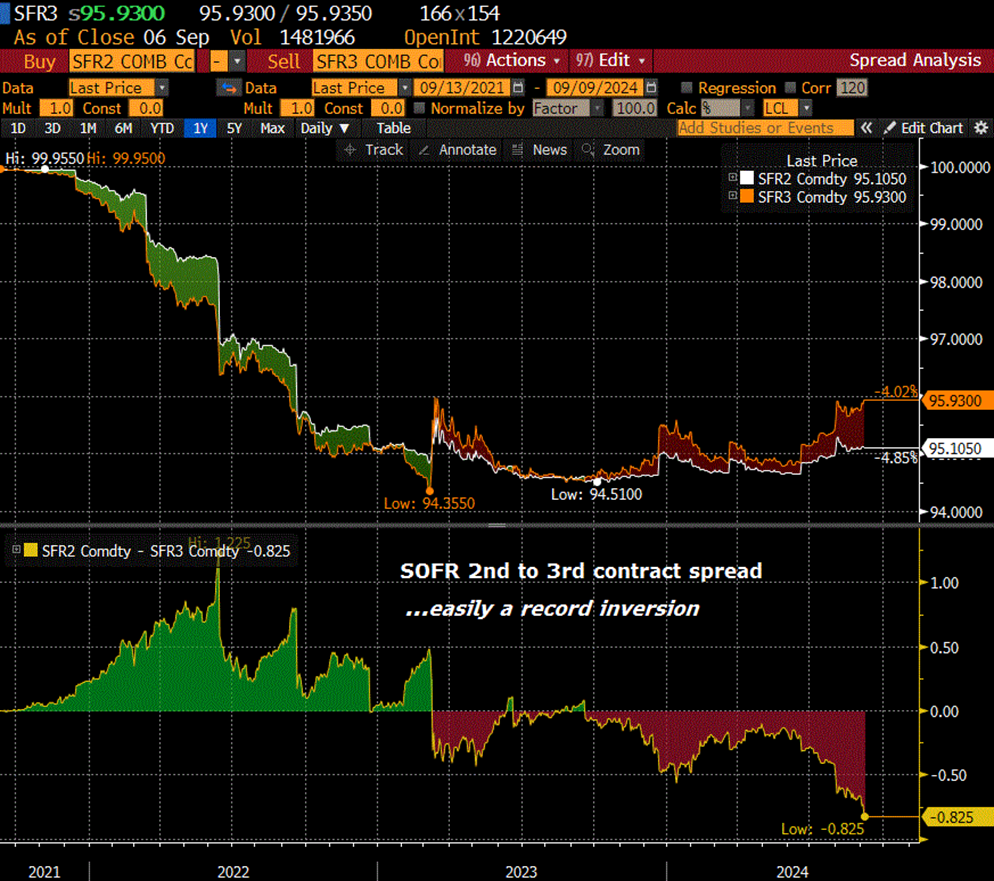

However, consider the next few contracts. SFRZ4 settled 9593.0, up 7.0 on the day, and 18.5 on the week; a new high settle (since Feb). U4/Z4 calendar settled -82.5, easily the most inverted a 3-month SOFR spread has traded.

The market obviously took Waller’s ‘front-loading’ comments to heart. SFRU4 to SFRH5, just a six-month spread, settled 9510.5 to 9656.5, nearly 1.5% of inversion. Extremely aggressive. However, SFRH5 at its high on Friday (9667) didn’t quite exceed the Aug 5 high of 9670.5, even though the settlement was higher.

SFRM5 DID exceed the August 5 high of 9695, posting a top price for the year of 9698 and a settle of 9691.0. 3.09% by next summer! SFRU5 also made a new yearly high and settle at 9711.5 and 9707.5s. The peak contract on the SOFR strip moved forward one slot to SFRH6 which settled 9718 against a high of 9719.5. This contract posted a low of the year at 9566.5 on April 30. It has rallied over 150 bps without an actual ease.

Now observe the chart below. It is the sixth quarterly (rolling) EURO$ contract back in 2007 to 2008. Prior to the first ease (of 50 bps) back in Sept 2007, the contract rallied from a low of 9450 to just above 9550. One hundred bps in a few months. I’ve noted the corresponding level on the chart with a helpful, “You Are Here” tag. From the September 2007 FF target of 5.25%, the Fed cut to 2% by the end of April 2008, 325 bps in a little over seven months. By the way, the sixth quarterly ED contract reached 9800, or 2% in March 2008.

I’ve argued it isn’t the same, that the household sector in aggregate is in much better shape than 2007, that it’s the government sector we need to be worried about, that the ‘terminal’ FF target shouldn’t be much below 3% this time around. However, the affluent sector of households that we’re all depending on to keep the economy chugging into a soft landing is heavily exposed to stocks and private equity. Maybe aggregate household leverage isn’t the same as 2007, but a rapid reset in equity values of the sort that we’re STARTING to see will erode confidence.

The real risk is that fiscal stimulus is dialed back in the new year. Seems unlikely that the private sector will be able to plug the hole.

News this week includes 3, 10, and 30yr auctions Tuesday, Wednesday and Thursday.

Consumer Credit for July is released Monday afternoon, expected $12b (old data)

CPI is on Wednesday expected 0.2 both headline and Core, with yoy 2.6% from 2.9% and Core 3.2% from 3.2%

PPI on Thursday, along with Q2 Z.1 report which includes Household Net Worth. That figure will be at a new record high as SPX rose about 4.5% in Q2. Just eyeballing it, a reversion to the trend from 2011 through 2019 would likely put this number (nominally) at $130T. In Q1 it was $152T.

| 8/30/2024 | 9/6/2024 | chg | ||

| UST 2Y | 392.3 | 365.2 | -27.1 | |

| UST 5Y | 371.3 | 349.0 | -22.3 | |

| UST 10Y | 390.9 | 371.0 | -19.9 | wi 370.8 |

| UST 30Y | 419.6 | 401.8 | -17.8 | wi 401.8 |

| GERM 2Y | 239.2 | 223.0 | -16.2 | |

| GERM 10Y | 229.9 | 217.2 | -12.7 | |

| JPN 20Y | 170.9 | 165.8 | -5.1 | |

| CHINA 10Y | 217.8 | 213.8 | -4.0 | |

| SOFR U4/U5 | -164.3 | -197.0 | -32.8 | |

| SOFR U5/U6 | -18.0 | -7.5 | 10.5 | |

| SOFR U6/U7 | 9.0 | 13.5 | 4.5 | |

| EUR | 110.51 | 110.86 | 0.35 | |

| CRUDE (CLV4) | 73.55 | 67.67 | -5.88 | |

| SPX | 5648.40 | 5408.42 | -239.98 | -4.2% |

| VIX | 14.96 | 22.38 | 7.42 | |