Priming for an ease

July 16, 2024

**************

–Goldman opined that the Fed has solid rationale for a July rate cut; Moody’s had also said something similar. (FOMC is July 31). With current EFFR at 5.33% or 9467, August Fed funds surged up to 9473 before falling back to 9468.5, an unchanged settlement. FFV4 which captures the Sept FOMC meeting as well as July’s, ticked up to 9499 and settled 9494, up 1.5 on the day. A 25 bp rate cut should put the new EFFR at 5.08% or 9492, so a print at 9499 begins to reflect significant concerns that a cut of 50 could occur. A couple of days ago, SFRU4 9500c were sold at 3.0, yesterday settled 5.0 with SFRU4 +2 at 9496.5.

–Powell expressed greater confidence that inflation is moving in the right direction. I’m not sure how much weight should be given to anecdotal evidence, but a friend who is involved with a private airport near Chicago said that business travel is rapidly slowing (thanks DK); last month’s fuel sales were the lowest in years. WSJ has a headline: Evictions surge in major cities in the American Sunbelt. BBG: Salesforce Cuts More Jobs in Latest Sign of Tech Austerity.

-Given a shift in sentiment toward near-term ease, the curve continues to steepen. 2y note fell 1 bp to 4.453% while tens rose 4.2 bps to 4.229%. 2/10 ended at a new high -22.4. On June 27, just over 2 weeks ago, I marked SFRU5/SFRU8 at -47 (9587.5/9634.5). Yesterday it settled -14.5 (9624/9638.5), a surge of over 30 bps. [notice that the price of SFRU8 barely changed]. In tens, there was a late buyer of 30k TY week-1 111.25p for 46. Settled 48 vs 110-315, Settlement date is 2-August, on which NFP will be released. Seeing a small bounce in treasuries this morning with TYU4 111-09.

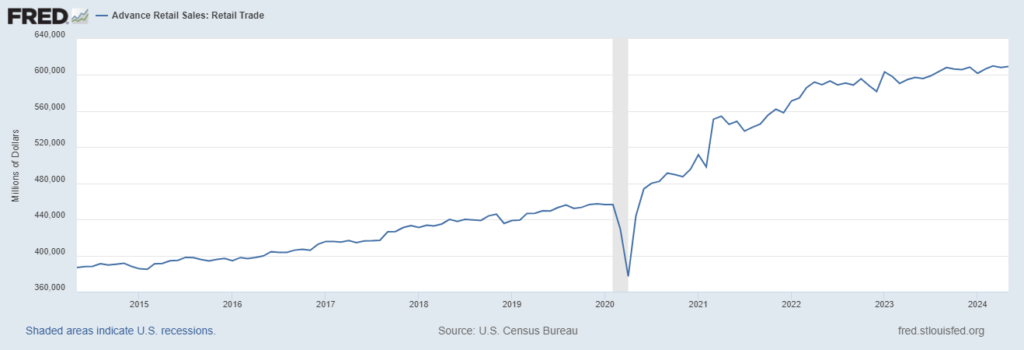

–Kugler speaks today at 2:45 on ‘…Economic Measurement and Creative Solutions’. I guess that just means changing the data! Retail Sales as well, expected -0.3%, but ex-auto and gas +0.2%. From the St Louis Fed website, I pulled the chart below on Retail Sales (nominal). The recent slope of the curve is surprisingly flat given inflation levels of 4-6%. According to my measurements, from April 2022, when the Fed had just started to hike, to May 2024 (last data on chart), total nominal retail sales were up just 3%…over TWO years. Real Retail sales are soft. But maybe we can just measure them differently.